City of Vernon

- Rachel Raymond

- Financial Reporting

- minute(s)The Challenge: Drowning in Complex Legacy Systems & Workarounds Project: Consolidated Financial Statement Automation City: Vernon, BC Population: 44, 529 (2021) Platform: ARLO When Elma Hamming, CPA, CMA, joined the City of Vernon, British Columbia as Director of Financial Services in March 2024, she inherited a financial reporting process that was, in her words, a “mishmash due to growth, change, and limited resources.” The city’s previous year-end statements relied on a mix of old legacy solutions and manual Excel workarounds, with comparative data misaligned between systems they were a challenge to audit. A recent transition to a new Workday ERP system in January 2024 further complicated matters, requiring a complete remapping of the general ledger (GL) structure. With a tight timeline, limited budget, staffing shortages, and an audit looming, Elma faced a daunting task: produce accurate, compliant financial statements without overwhelming her team or depending on external auditors to prepare them. Manual processes were time-consuming and increased the risk of error, pulling focus from strategic priorities like council reporting and long-term financial planning. Elma, who had previously worked with F.H. Black & Company Incorporated at other organizations, turned to FHB and their ARLO solution to transform Vernon’s financial reporting to maximize efficiencies and give the city a strong foundation for the future . The Solution: Automating with ARLO for Speed and Simplicity Elma and her team partnered with FHB to implement ARLO, a cloud-based platform designed to streamline financial reporting. Despite a compressed timeline, FHB’s consultants—Christine Gilbert, CPA, Tricia Fraser, CPA and Michael Spurlin —worked closely with Vernon to map the new Workday GL structure to ARLO and automate the production of financial statements.ARLO’s intuitive interface, resembling familiar tools like Word and Excel, allowed Vernon’s team to quickly adapt, even with limited prior exposure. Unlike their prior solution, which Elma found unnecessarily complex and non-intuitive for annual use, ARLO simplified data manipulation and statement adjustments. For example, FHB customized ARLO to handle Vernon’s unique water utility reporting, netting out regional district transactions seamlessly. This flexibility ensured the city could produce polished, compliant financial statements without the steep learning curve of legacy tools while enhancing the quality of data analysis. The Results: Efficiency Gains and a Path to Strategic Focus The implementation delivered immediate efficiencies. By automating GL imports, grouping of accounts, and statement updates based on Vernon's specific rules, ARLO eliminated the need for manual Excel workarounds, saving significant time during the audit process. “It’s definitely easier to manipulate than our previous solution,” Elma said, noting how ARLO’s user-friendly design reduced the complexity of mapping changes and adjustments. The city successfully completed its audit with no major findings, a significant achievement given the year’s challenges.ARLO also positioned Vernon for future efficiencies with capabilities and content that would have been extremely difficult and time consuming to incorporate into their prior solution. ARLO's PSAB content library prepares the city for upcoming reporting requirements, such as PS 1202 compliance in 2027, with pre-built templates and crosswalks. Elma’s team plans to expand ARLO’s use to Local Government Data Entry (LGDE) reporting and potentially quarterly council reports, further reducing manual workloads. “It simplifies the process,” Elma said, especially for onboarding new staff with limited public sector experience—a critical advantage given the public sector's staffing challenges. By automating repetitive tasks, ARLO freed up time for Elma’s team to focus on strategic priorities, such as financial planning and community impact. The city is also exploring ARLO’s benchmarking capabilities to compare performance metrics like reserves and debt against peer municipalities, aligning with Elma’s interest in PSAB’s Statement of Recommended Practice (SORP) ratios for long-term financial health. A Trusted Partnership Elma’s long-standing relationship with FHB, spanning her roles with the Town of Smithers, City of Rossland, Town of Oliver, City of Penticton, and now the City of Vernon, underscores the reliability of the partnership. “I knew I was in good hands,” she said, appreciating FHB’s willingness to take on extra workload during the compressed timeline. The team’s support, combined with ARLO’s intuitive design, turned a high-pressure, high-risk project into a sensational success story. The City of Vernon’s journey with ARLO demonstrates how automation can transform municipal finance from a “mishmash” of manual tasks into a streamlined, strategic function—saving time, reducing errors, and empowering teams to deliver greater value to their communities. Ready to streamline your financial reporting? Contact F.H. Black & Company Incorporated to learn how ARLO can transform your processes. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Vernon simplifies financial reporting with ARLO’s easy-to-use platform, automating tasks, reducing errors, and saving time.

READ MORE

City of Dubuque

- Rachel Raymond

- Success Stories

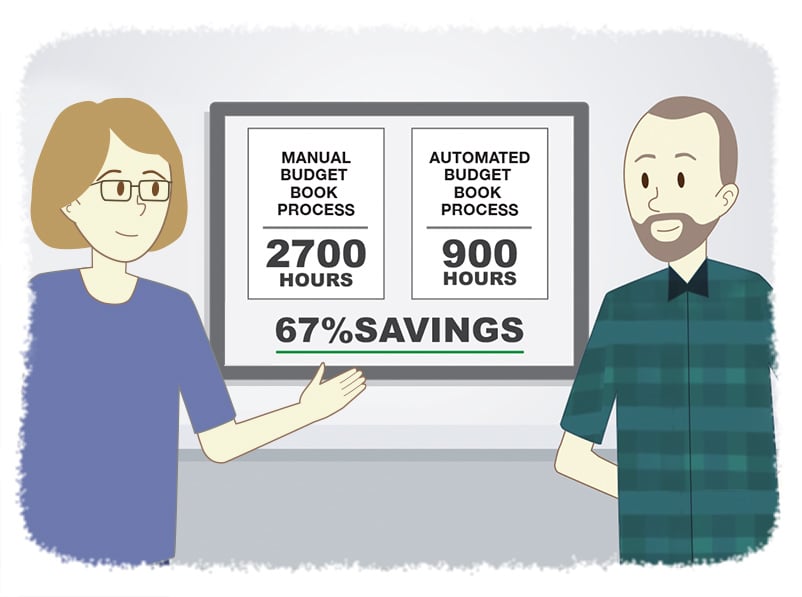

- minute(s)Simpler, faster, better budgets: On the right track with the City of Dubuque Project: Budget Book Automation City: Dubuque, Iowa Population: 58,877 (2023) Platform: Workiva The Scene Chief Financial Officer Jenny Larson has been with the City of Dubuque, Iowa, for 18 years. For much of that time, she served as director of the city’s budget department. Recently, she was asked to take over the finance department, which left the budget team short on staff and experience. “The budget staff has been built to accommodate my move,” said Jenny. “Two budget analysts came on board in 2022, and Laura (Laura Bendorf, Budget Manager) came on board in 2023,” she said. By late 2024, Jenny was still devoting part of her time to guiding the newly formed budget team. As she brought the City’s new hires up to speed, Jenny quickly realized that the team needed both a new approach for data storage and an improved process for budget book preparation. FHB conducted a Workiva Health Check for the City, evaluating their use of the Workiva platform and identifying ways to improve or expand it. Up until that point, they had been using the platform for report writing but had not tapped into its functionality as a single source of data. Their existing process involved using Workiva Sync to sync data from different Excel workbooks into their Revenue Consolidator and Expense Coordinator spreadsheets. Data visibility was poor, and their review process disjointed. As a result of the Health Check, the Dubuque team enlisted the help of FHB to meet a series of goals: Make Workiva the central repository for budget report data Replace existing synced sheets with sheets connected to the database Increase automation of budget book production Develop an accessible, repeatable process Prevent breakage of any existing links Use the same data sets to power multiple documents, presentations, and reports, including the ACFR Standardize styles across documents Set up and configure dashboards for data validation and collection The Results As part of the improvement process, FHB used keystones to calculate the numbers in the City’s report, instead of variable, complex formulas. So, when they’re reconciling or reviewing their numbers, it’s easier to identify issues; they can clearly see which segments make up each number. “That is really going to be a time savings,” said Laura. “It’s a lot more intuitive to just see it,” she added. Before the implementation, in the case of a discrepancy, they had to go back to individual departments to investigate its origin. How It Went “The implementation was smooth, it was fast—which was a very good thing. FHB kept me going and kept me on track. In the weekly meetings, there was always something to cover. I appreciated that kind of general check-in. We were always on the same page with FHB,” said Laura. Jenny compared her experience with FHB to a recent ERP implementation, which took four years to complete. The ERP project was initially led by a software consultant with no accounting knowledge. “We had to fire her...and we had to fire a project manager...we went through several implementation consultants and at least two project managers,” she said. In comparison, “working with FHB was hands-down a great experience,” she added. The Dubuque team was quick to praise FHB Principal Consultant Faith Olanipekun, CPA, who led the implementation. “Faith was very responsive. And I really enjoyed the energy and positivity she brought to the meetings. She really kept the project going forward,” said Jenny. Technical Consultant Myra Rogers also stood out as a key FHB team member. “It was helpful that she had a government background, because she understood,” said Jenny. “She was really knowledgeable,” added Laura. The Dubuque team is convinced that the project would not have been as successful without the help of FHB. “I think my five years in finance have taught me that we just don't have the staff capacity required,” said Jenny. “Even if we had the time...FHB's knowledge base made it so much faster,” added Laura What's Next Jenny and team are looking forward to reaping the full benefits of Workiva during their upcoming budget process for fiscal year 2026. "Using Workiva definitely has streamlined the process. I can only imagine it will get better once we're able to use everything that F.H. Black has done,” she said. The City has a few more FHB-led projects in the works, including organizing their documents, relinking the formulas in their spreadsheets, automating department budget forms, and linking their operating form to their all-expense consolidator. Update Six months after FHB spoke with Jenny and Laura about their Workiva database implementation, we checked in for an update on their subsequent initiatives. Jenny found that completing projects incrementally worked well for her team. “Doing progressive projects really helped. As we did each project, there was less and less involvement from our side, until the final project just went so quickly.” “There was a lot of work on the FHB side, but limited interaction from our side, because Faith and the team knew our structure so well and how the files work. It was really impressive. I don’t think we could’ve asked for a better outcome.” –Jenny Larson With FHB leading their projects, the City’s team was able to focus on other essential duties. "We only have three full-time staff, so quite honestly, I don't know when or if we would have gotten to the projects that FHB did. I just don't think it would have been possible. It allowed our staff to focus on budget amendments, annual budget department training, and now we're into the next budget cycle,” said Jenny. Not only were the projects managed adeptly, but they were also finished, “way before” deadline. “FHB just way exceeded our expectations,” said Jenny. “Nothing was overlooked.” © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

With the help of FHB, the City of Dubuque simplified their budget book process, saving their team hours of time per week over several weeks.

READ MORE

City of Walnut Creek ACFR Project

- Rachel Raymond

- Success Stories

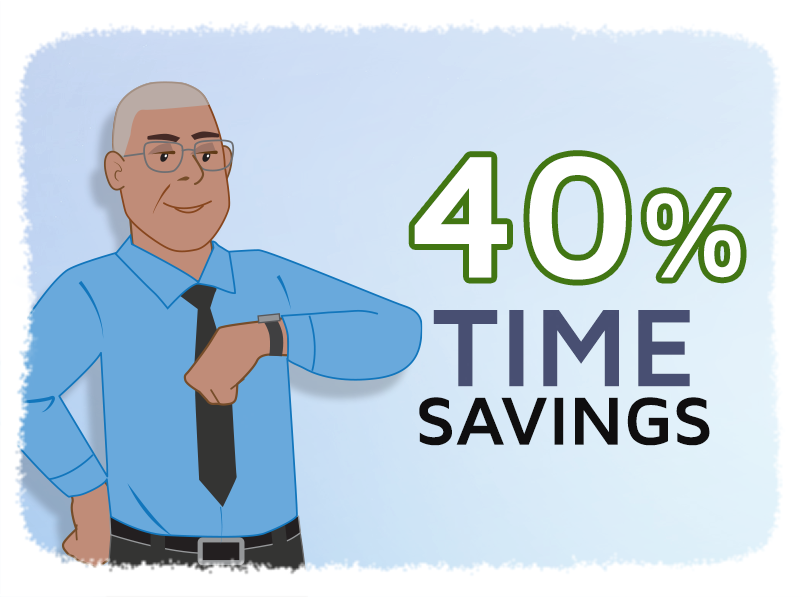

- minute(s)Public sector expertise saves Walnut Creek 1,000+ hours/year & enables ACFR publishing one month earlier than ever Project: ACFR Automation Organization: City of Walnut Creek Population: 69,152 (2023) Platform: Workiva FHB Extensions: Public Sector Data Model The Challenge Before we connected with the finance team at the City of Walnut Creek, California, they were mired in endless manual data entry and reconciliations. All of their statements and documents were housed in Word and Excel. Spreadsheets were riddled with inconsistent formulas and hard-coded numbers devoid of explanation. Hidden rows contained legacy data that affected totals. There were human errors aplenty. The team struggled to maintain consistent formatting throughout the report, ensure rounding uniformity, and catch discrepancies between fund statements and balance sheets. Only one person on the team had access to the Excel workbook that included all of the statements. That person left, leaving the team at a real disadvantage. It was nearly impossible for them to determine where any of the financial statement or notes table data came from. And they had no documentation of any ACFR preparation process steps. The Implementation FHB stepped in to evaluate the City’s challenges and determine the best available solution to help overcome them. Did you know? Out of the box, reporting automation software can boost productivity to some degree, but public sector organizations often fail to reap the full benefits of their technology investments. That’s why FHB leverages deep accounting and technical expertise to develop public-sector extensions on top of existing platforms, and why CPAs with public sector experience lead our implementations—for maximum productivity improvement. The FHB team, led by Principal Consultant Faith Olanipekun, CPA, helped the City automate much of its ACFR preparation process, using leading industry platform Workiva, enhanced by our proprietary public sector data model. “The implementation was both efficient and informative,” said Kirsten LaCasse, Administrative Services Director for the City. Faith and her team eliminated the City’s reliance on multiple, disjointed Word and Excel documents, leveraging Workiva's functionality as a cloud-based, single source of data. FHB ensured that multiple finance team members will share access to and understanding of the City’s new data source, to prevent any future gatekeeping of information. And as an added benefit of the platform, an unlimited number of team members can now collaborate in real time. Faith equipped the team for success with clear, repeatable process steps, making ACFR preparation, and employee training and onboarding, much simpler. The Results With the implementation complete, Kirsten and her team immediately recognized its value. “Before, it took one full-time employee about half of her time throughout the year, and all of her time for part of the year, to prepare the ACFR manually,” said Kirsten. All told, FHB’s implementation of Workiva will save the City’s team roughly, “1,000 staff hours per year, maybe a little bit more,” Kirsten said. “This year, we were able to submit our ACFR one month earlier than in previous years. We got it in before Thanksgiving for the first time ever. Our staff is now able to focus on the actual GL entries and notes without rushing,” she said. What’s more, the team can, “confidently say where every number comes from and how it ties to the trial balance,” said Kirsten. And FHB’s implementation makes proper rounding and identification of discrepancies a breeze. “All of our journals are tracked and easy to provide to auditors. Our presentation of information is more professional and consistent, and our frustrations are dramatically diminished,” she said. “The elimination of simple human errors will inevitably increase the level of confidence our Council and community have in our staff.” Looking ahead, the Walnut Creek team is considering including the SEFA (Schedule of Expenditures of Federal Awards) as part of the ACFR, rather than creating a separate document. “It could certainly help us, when we’re preparing to bring the ACFR to Council, to have the SEFA somehow incorporated,” said Kirsten. We’re also talking about doing a PAFR (Popular Annual Financial Report), but we haven’t gotten that far yet,” she said. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Read how the finance team at the City of Walnut Creek reduced time spent on ACFR preparation by 1,000+ hours per year with the help of FHB.

READ MORE

Cincinnati Metro Housing Authority

- Rachel Raymond

- Success Stories

- minute(s)Cincinnati Metro Housing Authority chops months of work per year with FHB + Adra Project: Reconciliations Automation Organization: CMHA Platform: Adra by Trintech How It Started In October of 2023, Monica Mitchell joined the Cincinnati Metro Housing Authority (CMHA) as an Account Reconciliation Specialist. The organization had been using Excel to manage monthly financial closing, but they recognized their need for automation and a more standardized, repeatable reconciliation process. First, they created Monica’s role for the purpose of managing that process. Then, they hired FHB to configure and implement a new financial-close-automation software, Adra by Trintech. Shortly thereafter, three key team members transitioned away from the project, and Monica needed assistance in handling the software implementation and monthly reconciliations. Our Approach FHB's objective at the project’s outset was to implement three of CMHA’s largest bank accounts in Adra Matcher and Balancer. Our approach: Understand & document the existing reconciliation processes. Set up the frequency of account preparation, approval, and review. Write custom rules to automatically match as many transactions as possible. Train the CMHA team to use the system and to write their own rules going forward. Test transaction matching through three rounds of rules to maximize the percentage of automatic matches. Provide the team with best practices to simplify and improve matching in the future. How It Went When we spoke with Monica, she had nothing but praise for FHB’s implementation team. “Jill [FHB Principal Consultant Jill Moats, CPA] was awesome,” she said. “She was very patient. It was kind of chaotic over here [amid staffing changes]. But she was very good at getting us to focus and answering our questions. Jill is very, very good at getting to the core of the problem and giving an explanation in plain English,” she said. "I appreciated the fact that Jill is an accountant and that she's done reconciliations.” –Monica Mitchell, Account Reconciliation Specialist, Cincinnati Metro Housing Authority “I have a lot of experience with implementations, and programmers always think it's a great thing to implement new software, but they never think about the end user and whether it makes sense to them. I think that FHB takes that into account, especially during implementation, asking, ‘How will you use this?’ I found that really helpful.” “I am somebody who learns much better by having someone guide me through than by trying to figure it out on my own...what happens with going it alone is that you get so far and then you run into a wall. And then it takes days to get the wall torn down. And you forget what you were doing before you hit the wall. I appreciated having Jill to say, ‘maybe you should look at it this way.'" The Results For Monica, the implementation by FHB couldn’t have come at a better time. "Having the tools to handle [reconciliations] makes it all so much easier,” she said. Now that it’s up and running, the solution saves Monica weeks of work. “I also picked up [responsibility for] what we call the lock box—our Low-Income Public Housing or LIPH main. My former colleague used to struggle with that; you should see those Excel reconciliations. He tried to explain to me how he did it in Excel, and I said, ‘No. I don't even understand what you're saying.' When I took it over, I said, ‘I can’t do that account without Adra.’” Now, only a small percentage of open items remain unmatched, mostly due to timing. “I'm [reconciling] it within 0.5 percent, so, I'm happy with that,” Monica said. “Another of our big accounts is the HAP HCV (Housing Assistance Payments Housing Choice Voucher), which includes 18,000 transactions every month,” she said. The auto-matched transactions for that account are around 98 percent, meaning now, they only need to review around 250 of those 18,000 transactions monthly. What's Next Monica anticipates enlisting the help of FHB for future work. “Now that I've really bought into it, I can start convincing other people that they can buy into it. Some have the attitude, ‘why do we need new tools if we can just do it in Excel?’” © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn how Cincinnati Metro Housing Authority, with the help of FHB, cut months of work per year out of its reconciliation process by implementing Adra.

READ MORE

Pinellas County Clerk's Office ACFR Automation

- Rachel Raymond

- Success Stories

- minute(s)Out of the Woods with Pinellas County Comptroller's Office Project: ACFR Automation Organization: Pinellas County, Florida Population: 961,739 (2022) Platform: Workiva The Challenge In sunny Pinellas County, Florida, situated on a 280-square-mile peninsula between Tampa Bay and the Gulf of Mexico, Bill Seiter serves as Assistant Director for the Clerk of the Circuit Court and Comptroller’s Finance Division. Back in 2018, Bill and his team engaged the help of FHB to implement the best available tool for improving their Annual Comprehensive Financial Report (ACFR) preparation process. Since then, everything has changed—the report’s size and complexity, as well as the technology available to automate the process. Although the desktop program FHB implemented in 2018 was a major improvement over their prior solution, by 2024, it could no longer support the team’s growing needs. The old program was complicated and required a great deal of time to set up and maintain each year, ultimately creating additional work for the team. They also found basic actions, like formatting, unnecessarily difficult. By March of 2023, Bill and his team were ready for a better solution. They reached out to FHB, once again, for help selecting and implementing the right tool to further streamline preparation of their annual report, in light of their changing needs. “We were looking forward to something a little more user-friendly,” Bill said. His team also sought to better leverage the native capabilities of a new platform. And finally, they wanted a tool that would allow collaboration, so that multiple team members could work on various sections of the report simultaneously. After considering available options, the Pinellas team elected to implement Workiva, with the support and guidance of Workiva Elite Partner and public sector specialist, FHB. The Implementation Out of the box, Workiva serves as a solid, blank, foundational platform, upon which FHB developed many Public Sector Extensions that enable a faster, more robust implementation; provide enhanced functionality; and maximize automation. FHB’s central extension is a Public Sector Data Model, which includes pre-built tables, queries, chains, and scripts. It can be paired with other extensions to streamline, automate, and simplify workpapers, rounding, adjusting journal entries, data validation, GASB pronouncement automation, Schedule of Expenditures of Federal Awards (SEFA) automation, and more. How It Went From the kickoff meeting, to importing the County’s data into Workiva, to replicating their prior year ACFR, the implementation took just 14 weeks. “The project was managed really well,” said Bill. FHB Principal Consultant Joy Richardson, CPA, led the implementation initially, followed by Principal Consultant Faith Olanipekun, CPA. “Faith got up to speed quickly. They both seemed to really know [the old software] as well as Workiva,” he said. The Clerk’s office was impressed by the responsiveness of Joy, Faith, and the entire team. “They were available and responded to questions within a day, usually within a few hours,” said Justin Hansen, Senior Manager–General Accounting & Reporting. “From my perspective, the implementation was fantastic.” –Bill Seiter, Assistant Director How It's Going To get a true sense of project outcomes, we regularly follow up with our clients once they complete their first reporting cycle with Workiva. Like all of our clients, Pinellas was highly satisfied with their results. “The collaboration was there, especially for the first year, when everybody’s getting used to the software. It was easy to use, and we were done about a week earlier than we were last year. Considering we switched both auditors and software, it turned out really well,” Bill said. “Workiva was definitely easier for staff to understand and train on. It's more native to what they know in Word and Excel, and there’s better communication,” he added. “Workiva is awesome. And having a foundation in Excel makes it super easy to use. So, I love it.” –Shpresa Zenku, Senior Finance Accountant “It's very risky to have just one or two people who know how to use software that's so important for your process. Workiva gives our staff the opportunity to get more into the preparation. It's a learning tool, it’s a ‘spread out the work’ tool. So, it's not all concentrated on one person. I'm pretty happy with it from that perspective,” Bill said. “Last year (in the old program), it was just me…making all the updates. This year, we had all our accountants here. And we even got our analysts in there helping as well, with the statistical sections,” Justin added. What does the Pinellas team love about Workiva? Easy to learn and use Saves time Facilitates onboarding Enables self-sufficiency Streamlines steps Promotes collaboration Looking Ahead The Pinellas Clerk’s team expects to see added time savings during future ACFR preparation cycles. “Now that we've been through a year and were able to make tweaks needed after initial setup—we found some input values that we should have linked and automated, so we’ve made those updates—going forward, I think we're really going to see the time savings,” said Justin. They’re also keeping an eye out for other automation opportunities. “We used our reconciliations worksheet created last year as our source for the reconciling document. So, we can automate and continue improving that,” Justin added. Soon after completion of their ACFR automation project, FHB helped the Pinellas Clerk’s team update their implementation to include the groupings needed for its federally mandated SEFA report. Bill and his team are so happy with the level of support and care provided by FHB, they’ve volunteered to spread the word. “If you have prospective clients, I’m happy to be a reference,” he said. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

FHB helped Pinellas County Clerk’s Office complete its ACFR earlier while implementing new software that enables greater collaboration, more efficiency, and ease of use.

READ MORE

The University of Texas System

- Rachel Raymond

- Financial Reporting

- minute(s)What Starts Here Changes the World: An Incremental Approach to System Improvement Projects: Staff Augmentation, AFR Automation Organization: The University of Texas System, Founded in 1883 Number of Students: 256,000 Platform: Workiva At FHB, our client engagements are anything but transactional. We get to know our clients’ teams, their systems, and their challenges, forging long-term relationships that often span multiple projects and many years. Such is the case with The University of Texas System. The Beginning When we first spoke with UT System, they had been considering implementing Workiva for process improvement and automation for several years but were unable to get internal buy-in for the necessity of a new approach. Fortunately, Veronica Hinojosa Segura, NACD, D.C., the System’s Associate Vice Chancellor, began to get her team’s buy-in once FHB demonstrated the “art of the possible.” “When I came on to this role six years ago, I was surprised to find that we were a $45 billion net-position organization, still consolidating financial statements with Word and Excel,” said Veronica. “It took almost an army of people. Once we received information from the campuses, to even try to consolidate, there was a lot of copying and pasting. So, inefficiency was the biggest driver for [change]. And then selfishly, my goal was to become best in class out of all the university systems in the country,” she said. During that time, UT System lost several key finance team members, which led them to believe they would need to kill the process-improvement project altogether. They would have enough problems just completing year-end the old way, let alone taking on something new. “Around 120 years of institutional knowledge went out the door,” said Veronica. FHB agreed that this development would put the implementation at risk. Instead of letting the team get stuck in a catch-22 situation (needing new tools to become more efficient and require less staff time, while being unable to implement new tools because of needing more staff time), we pointed out that many clients hire FHB for staff augmentation, as we have a deep bench of CPAs with decades of experience working in the public sector, doing exactly the kind of work required of the UT team. That experience has given them first-hand knowledge of historic and upcoming pronouncements, including GASB 87, 94, and 96. We proposed that the UT System team start “phase one” of their improvement initiative by hiring FHB to support them through year-end and ensure their success. This engagement provided the added benefit of allowing us to learn their processes and challenges firsthand. Project One: Staff Augmentation In 2022, the UT System team was “stretched pretty thin,” said Jamie Frey, Director of Financial Innovation. At the outset of our engagement, they tasked the FHB team with consolidating variances in their Annual Financial Report (AFR); writing an explanation for the variances in the report’s management, discussion, and analysis (MD&A) section; and reviewing its footnotes. “The FHB team did a great job,” said Jamie. “They have the expertise…I particularly liked the organized way they communicated back to us. Jan (FHB Principal Consultant Jan Brewer, CPA, CGMA, MBA) was instrumental in that. There was a worksheet, with a summary tab, and then it went into detail. And it was very easy to review. It had stoplights indicating issues or things we needed to look at. It was very organized, so it allowed us to easily look at the overview and see what we needed to dig into,” she said. The success of the four-month Staff Augmentation project set the stage for future engagements between FHB and UT System. Project Two: AFR Automation Next, FHB undertook the project to help UT System streamline and improve their AFR preparation process, using reporting automation platform Workiva. The Team Throughout the AFR project, FHB’s expertise and experience shone through. The UT team was thrilled with the combination of accounting acumen and technical expertise demonstrated by our team. They were further impressed with our deep understanding of Workiva. Jamie also commended the project management leadership of FHB’s Kelsey Macke, PMP. “The team was very knowledgeable. The running of the meetings was very organized, the project plan was very organized and laid out. The FHB team pivoted when needed. In terms of running projects, they're very skilled,” she said. “You have an excellent team,” Jamie added. I want to thank everyone we worked with; it was a pleasure. So much talent, and the kind of talent that we needed on this project,” she said. “I was pleasantly surprised at the ease of automating the process,” said Veronica. "Obviously, this was not FHB’s first rodeo; you had a template we could follow that made it so much easier for us. And Workiva is a very user-friendly tool. It looks and feels like Excel, something that my team was already used to,” she said. The Outcome In terms of the project’s outcome, UT anticipates significant time savings (particularly in the MD&A section of their AFR); improved collaboration; and mitigation of error. “For us, I think collaboration is probably number one,” said Jamie. “I love the commenting feature. I love how you can filter and see what's for you. I love that our auditors can go directly in there and make their comments and it's going to be the latest version. We can respond directly and they can see the edits directly,” she said. “We probably cut about three and a half to four weeks of time [out of the AFR process], which came just in time, since the Comptroller's office has shortened our deadline,” said Veronica. The UT System team is also happy to have established a repeatable, formalized business process that will help potential new hires and users get up to speed more quickly. And last, but not least, the UT Team was thrilled with the Capstone Training provided by FHB at the project’s completion. The Capstone package includes one video that walks through UT System’s specific AFR process steps, and another video providing answers to their remaining questions. “The Capstone video was excellent. I think you'll continue to hear that from your clients. That’s a great resource and we appreciate y'all doing that so much,” said Jamie. At the close of the AFR project, the UT team felt well-positioned for the future. “We’re already seeing, as we roll this forward, some things that we can implement in the future to continue to make improvements. We’re so excited to see where this goes,” said Jamie. “I absolutely think we're on the right track. This was a change that we needed,” said Jamie. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

With the assistance of FHB's experts, The University of Texas System met their pressing deadlines and cut three to four weeks from their AFR preparation process.

READ MORE

City of San Luis

- Rachel Raymond

- Success Stories

- minute(s)Game Changer: City of San Luis Cuts Weeks from ACFR Process Project: ACFR Automation Organization: City of San Luis Population: 35,770 (2022) Platform: Workiva The Need The small but mighty finance department at the City of San Luis, Arizona, was looking to automate its Annual Comprehensive Financial Report (ACFR) preparation process. Their primary goals were to save as much time as possible and reduce their risk of error. They wanted a streamlined, repeatable process producing a quality, reliable report. When FHB met the City’s team, they were relying heavily on hand-keyed data entry. “We were doing the process manually…the financial information was in Excel, and the financial statements, some of that was in Word,” said Monica Castro, CPA, Director of Finance for the City. “There seem to be more errors when you do a lot of manual work. So, that's one of the things that we wanted to improve,” she said. As an added challenge, the San Luis team was knee-deep in budget season as they set out to optimize their ACFR process. The Right Tool The FHB team, led by Principal Consultant Faith Olanipekun, CPA, met with the San Luis team to assess their needs. Based on their conversations, FHB recommended that the city implement Workiva. As a cloud-based tool, Workiva was great fit for San Luis, allowing multiple people to work on the ACFR simultaneously; the software is also intuitive for anyone who’s used Excel, and specifically designed to support financial reporting. Leaving Nothing to Chance The Partnership The notion of cost savings might entice some municipalities to implement software on their own. However, Monica saw the value in a formal, professional implementation. “FHB’s expertise was crucial to the success of the project. I would not have been able to implement Workiva without the help of the FHB team,” she said “They were always available when we needed them, quick to respond to our questions and provided answers that solved our issues. Their accounting expertise was excellent," she added. “The implementation was great,” said Carolina Corral, Accountant for San Luis. “Faith was available whenever I needed help. She was good at explaining how to do things.” “FHB is a great team to work with. They really helped us through the process, gave us a lot of alternatives, especially with us being a small municipality,” said Monica. The Results Monica estimates that the ACFR automation project will save her team, "Weeks. Because for instance, the management, discussion, and analysis (MD&A) has a lot of tables in it. Before, we would update the tables in an Excel spreadsheet, then copy and paste it into a Word document. With the new software, the table is already built in that document—as long as you upload the information, it is already linked to pull the information into the note or wherever it belongs.” Another benefit of the project is the simplification and automation of formatting, which will improve the standardization and professional appearance of the team’s reports. “Everything will have the same indentation, same margin, same font,” said Monica. “Rounding was another thing that caused a lot of headaches throughout the report. So, having a rule for that and making sure that everything gets rounded as to the specifications we want will save more time,” she said. Monica’s team now feels comfortable moving forward in Workiva. “The training provided by FHB throughout the process helped us better understand the software and be able to manage it ourselves,” she said. Looking Ahead To ensure Monica’s staff is equipped for success, FHB’s Capstone Training will be invaluable, as it includes a video capturing instructions and demonstrations specific to the City's process. Combined with Aftercare Support, to be provided by the same FHB team members who led the implementation, the training will ensure that the City won’t waste any time with questions or worries about optimal use of the solution. In the future, Monica and her team may reengage FHB to help revamp their budget book process. “I definitely see a lot of potential in Workiva,” she said. “Its capabilities are much greater than the other application we have.” In the past, she said, “There was always a rush. We were so focused on just getting the document completed, we would just finalize it at a bare minimum. Because of the limited time, we were always working against the clock and just meeting the deadline of having the report out for compliance purposes." "I definitely think that we will be able to make a better document, and that's the ultimate goal,” she said. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn how FHB helped the City of San Luis cut weeks from its ACFR process while improving accuracy.

READ MORE

State of West Virginia

- Rachel Raymond

- Success Stories

- minute(s)West Virginia Team Automates More Than 90% of Budget Book Project: Budget Book Automation Organization: State of West Virginia Population 1.78 million (2021) Solution: Workiva Wdesk & Wdata The Challenge When we first spoke with the State of West Virginia (WV) budget office team, they were looking to automate their process for producing Volume II of their annual budget book. Heather Greenfield, Budget Analyst, explained that the team’s existing process was “all manual…you’re talking about the…domino effect…so, if you made one change, it would hit 12 different places across several different books—thousands of pages—and you’d have to remember where all of those were.” How It Went With their 2024 budget book recently completed, WV sat down with us to discuss the project’s implementation and outcomes. “Personally, I've never gone through an implementation where I was so heavily involved. Most of the ones I've gone through...had a tech team heading up the project, so this was pretty ‘hands-on' for us, but it was good... I think it helped us learn what to do and troubleshoot a lot more so than if we hadn't been so hands-on,” said Misty Reese, the office’s Deputy Director. FHB Principal Consultant Jill Moats, CPA and her team set up custom queries, tables, and scripting to move data from their Enterprise Resource Planning (ERP) system, powered by CGI, into Workiva and automate their narratives—eliminating the need to update each one manually and the associated risk. FHB also provided WV with the full documentation of their configuration, with step-by-step instructions for updating scripts, creating new groups, and more. This documentation will be particularly helpful when bringing new employees on board. "There was very little that we had to do manually besides setting it up as a one-time thing...and we have a colossal amount of data...it was pretty impressive," said Heather. At one point during the implementation, the WV team ran into some technical difficulties. FHB’s tech support team did some troubleshooting and discovered that the issue was software-related—which is not unheard of, even among best-in-breed solutions like Workiva. FHB and Workiva worked together to facilitate a quick resolution. “It was helpful to have somebody to go to bat for us...it's nice that F. H. Black has had all this experience with [Workiva] and could get it sorted,” said Heather. An Expert Team Throughout the project, the WV team was in Jill's capable hands. Her public-sector accounting expertise was immediately evident, said Heather. “Every state or project is going to be different, but I felt like—even for our most complicated tasks or procedures, different accounting techniques, or details specific to us—she was able to pick up on those pretty quickly.” “Jill was awesome. Anytime we had a problem or question, she just dove into it and was relentless in figuring it out…I felt like she had our back.” –Heather Greenfield, Budget Analyst, WV State Budget Office Misty agreed. “[Jill] was wonderful. Very smart. She was really good to work with,” she said. The entire WV team was highly impressed with Jill’s responsiveness. “She would send us messages, even late at night,” Heather said. “Yeah, at 1 a.m., we were thinking, ‘why are you awake?’,” Misty added. “We even had a meeting on her day off, so she always made time for us…I never felt like she left us hanging,” said Heather. Having an expert guide the project was crucial to ensuring an optimal outcome for the WV team. Jill adapted project steps to meet the team’s needs in real time, harnessing functionality that they otherwise wouldn’t have known existed. Staying on Track WV was also pleased with FHB’s project management approach. “Their tool worked really well. It was helpful to go in and see exactly what I had to do, and if I was behind deadline,” said Heather. “And then also having the links to…a Microsoft Teams meeting, or file or video links, all in one place. It kept the whole thing organized,” she said. A Measurable Outcome With the help of FHB, the WV team successfully automated more than 90 percent of their budget book document. For the first time, Heather and her team were able to beat the book's deadline by several hours. "You don't finish Volume II early. And it was done two hours early. It was crazy," she said. What's Next “[In the past], sometimes we didn’t have time to even proof our books. There were so many changes and... we were doing all this manual work...we just sent them off because we're required...to do so. Now, we don't have to worry about those little embarrassing errors. We can go through and read the books, we can do analysis if we want to,” said Heather. The WV team plans to make the most of its new setup. “The goal is to add other volumes...and that will save even more time…there are so many possibilities,” she said. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

With the help of FHB, the State of West Virginia dramatically reduced the time it took to produce their Budget Book.

READ MORE

City of Houston and Houston Airport System

- Rachel Raymond

- Success Stories

- minute(s)Houston, we have a solution. Project: ACFR Automation Organizations: City of Houston Controller's Office & Houston Airport System City's Population: 6.8 million Solution: Workiva Wdesk & Wdata Occasionally, two connected organizations hire FHB to guide them through implementations concurrently. Such was the case for the Office of the Controller at the City of Houston, Texas, and Houston Airport System. While FHB Principal Consultant Joy Richardson, CPA, was leading the Controller’s office through automation of their ACFR process, her colleague, FHB Principal Consultant Jill Moats, CPA, began working with Houston Airport System to automate theirs. The Airport project was expected to trail behind the City’s project by about two months. However, in the end, the two implementations were wrapped up within one week of each other. The Challenges When we met the two teams, each of their ACFR preparation processes was manual and cumbersome, requiring a great deal of data entry. Former Deputy City Controller–Financial Reporting at the City of Houston, Beverly Riggans, CPA, knew the process needed to be modernized, and spearheaded the effort. “We used spreadsheets, linking, PDFs,” said Conrad Lin, Deputy Director–Financial Reporting, Office of the City Controller, City of Houston. “If we changed one page number, we’d have to [manually] change 25 other page numbers,” he said. Collaboration within each separate team was tenuous at best. “[We saved] the spreadsheet into network folders, and you could only have one person in there [at a time]. So, [you’d] see emails coming through saying, ‘can you get out of the file?’,” said Conrad. Collaboration between the two teams was also challenging. “The airport would prepare their own financial statements, and then send a spreadsheet to the City Controller, who would then…enter it into the controller’s spreadsheet. And sometimes…the captions were different, they may have entered it in the wrong line…once it [was] published, the lines [wouldn’t] line up…it just caused a lot of a lot of issues between the departments,” said Conrad. “Government’s having a hard time hiring people—qualified, experienced reporting personnel. So, we have to figure out some way to utilize technology to do some of the job,” said Conrad. Leaving Nothing to Chance Both the Airport and City teams chose to implement Workiva for ACFR automation. Out of the box, the software is a blank slate to be built upon. With the right skills and knowledge, it becomes a powerful tool for process optimization. Why Not Self-implement? While some finance teams might opt to self-implement automation software, Conrad advises against it. “I wouldn't think that would be a good idea…because the system is definitely more sophisticated and more complicated… you need some experience with it in order to set it up correctly…doing it yourself…it would take a lot of trial and error to get it to work. And typically, a regular user wouldn't know how to write a script…even if you [get assistance with] those very technical parts of the system…to do the initial setup, it will help a lot. [If there are] issues later on, you're going to be spending more time and money to try to fix it [rather than] just doing it correctly from the start,” he said. Conrad recalled that the City’s Combined Utilities team elected to self-implement a similar solution. It took them three years, and there are still a lot of updates to be made to the setup in Workiva, he added. For any city like Houston—large and complicated, with multiple entities they're trying to connect—self-implementation would be exceptionally difficult. “I’d say it would be impossible for the controllers to just set up the whole thing…you could have a whole team of two or three employees just working on [it] year-round for five years, trying to get it all integrated and connected,” Conrad said. A Powerful Partnership Both the City and the Airport System were very pleased with FHB’s performance and partnership. “Joy was very knowledgeable. She’s been an auditor. So, [our] implementation was great,” said Conrad. Nicki at the Airport System provided similar feedback. “Jill was awesome…Jill, [FHB Technical Consultant Michael Spurlin], [Principal Consultant Faith Olanepikun, CPA], all of them, were really quick to respond. Communication was seamless. We were able to get everything done right away, with no issues at all,” she said. Nicki appreciated that the FHB team was transparent about what they could accomplish, rather than trying to placate her team. “[FHB] was very good at letting us know what we could and could not actually do. They didn't...commit to something that they knew wasn't possible, which I really appreciate.” –Nicki Thibodeaux Public Sector Expertise In addition to their software expertise, all of FHB’s Principal Consultants are CPAs who bring decades of public sector experience to every implementation. “They have seen many governments’ financials and they have worked in government,” Conrad said. When asked, on a scale of one to 10, how important government experience was for a successful implementation, he replied, “A 10. I saw another implementation, without the experience, and there were multiple issues, missing pieces, costly to fix… they didn't have the knowledge of the accounting or the Government Accounting Standards Board (GASB) requirements. You have to have governmental experience to…know how to fix the issues,” he said. The Results Accuracy Nicki is relieved that many opportunities for manual error have been eliminated from the Airport System’s ACFR process. “...everything is crossfooted with the data validation table…[with] the linking, we put our number in one spot and it goes to the five places that it needs to go to... so, a lot of that tedious crossfooting [is taken care of].” Time and Cost Savings The Airport System is grateful for the time savings their new process will bring. “I think typically, [our] ACFR [isn’t] released till the end of December. And we were literally done on our deadline, which was Nov. 15—a month and a half early. Everybody sees how much [this implementation] has improved our process, immediately,” she said. Conrad’s team saw similar results. Last year marked their first time meeting the ACFR deadline. “I don't think it had ever happened ‘til last year…we actually finished it,” he said. For Conrad and his team, the implementation resulted in a time savings of 75 percent, reducing four months of work (for 10 people) down to one month, he said. This dramatic reduction in workload means “more efficiency and less stress for the staff, and reduced turnover,” Conrad said. It also means savings of approximately $150,000 for the City, which can be dedicated to other projects. Benefits of Concurrent Projects When connected teams within a larger organization implement the same solution concurrently, they are bound to see additional benefits beyond what is typically expected. This was true for the Airport System and the Controller’s Office. “The fact that [FHB] did the City and [Airport System] at the same time, we saw right away how that benefited both sides. We have a lot of work papers that were fed from the Airport to the City, and [vice-versa]. And your team was able to implement that,” said Nicki. “I loved how Jill and Joy were able to collaborate…to use the work Joy did in the first month [with the City] to speed up [Jill’s] work on the Airport,” she said. Having FHB work with both the Airport and the City, “eliminated a lot of unnecessary conflict,” said Conrad. “It’s good that the same firm [got] everything set up at once and applied the same standards, procedures, that really helps,” he said. Because the two systems were interconnected and using the same software, communication and collaboration were simpler and timelier. Nicki appreciated, “the synergy of being able to use the software with the two reporting entities and [the way] Conrad was able to add comments to [the Airport’s documents] ...it was real time [collaboration]...there was no delay,” she said. It's much easier now that we have all the workspaces connected to the airport…[the Airport] pushes [data] to [the City], the Airport [has] access to [the City data], and we [can] look at it together at the same time, so there's no difference between [the two]. And it's a much quicker process,” said Conrad. Having the two systems integrated saved the City “days of time,” he said. What's Next? As a testament to the effectiveness of FHB’s training, Conrad and Beverly successfully added their “trends” report (a shorter, simpler report than the ACFR) into their new system without any guidance. In the future, “we want to learn how to write script and…how to get different reports…so if we need to create another monthly or quarterly report, it doesn’t affect the ACFR file,” he said. Conrad’s team is also open to discussion with FHB about future Treasury and GASB work. Did you know? FHB offers a live, CPA-led course on Structured Query Language (SQL) and the basics of chains. Register for Workiva 201 today. With the Controller’s and Airport System’s projects successfully completed, the City’s Finance Department is now looking to optimize their monthly financial reporting process, Conrad said. Nicki and the Airport System team have their eyes on a couple of additional projects as well, around financial close reconciliations and interim reporting/variance analysis. “So, we'll probably be reaching out [to FHB] as we get to those,” she said. We’re always curious as to whether our clients would recommend partnering with FHB, knowing what they know once implementation is complete. When we asked Nicki, she did not hesitate to reply. “Absolutely. Absolutely,” she said. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

By partnering with FHB for ACFR process improvement, the City of Houston and Houston Airport System reaped the benefits of concurrent implementations.

READ MORE

Insurance Risk Management vs. Enterprise Risk Management

- Ed McCaulley

- In Control

- minute(s)Comparing and Contrasting Two Approaches The goal of risk management, in its myriad forms, is to help organizations achieve their objectives by minimizing threats and maximizing opportunities. Prominent approaches include Insurance Risk Management and Enterprise Risk Management (ERM). In this blog, we will highlight the similarities and differences between these two strategies. Historical Perspective As a formalized discipline, the insurance industry started in the late 1600s in a popular London gathering place for shipping magnates named Lloyd’s Coffee House. Ships returning from long voyages, laden with trade goods, represented an enormous financial windfall to their owners. However, the risks were significant, and many ships never returned, becoming lost at sea due to weather, pirates, or simply poor decisions. Initially, groups of owners got together and started sharing risks, taking a stake in each other’s ships and cargo so that a successful voyage benefitted all owners, and a lost ship did not become a financial catastrophe to a single owner. Over time, these risk-sharing arrangements evolved into risk transfers. Individual investors would promise to repay the ship owner in the event of a loss, and in exchange, they would receive a premium. To formalize these arrangements, investors (insurers) would literally write their names under the text describing the possession or event for which they were assuming some risk. This gave rise to the term “written under” or underwriting. In comparison, Enterprise Risk Management does not have a storied background; in fact, the discipline is still being developed. In the mid-1990s, several high-profile company failures prompted the creation of the COSO Internal Control – Integrated Framework. Published in 1992, this initial COSO model quickly become the de facto standard to guide an organization’s internal control activities. However, in the years following its release, organizations began to realize there were gaps. In 2004, COSO came out with the Enterprise Risk Management – Integrated Framework, which broadened the scope of the model from financial reporting and fraud risks to include all risks impacting an organization’s objectives. In 2009, the International Organization for Standardization came out with ISO 31000, a family of standards related to risk management. ISO 31000 provided thought leadership on the practical side of risk management, including guidelines and practical advice for implementation. The COSO Internal Control and ERM frameworks were updated in 2013 and 2017, respectively. Insurance Risk Management At its core, Insurance Risk Management involves the treatment of risk through risk transfer. This approach leverages insurance products to shield against financial losses stemming from unforeseen events. Here are some of its defining characteristics: Risk Transfer Principle: Insurance Risk Management principally focuses on transferring risk from the insured party to the insurance provider through the payment of premiums. However, the risk must be an “insurable risk,” which requires that the loss be accidental and unintentional, determinable and measurable; the chance of loss must be calculable; and the premium must be economically feasible. Tailored Risk Coverage: This coverage is focused on specific risks, like property damage from fire or flood; personal injury to customers, consumers, or employees for failing to meet some fiduciary standard; or business losses from natural disasters. These risks are covered by various insurance policies—including property, liability, and business interruption insurance, for example. Insurers analyze specific risks and tailor coverage to address those risks explicitly, as defined in the insurance contract. Financial Safeguarding: The primary objective here is to provide financial protection in the event of unexpected occurrences, ensuring organizations can rebound from losses without severe financial repercussions. Claims Management: Whether an organization is self-insured or purchases insurance, it has a role in managing its own claims—specifically, looking at the root cause leading to a loss and determining whether policy or process changes are necessary. For self-insured organizations, additional tasks include determining the legitimacy of the claim (aka claims adjudication), settling claims, paying claims, and establishing claims reserves. Premium Reduction: An organization’s secondary objective is to reduce its premium payments by implementing other mitigants to reduce risks. For example, a policy stating that all firefighters employed by a municipality must wear protective clothing when responding to a call helps to reduce accidents and potential injury, thereby reducing claim frequency and severity, reducing an insurer’s claims costs, and (hopefully) leading to reduced insurance premiums for the municipality. Enterprise Risk Management (ERM) In contrast to Insurance Risk Management, Enterprise Risk Management (ERM) involves a holistic approach, encompassing a systematic methodology to identify, assess, prioritize, and manage risks across an entire organization. Key aspects include: Holistic Perspective: ERM casts a wide net, considering risks across all organizational facets—spanning financial, operational, strategic, information technology, and compliance realms. It involves evaluating how these risks interconnect and influence an organization's overarching objectives. Strategic Integration: ERM seamlessly integrates risk management into an organization's strategic planning, aligning risk considerations with decision-making processes and value creation. ERM is a method for aligning risk with acceptable tolerance, starting with the organization’s strategy, which requires thinking through and identifying risks they are willing to accept, those they wish to avoid, and those for which they have an appetite. Risk Culture and Governance: ERM emphasizes nurturing a risk-aware culture within the organization and establishing robust governance structures for effective risk oversight at all levels. Contrasting Features While both Insurance Risk Management and ERM aim to mitigate risks, they differ in scope, application, and the treatment of risks. Scope: Insurance Risk Management is more confined and specific, concentrating on particular risks covered by insurance policies. ERM takes a comprehensive view, considering risks holistically across an entire organization. Purpose: Insurance Risk Management primarily seeks to transfer risk and provide financial protection, while ERM aims to integrate risk management into strategic decision-making and bolster overall organizational resilience. Approach: Insurance Risk Management operates within the boundaries of insurance contracts, claims, and premiums, while ERM adopts a strategic approach, embedding risk considerations into daily operations and decision-making. While both Insurance Risk Management and ERM play pivotal roles in mitigating risks within organizations, they operate on different scales and serve distinct purposes. Recognizing the nuances and intricacies of both approaches is crucial for organizations to effectively navigate the complex landscape of risk they encounter. It is important to note that while transferring risk through insurance is a vital aspect of risk treatment, ERM offers a more comprehensive toolkit, encompassing various strategies beyond mere risk transfer, thus enhancing an organization's capacity to handle risks proactively. A robust risk management strategy often incorporates elements from both Insurance Risk Management and ERM to create a comprehensive framework that addresses a wide array of potential threats while aligning with an organization's strategic goals. Read how to develop risk appetite/tolerance statements © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn the similarities and differences between Insurance Risk Management and Enterprise Risk Management.

READ MORE

[Workiva + Adra]: An Integration Powered by FHB

- Jamie Black

- Workiva

- minute(s)Adra is a leading software for the automation of the financial close process, while Workiva offers a cloud-based, collaborative platform connecting reports and data. Both solutions are known to save users time and money while improving accuracy and repeatability. And together, they equal more than the sum of their parts. FHB recognized that the combination of Workiva and Adra would offer a uniquely transparent, accurate, and controlled solution for financial close and statutory and regulatory reporting, while streamlining workflow across the entire record-to-report (R2R) process. So, we developed an integration tool to bring you the best of both worlds. Introducing: [Workiva + Adra] At FHB, we have one focus—streamlining and automating processes to lighten the workload of public sector finance and budget teams across North America. To that end, we partner with industry-leading software companies, providing custom implementation of the best available solutions to meet our clients’ needs. Workiva and the Adra Suite of Solutions by Trintech are two such valued partners. Learn more about [Workiva + Adra]. To find out how [Workiva + Adra] can work for you, schedule a call with our expert team. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Reap the combined benefits of Workiva and Adra with FHB's integration tool.

READ MORE

City of Albuquerque

- Rachel Raymond

- Success Stories

- minute(s)Collaborative ACFR Process Takes City of Albuquerque to New Heights Project: ACFR Automation Organization: City of Albuquerque Population: 562,599 (2021) Solution: Workiva Wdesk & Wdata The Need When we met the finance team at the City of Albuquerque, New Mexico, preparation of their Annual Comprehensive Financial Report (ACFR) was highly manual and time-consuming. “We [entered] our adjusting journal entries in PeopleSoft, [our] ERP system...[and uploaded] them…daily, sometimes twice a day,” said Mari Hughes, the city’s Deputy Controller. “When I first started, we combined hundreds of Word and Excel files, manually paginated all of them,” said Jason Shaw, CPA, Associate Controller for the city. Mari and Jason wanted “...something more user friendly and integrated, [that was] non-relational, column based," he said. Another pain point was “not knowing how to fix certain items when they [came] up, having to rely on technical calls and help just to resize a chart, things like that,” said Jason. “If there was an issue...with a formula or something, really, it was only me who knew how to troubleshoot it,” Mari added. While the Albuquerque team appreciated the power and capability of their legacy software, its limitations for their purposes made them realize that it might not be the ideal fit for their organization. “We used to create mirrored duplicate statements in Excel to check ourselves against [our software]” said Jason. The team struggled with the unfamiliarity of their existing user interface and some of its grouping concepts. Additionally, their software limited collaboration. Because it wasn’t cloud-based, and the finance team was assigned a limited number of user licenses, only one single person could work within a document at any given time, while their colleagues had limited, read-only access. When Albuquerque connected with FHB, they were seeking a more efficient, collaborative, and intuitive solution and overall process for producing their ACFR. The Solution The FHB team worked closely with Mari and her staff to assess their current process, then recommended implementing Workiva’s cloud-based tools. Wdata would serve as a central database and single source for all data, while Wdesk would be used for reporting and formatting. Unlike the custom syntax of their existing software, which was unique to their organization, the syntax in Workiva is mostly familiar to anyone who has used Excel, making the transition to Workiva much easier and more intuitive. In terms of groupings, the FHB team would be able to leverage Albuquerque’s existing groupings (already set up in their ERP) with minimal modifications. And as a cloud-based solution, Workiva would allow several of the city's team members to work within a document simultaneously. The Implementation A Uniquely Qualified Team The implementation took 16 weeks from start to finish. FHB Principal Consultant Christine Gilbert, CPA, CA, led the project. “She did a fine job of doing as much as she could with our data,” said Jason. Steering the team away from creating new, massive, complicated codes, “she was the one who just kept coming back to, ‘use what you already have.’” “I think you guys were really easy to work with, very clear and concise in expectations, from the client and yourselves.” –Mari Hughes The Albuquerque team also appreciated Christine’s unique combination of expertise in both their legacy software and Workiva. “She holds a very interesting seat, helping people implement both of them,” said Jason. Christine also demonstrated methods used effectively by other clients so that the city could pick the right approach for their needs. “The level of knowledge and detail and thoughtfulness about our data and how to make it work best was great.” –Jason Shaw, CPA All the Automation The FHB team was dedicated to making Mari and her team’s lives easier by automating as much of the ACFR preparation process as they could. While figuring out how to set up sheets in Workiva efficiently, Christine helped develop solutions for cash flows, based on how the Albuquerque team’s data works and how they had done them in the past. FHB also worked with Mari to balance her government-wide statements. Keeping Things on Track Mari’s staff was also pleased with how seamlessly the project was managed through FHB’s project management tool, Asana. “We would start every…meeting by ticking off tasks…the communication process and tagging people, that worked [smoothly],” said Jason. The Outcomes Time Savings One clear benefit of the city’s Workiva implementation is time savings. Their team will no longer need to create duplicate statements and publish multiple versions simultaneously. “The way that Christine worked through...the implementation should virtually eliminate a lot of the mirrored work that we were doing.” Jason said. Workiva’s grouping functionality will save the city even more time. “We were able to leverage the attributes that we have in our ERP system, which we implemented…with the intent that we were going to use those for our grouping codes…the implementer for [our former software] told us we couldn't use them. But for Workiva, we're able to use them…now [we won’t] have to spend a bunch of time each year…grouping new things,” said Jason. “It's going to save some time, particularly on the more detailed schedules...it could save one to eight hours per the big funds, particularly if you've got a lot of new data,” he said. Freedom to Do More Mari is excited about using the time they’ll save to focus on higher-level tasks. “The way that we've got the citywide statement set up in Workiva, with the linking and things like that…if there [are] any issues with the reconciliation…those will be easier to identify,” she said. “And I don’t have to worry about any inconsistency there...that's going to save some time. And then I think that will hopefully free us up to do a little bit more thorough...final review.” “A repeatable process is what we're looking forward to the most—being able to teach... more than just Mari and I...how to do the critical functions,” added Jason. Ad Hoc Reporting The team is excited to be able to capture and share a true snapshot of accurate data upon request. Enhanced Collaboration Mari's team can't wait to take advantage of Workiva's cloud-based environment, where multiple people can view the data and make updates at the same time. They will no longer need to rely on screen sharing to demonstrate how to fix something, for example. “We're extremely grateful for the collaborative workspace that this will be.” –Jason Shaw, CPA Ease of Use Because working in the Wdesk report writer is like working in a beefed-up combination of Word and Excel (with which her team is familiar), Mari will no longer be the sole troubleshooter on staff. “I think it’s just more straightforward,” she said. Mari added that her team looks forward to using Workiva for report formatting, as “there’s not going to be that kind of fighting with it,” that they experienced previously. “Things like that, I think are going to make our lives a lot easier, because you don’t need to be dealing with that stuff when you're in the eleventh hour, and you're already freaking out about deadlines. And then you have a software program that's just not that easy for you to use,” she said. As icing on the cake, Mari has found the Workiva support and training site to be thorough and easy to use, she said. Looking Ahead More Hands On-deck In the past, Mari and Jason were the only team members capable of data review. “We haven’t felt comfortable [sharing the review] because…[neither of us had] time to explain more,” to staff members who expressed interest in helping. “It was, ‘thank-you, but no’,” said Jason. “At this point, I think we're going to be able to start opening some of that up as well…keeping the two of us on…the overall picture instead of the minutia of…rounding from front to back. We can let some of the other more advanced staff do things like that, [which] we weren't comfortable with before,” he said. Spreading the Word Since the implementation, Mari has become an FHB advocate. “I've already told a couple people…like my former boss…she's got a different agency now…I told her…we're going to Workiva and she [said], ‘Oh, how are you liking it so far?’ I said, ‘so far, I like it much better’…I was telling her…about being able to leverage our groupings that already exist and [such]…she [is] hoping to look into that within the next couple of years [for herself]. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

With help from FHB, the City of Albuquerque traded hundreds of manually manipulated Excel and Word documents with erroneous links for an efficient cloud-based, purpose-built solution for preparing its ACFR, resulting in saved time and effort.

READ MORE

School District 83

- Rachel Raymond

- Success Stories