An Interview with Washington County: Budget Book Automation

- Jamie Black

- Success Stories

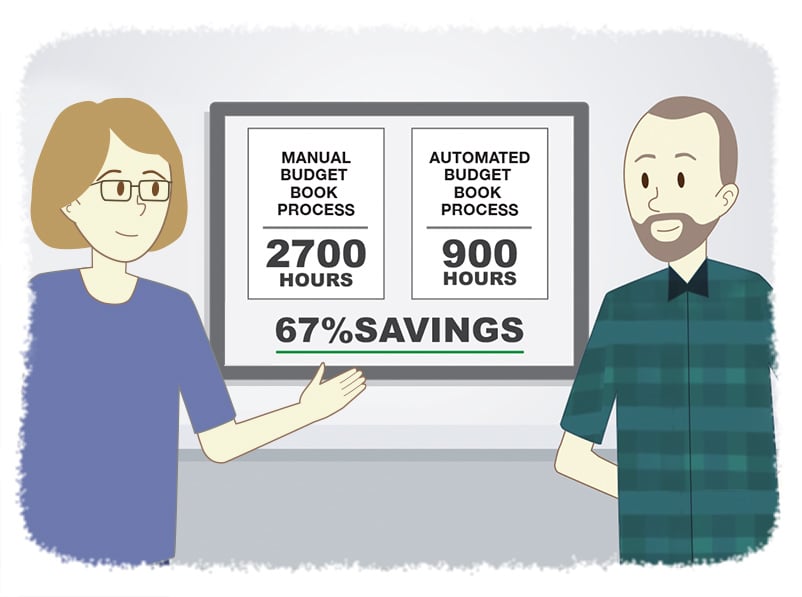

- minute(s)Washington County is the second largest of 36 counties in the State of Oregon. As of the 2010 census, its population was 529,710 and its largest city Hillsboro had a population of 91,611. With a $1.2 billion total budget proposed for 2018-19 to include investments in infrastructure, transportation and affordable housing to name a few, the county's budget department has 'its work cut out for it.' The Challenge The county's budget book spans more than 300 pages. It took four of the team's six staff members approximately 75% of their time from March through the end of June to prepare. Links to Excel in Word documents would routinely break or malfunction randomly; these errors plagued their processes as they would change numbers in multiple locations unexpectedly. The Interview We interviewed Washington County to learn their thoughts on the budget book automation project we completed with them in 2018 (see the book that resulted here). Here are the highlights: 1 What was your business process to tackle the Budget Book previously, how much time did it take and why did you want to switch? Our process was to download information into an Excel Spreadsheet after the information was entered in Questica, open a series of Word Documents by our Functional Area’s then link the spreadsheet that pertained to a specific Org Unit to the correct page in the Word Document, write the budget analysis and present to the Deputy County Administrators for their review and input. As the Deputy County Administrators recommended changes, the changes would be entered in Questica, downloaded into Excel, update the links, reprint the page for further review. At the end of all the changes then the summary sheets would need to be redone with new downloads, the prior links were updated, the budget analysis sections would need to be proofed to verify the words and numbers matched the linked tables. Then after the Budget Summary Book was completed for the public hearing it would need to be re-done after the year-end changes and impacts changed by the budget committees before it was produced as an Adopted Budget Summary in July. This took four staff members approximately 75% of their time from March through the end of June. The desire to switch to a different process was generated as a result of the Excel links in the Word Documents continued to break or malfunction randomly, the mistakes that would plague the process due to changing numbers in multiple locations and a desire to automate some of the processes, standardize language and writing style and have increased confidence in the final numbers in all reports. 2 What other solutions did you consider? How did you hear about FHB, and what were the key factors in choosing our solution over the others? We looked at a few other solutions that were more of a publication software style and did not link to Questica or provide number checking abilities. Two staff members were able to attend the Questica conference two years ago and watched a demonstration from FHBlack on the ability to link Questica to preparation of the Budget Summary Book. In addition, Questica sales representatives assisted us with finding other agencies who had implemented CaseWare as a Comprehensive Annual Financial Report solution. The key factors for our selection were the interface ability to link CaseWare to Questica and the standardization of programmed sentences and fonts. 3 Were you initially concerned about working remotely or working with a Canadian company? We had very limited experience working 100% remotely on software implementations so yes, we did have some reservations at the start. We had no concerns about working with a Canadian company. 4 What process did you follow to implement CaseWare and how did you feel the implementation went? Perhaps provide a summary of the process? We used the consultant for all implementation of the software and preparation of the past year Budget Summary Book. We met weekly during the development and provided results of queries from Questica that the consultant built. The consultant was given access to our systems or was able to direct us on what was needed during our webinar sessions. All sessions were attended by the County team so that we were all learning about the software, provided the consultant information on how our budget process worked, accounting structure, how the software used the data to provide the summary pages, spreadsheet view, pictures, and how other outside the system documents were added. We were then able to work more independently when putting together the new year budget summary with the assistance of the consultant. The consultant was very knowledgeable about CaseWare and was an invaluable partner in the successful implementation of the software. He was very adept at learning our account structures, setting up what was needed and provided a best practices approach to how the book went together. He was great at problem-solving and thinking outside the box to find solutions that benefited our project. The implementation was successful and the experience was one of the best we have encountered. 5 How many team members at the County worked with the CaseWare Budget Book Solution? We had six staff members on the County team, a Project Manager, Chief Financial Officer, Controller and three other budget analysts. 6 From your perspective, how is the County in a better position now as compared to with your old solution? Is the process faster? What are the biggest benefits? Could you estimate the time savings or provide any examples. We are just now about ready to begin our second actual year of preparation of the Budget Summary book. Our process starts with getting the budget into Questica before we can begin using CaseWare. We envision that the process to interface the needed information from Questica to CaseWare will go smoothly. The interface is required in order to prepare the first draft of the summary pages with the financial information linking smoothly. We do plan to use the consultant to assist us with the initial conversion to the new fiscal year so that we have clear written directions to complete the process. We believe that the time staff use to put into downloading information into spreadsheets, unhiding rows, adding new organizational units etc. will be better spent providing additional analysis, and free up time to work on other projects that often get delayed during this budget preparation time. One budget analyst is also having time re-directed to assist in the implementation of CaseWare for our Comprehensive Annual Financial Reporting implementation project. I would estimate that we are saving about two of the FTE who were working on this part of the budget development. 7 What is your perception of our expertise? Specifically, can you speak to our knowledge of: Technology generally and CaseWare/Questica specifically Budget Book process & requirements Our consultant was very knowledgeable on both CaseWare software and Questica information and queries. The consultant we used was great and his knowledge of the Budget Book process and requirements was outstanding. He was able to build our document to meet our needs, troubleshoot issues that arose and make many great suggestions to assist us in this process. The software is complicated enough that I am not sure we would have been successful without his direct work and interventions when we had difficulties. 8 What was our client service like? Did you feel like we carefully managed the project, knew and met your deadlines? Did you feel like you were well taken care of by your consultant and that your concerns were heard, and your questions answered etc. Client service was great. Some interim project deadlines were allowed to slip by the Chief Financial Officer. However, the overall project deadline was met. The consultant was dedicated to making sure the project was completed and we were happy with the final product. All our concerns and questions were answered by the consultant and his level of patience and willingness to provide additional training were excellent. From a project perspective, F.H. Black exceeded our expectations. From day 1, their project manager (Darryl Parker) made us believe we were his one and only client. With his deep knowledge in governmental accounting, he had a clear understanding of our practices and challenges. Also, project timelines were clearly communicated. When challenges arose, Darryl seemed to do magic getting us back on track! A true pleasure to work with! 9 Would you recommend FHB and specifically the CaseWare Budget Book solution to other state or local government finance departments and why? Yes, we would recommend both FHB and CaseWare Budget Book to other jurisdictions. We believe the time savings going forward will more than offset the annual cost for access/licenses. The ability to customize the look and feel of the book to match our prior books, add our own other documents that did not make sense to build into CaseWare including charts and graphs are key to the successful build of our Budget Summary Book. 10 Do you have plans to tackle any other automation projects (Comprehensive Annual Financial Report, monthly, quarterly, state-mandated reports etc.) with CaseWare and FHB? If so, please discuss them and why you feel the county will benefit from these automation projects. We have just begun the implementation project to automate our Comprehensive Annual Financial Report. In addition, we have two other departments within the County who are interested in automating some of their quarterly or annual financial reports. The automation of the Annual Report is anticipated to save a great deal of staff time chasing down numbers that change during the development of the Comprehensive Annual Financial Report. Every time a number changes in the current process causes additional time to find and make the changes in all places impacted. CaseWare will carry through the changes to all needed tables/pages so that this additional review time will be saved. The other departments see the value of this software and are excited to develop projects to assist them with meeting their reporting needs. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Washington County automated their budget book with the help of F.H. Black & Company Incorporated by implementing the Questica Budget Book powered by CaseWare solution, drastically streamlining the processes while producing a more reliable report.

READ MORE

What is your Bitcoin strategy? Accept / Invest / Avoid

- Waldo Nell

- Tech for Execs

- minute(s)Most people have heard of “Bitcoin”. It was all over the news about a year ago with massive increases in value, which lead some to ponder if Bitcoin would become the currency of the future. Much has happened with Bitcoin in the last year (both positive and negative) and we thought it was time to consider the opportunities of Bitcoin from a Finance Department perspective. As you all likely know, Bitcoin (BTC) is one of many types of cryptocurrency. Other well known cryptocurrencies include Litecoin (LTC) and Ethereum (ETH). Bitcoin is the oldest and most well-known of the cryptocurrencies. It has been around for almost a decade, but only recently began to experience significant increases in value. This increase lead organizations around the globe to wonder if / how they should take advantage. 1) Should your organization accept Bitcoin? For most finance departments, there are 3 reasons that they should not rush to accept Bitcoin (or any digital currency): Low Demand - There is little consumer demand to pay with Bitcoin. This is driven by significant appreciation hopes by those that hold Bitcoin, and high transaction fees. Perceived Legal Risk - Digital currencies are treated as 'commodities' not currencies. This can lead to difficulties with your legal options in the event of theft. Increased Administration - The steps required to accept digital currencies are not the same as accepting traditional currencies. While straightforward, it is one more barrier to moving forward. Further, given price fluctuations, (discussed below) you may want to quickly convert from Bitcoin to cash. This is an additional administrative task that likely further discourages adoption. The result is Bitcoin Acceptance is Low and Getting Lower. I'm not certain at this date what would compel Finance to prioritize its acceptance. 2) Should finance invest in Bitcoin? The answer for nearly all finance departments is holding significant amounts of Bitcoin today is too risky. In just the last few years (from Q3 2016) Bitcoin value began growing exponentially. In Q2 2016 a single bitcoin was valued at approximately $590. Approximately six months later in Q1 2017, the value jumped to $1,400, and in Q4 2017 it peaked at $25,000, before falling to today’s value of $8,200 (CAD). This exponential growth followed by a rapid decline in value highlights the volatility and uncertainty inherent in this modern currency. This volatility likely makes significant holdings by finance in Bitcoin unwise. Some look to Bitcoin futures to bring Bitcoin into the mainstream financial markets. On the prospect of these futures, JP Morgan set their Bitcoin evaluation to "Bullish" as an investment asset. Some analysts believe that the recent advent of these Bitcoin Futures contributed to the major valuation gains that were seen in late 2017. Largely however, this futures market has been disappointing. “Institutional players have stayed on the Bitcoin sidelines, and as long as they are, the futures contracts are likely not to generate substantial amounts of volume.” Craig Pirrong, a finance professor at the University of Houston The future of Bitcoin and its underlying blockchain is definitely something to keep an eye on, but given all the above finance should view Bitcoin like any very risky investment; only invest amounts that you can afford to lose. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

12 months ago, Bitcoin was all over the news with meteoric valuation gains. The last year has seen the value drop considerably. What should your finance department do in 2019 with Bitcoin? We answer the two biggest questions.

READ MORE

Important Notice: CaseWare Financials Template (GASB)

- James Goligher

- What's New

- minute(s)We have learned of a bug affecting CaseWare's GASB Financials Template. Issue: On installing the 2016 patch customized schedules are lost from the content library. CaseWare International has already resolved this issue. On September 24th, 2018 Patch 2016.00.335R6 was released. If you have already updated to Version 16, it is important that you immediately take action to ensure your Schedules are not lost. If you are yet to update, ensure you install the latest version. Templates should always be backed up before installing a patch. To backup use the 'Repackage' option. Only users who have added customized content to the schedule libraries of the template are affected. Unfortunately, that includes many of FHB's clients using the GASB Template. Our clients are invited to book a support call with one of our consultants who will be happy to discuss the issue with you and assist in taking the appropriate steps to ensure that your content is protected. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

We have learned of a bug affecting the 2016 version of CaseWare's GASB Financials Template.

READ MORE

Comprehensive Annual Financial Report Automation Success - State of ...

- Jamie Black

- Success Stories

- minute(s)The State of Maine is thrilled with its new automated approach to preparing the Comprehensive Annual Financial Report (see the resulting document here). We interviewed them to learn more, and share their insights with others considering a Comprehensive Annual Financial Report automation project. Read the full interview: The Interview 1 What was your business process to tackle the Comprehensive Annual Financial Report previously and how much time did it take? We import a trial balance from our accounting system that is formatted for use by our reporting application using Excel. We request information from numerous state agencies and other sources for the purpose of posting adjustments (over 300 manually entered adjustments and over 100 "auto-reversals") to account balances and compile other information for note disclosures, required supplementary information and statistical information. Our previous Comprehensive Annual Financial Report reporting software generated only numerical financial statements in Excel format. Narrative information was generated with Word. Desktop publishing was a completely manual process that involved converting multiple documents into PDF format and compiling numerous PDF documents into one published document. The entire process began with some "prep" work in August, with the full commitment of all five members of the financial reporting team beginning in September. Draft financial statements typically were issued by approximately the second week in December and often the Auditor's Opinion letter would not be received until the last week of December, with the deadline to qualify for a Government Finance Officers Association Certificate of Excellence being December 31. A significant amount of time involved in generating the Comprehensive Annual Financial Report requires the compilation of information, making calculations, documenting, reviewing and filing workpapers for review by our Auditors. Additionally, we are the reporting entity for several component units, who must complete their financial statements before we can include their information in our statements. Thus, it would be difficult to push the timeline back further than approximately December 1st. 2What product were you using before and why did you want to switch? We used "CAFR Unlimited." The product was a Microsoft Access based application that was originally developed by a lone developer and sold to a software development company. The company discontinued support for the original application and planned to convert the application to a networked, SQL server platform, but discontinued support for that product as well. The product was simple to use and worked well for us. But, it had no desktop publishing capabilities. The reports that CAFR Unlimited produced were all Excel based reports. Thus, we switched, number one, for the lack of product support; and two, we wanted a more robust product that provided publishing and workflow capabilities. 3Did you look at other solutions and if so, what was the key factor(s) in choosing our solution? We were provided with demonstrations of other products, but none of them had all the capabilities that CaseWare offered. We also liked the staff at FHB and felt comfortable that they would provide excellent customer service. After a demonstration of CaseWare, we were instantly intrigued by the product. When we asked the presenter "will CaseWare do this?", the answer was in most cases "Yes, this is how that is done." The decision to go with CaseWare was easy. 4Were you concerned about dealing with someone other than the software vendor for implementation? No, not at all. In fact, after the implementation, we had a couple of minor "glitches" to resolve and in a least one case, F.H. Black resolved the problem quicker than CaseWare International's support staff. So, we're very happy we have the support of FHB. 5What process did you follow to implement CaseWare? We installed CaseWare on our computers and received four days of training from an F.H. Black consultant in two separate 2-day sessions. We provided the consultant with the prior year Comprehensive Annual Financial Report and our previous trial balance "crosswalk" or "rollup" codes. The consultant recreated the prior year's statements, notes, and various schedules based on Governmental Accounting Standards Board (GASB) templates. Through online "Goto Meetings" we met with the consultant at least once per week to discuss questions we had and offered our comments about changes that needed to be made. During this process, the consultant maintained the "master copy" of the CaseWare Working Papers file. Once the prior financial statements had been substantially recreated, the consultant performed a "roll-forward" to create the current year (new working papers file) financial statements; and control of the master copy was handed off to us. We entered adjustments to account balances as usual during the report compilation period. During this period, we continued to make editorial improvements to the Comprehensive Annual Financial Report with the help and support of FHB. The final step of publishing the Comprehensive Annual Financial Report merely involved "hitting the print" button. 6How did the implementation go? It was a lot of work and required the effort of five of our staff as well as three of F.H. Black's staff. Considering that our Comprehensive Annual Financial Report is an extremely complex and detailed 250-page document, the process went quite well. 7From your perspective, how is the State in a better position now as compared to with your old solution? Is the process faster? Could you estimate the time savings or provide any examples? We believe we are using a much better tool than before. We are comforted in the fact that we have support of a company with knowledge and expertise in financial reporting and supports mature industry-leading software with an international presence. It's difficult to measure "fast" in our circumstance. CaseWare's strength is with its desktop publishing capabilities. But, in terms our timeline, since we are a relatively large governmental entity, we post numerous adjustments (approximately 300 plus), that must be processed through our rigorous documentation and review process. This takes a tremendous amount of time regardless of the tool(s) used. CaseWare does save us the time and tedium of having to manually enter every adjusting journal. At the end of the reporting process, we used to compile numerous Excel workbooks and Word documents, send files to a "PDF printer" and import many PDF files into the final published version. Since individual documents came from so many different sources there was no consistency in page margins, page numbering, fonts and font sizes, etc. CaseWare is "heads and shoulders above" our previous software in terms of the quality of the published report. We also believe the overall integrity of the report to be much better and the risk of errors and omissions is less than before. 8What are the biggest benefits of the CaseWare tool vs. your old system? The biggest advantage is the desktop publishing and the ability to reference values between statements to ensure that all values agree. Our prior reporting application had no desktop publishing capabilities. The exceptional feature of CaseWare is that anyone can see a real-time view of the draft report at any time during the report compilation period. You don't have to wait until the end of the process to view a compiled "camera ready" draft product. CaseWare provides the ability for the user to formulate unlimited diagnostics and analytics to ensure the completeness, accuracy and integrity of the final product. CaseWare allows the user to easily generate customizable reports using its "automatic document" functionality. These reports were invaluable in establishing and verifying account rollup balances during the implementation phase and the reports were extremely useful for auditors as well during the first year of our Comprehensive Annual Financial Report reporting. Our old system did not allow the user to save customized worksheet reports; whereas CaseWare allows users to create as many "worksheet" reports as desired and organize them anyway they want. Our prior tool allowed for the import of the trial balance only. CaseWare allows user to import trial balances, budgets, revenue forecasts, performance measures, and even adjustment data from properly formatted Excel workbooks. The import functionality is extremely convenient as it eliminates the time and tedium of entering data that we've already "crunched" in our complex Excel spreadsheets. The import functionality also limits or eliminates data entry errors. 9What was your experience with FHB like? The consultant assigned to our project has over ten years of experience, his combined background in accounting and computer programming and technical acumen makes him an invaluable resource for us and FHB. 10Did you feel like we carefully managed the project, knew and met your deadlines etc? Yes. We were very clear in communicating our timeline to FHB. We had established a reasonable timetable at the beginning of the implementation project. We believe that effective planning and communications by all parties was key to the success of the project. 11What was our client service like? Did you feel like you were well taken care of and that your concerns were heard, and your questions answered etc? We believe FHB's customer service is "top notch." The team made a concerted effort to understand our requirements and concerns. We participated in periodic "how's everything going" meetings. We got the sense that FHB strives for continuous improvement in servicing its clients; and is genuinely concerned about its clients' opinions and satisfaction with FHB's products and services. 12How well did we communicate? Were we clear and concise, were we readily available to discuss your concerns? Did we do a good job of setting expectations and keeping you updated each step of the way? The consultant assigned to our project was extremely knowledgeable, helpful, easy to work with, and explained every detail of the technical, "under the hood" aspects of CaseWare whenever we had specific questions about how the application works. 13Is there anything you wish you knew at the beginning of this process that you know now? Advice for others considering a similar Comprehensive Annual Financial Report automation project? We can't think of anything that we wish we knew at the beginning of the process. However, as one would expect, the more complex the set of financial statements, the more lead time an entity should provide itself to implement CaseWare. Our Comprehensive Annual Financial Report is 250 pages that includes introductory information, management discussion and analysis, basic financial statements, notes to the financial statements, required supplementary information, notes to the required supplementary information, combining and individual financial statements, and statistical schedules, all prescribed by GASB standards. We started our implementation project in April of 2017 with training. The recreation of the prior year's financial statements, to be used as a template, took place from May through August. The generation of the current year's financial statements occurred during the usual time frame from September through December. We completed the published report approximately two weeks ahead of the usual timeframe. As with any project, proper planning, delegation of tasks, and adherence to deadlines is important to achieving a successful outcome. 14Would you recommend CaseWare to other state or local government finance departments and why? Absolutely...Yes. Based on our research and experience, CaseWare appears to be the most comprehensive reporting application on the market - the one tool that "does it all." © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The State of Maine automated their Comprehensive Annual Financial Report with the CaseWare solution and are thrilled with the results. We interviewed them to find out more about what they did before, the implementation process, and where they are now.

READ MORE

Has Artificial Intelligence improved your finance department yet?

- Jamie Black

- Finance Evolved

- minute(s)Finance has always utilized technology. From the humble abacus (2700 - 2300 BCE) to adding machines (1642 CE), to today's PCs. The last 40 years have seen even ‘Moore’ (excuse the pun, couldn’t resist) spectacular technological advancement, as discussed in our Tech for Execs: Ignorance is not bliss article. The questions we tackle here are what will the future bring, how disruptive will this change be for the finance department and what can we do today? Future Technology - Artificial Intelligence (AI) In short, AI refers to a device that perceives its environment and takes actions that maximize its chance of successfully achieving its goals. This definition is intentionally broad as AI could refer to a software application designed to perform bank reconciliations or Terminator robots. When we think about AI in terms of software, one guide is that the application can do things that it was not specifically programmed to do. It learns based on the outcome of previous events. There are two categories of artificial intelligence: 1) Narrow AI Narrow AI is focused on one very specific topic. Still, in its early stages, we can already see developments in narrow AI. AlphaGo Zero is a computer program that taught itself the board game Go by playing against itself. Within days it was better than the best Go-playing applications which themselves beat the best human Go players. Then in 4 hours it taught itself Chess and could beat the best Chess programs in the world (the ones that beat the best humans). Finally, it taught itself Shogi (a Japanese version of Chess played on a bigger board) in 2 hours and was better than the world's best Shogi program. Some other interesting examples: Google's self-taught Go playing AI crushes the best human player, AI in Tesla will predict your destination, MIT's autonomous cheetahs figure out how to navigate obstacles entirely on their own, Boston Dynamics SpotMini locating, recognizing and opening a door, Amazon's use of AI to improve their business processes 2) General AI General AI (sometimes called Artificial General Intelligence or AGI) is a hypothetical machine that exhibits behavior at least as skillful and flexible as humans across a broad set of topics. This is the Hollywood sci-fi that many people immediately think of. Should AGI become a reality, it promises to change every aspect of our world fundamentally. Many experts in the field are in fact worried that it will lead to disaster. To learn more, I recommend an excellent Ted Talk by Sam Harris or Nick Bostram's great book on the topic. AI & the finance department What will AI (narrow or general) mean for the finance department? In the near term, repetitive and time-consuming tasks are being automated at an accelerating pace driving massive improvements in efficiency. These advancements tend to be less risky and relatively low cost and thus are immediately appealing. The benefits are enormous, freeing your team from the mundane, repetitive work allowing them to tackle the difficult, often more rewarding tasks that they may not have time to tackle today. As the technology improves, analyzing data and making decisions based on this analysis are also likely to be automated. We expect that the move to rely on AI for these most complex and difficult tasks - the ones that require years or decades of experience in humans - will be initially slow and cautious. Nearly all studies suggest that the entire finance function (like many others) will be entirely automated by AI exclusively or a human-AI hybrid. The process has begun. Recent research indicates 46% of CFOs in large companies already use narrow AI in some role in their organization and another 30% are investigating its use. Today's Technology - Robotic Process Automation (RPA) For decades finance departments leveraged spreadsheets and more recently databases. These technologies allow for simplistic automation such as calculations or manipulating manually defined groups of data. While basic, this automation has allowed finance departments to complete larger & more complicated tasks with fewer hours of investment. RPA takes automation to the next level and can be considered a pre-cursor to AI. The three characteristics generally associated with RPA: It does not require programming skills on the part of end users, It does not require complex, disruptive integration with existing systems, It is designed to be managed and even implemented by a business user, Some simplistic examples: data analytics & monitoring systems that check thousands of variables in the way it’s been taught, against the benchmarks that have been provided. When exceptions are identified appropriate individuals are notified automatically and escalations occur at pre-determined intervals. automation of reconciliations between any data sources with automated adjustments when common deviations (think bank charges in the context of a bank rec) occur. automated modification of language in your MD&A based on the significance of an identified variance. So if the variance between actual and budget is greater than a predetermined threshold, entire sections of the report turn on and standard analysis is performed, automated analysis of documents to find violations of integrity, automated balancing of amounts across large complex documents. Take advantage now It's clear that technology has, does & will continue to influence the role of finance. While the exact timeline may be difficult to predict, the importance of continuously evaluating and embracing technology is indisputable. It is likely that many of the tools you use today include RPA functionality that is not being utilized. Further, you can expect to see a lot of narrow AI tools specifically targeted at finance in the very near future. Spending a bit of time to leverage these tools can provide your finance department with significant benefits at a very low cost. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

AI is coming and it will dramatically improve your finance department's efficiency. It is already starting and many of us don't know it yet.

READ MORE

Windows Security Basics for the Finance Professional

- Waldo Nell

- Tech for Execs

- minute(s)Finance professionals interact with Windows security every day when they provide a username and password to login to their computer/network. Another common interaction occurs when they want to install a new application and are stopped and forced to call IT. Finance professionals can struggle when security prevents them from accomplishing necessary tasks. As we have argued elsewhere, it is useful to have a bit of insight into how Information Technology works so you can either: solve the problem yourself or better communicate with IT. Just as we did with passwords, we also hope to provide finance professionals in small organizations with a better perspective on how their IT department (often outsourced to consultants) ought to leverage File Access Permissions to help mitigate risk. There are many different kinds of security involved on a typical computer helping protect you or your organization from problems (malware infecting your network, unauthorized access to company files, etc.). One such security mechanism is called File Access Permissions. Please note that this topic is actually complex and varies by specific operating system. Thus to keep it brief we will simplify some topics (while being largely accurate) and assume a recent Windows operating system. Access Control Lists and Permissions Each file, folder, and network share have an associated Access Control List (ACL). An ACL is a list of users/groups that have specified access rights to the file/folder/share dictating what they can do with it (called Permissions). Common permissions include Read and Write. ACL entries might look like this: File: Inventory2017.xlsx User Bob: read permission User Mary: read/write permission Assuming no other rights are granted elsewhere, user Bob has permissions to read the file, but only user Mary is allowed to both read the file and make changes to it. If user Bob tries to save the file, he will get an error. In a well-designed network, ACLs are usually defined a bit differently as the above example is quite brittle and hard to maintain. If you had to assign access rights file by file imagine how much work this would be and how easy it would be to make a mistake. Active Directory, Security Groups, Files and Folders In a typical Windows-based network, information on all employees, consultants, and computers are stored in a central directory called Active Directory (AD). As you can see from the image below, it is nothing mysterious. It is a hierarchical tree (like an organizational chart) grouping users and storing details such as your login name, password, email address, etc. The grouping feature is valuable. The idea is simple - a security group is a collection of people that share similar access rights. For instance, HR staff may need access to specific files while Accounting may need access to different files. By creating an HR group and an Accounting group, and adding all HR staff to the HR group and Accounting staff to their group, the IT administrator can now apply security policies based on groups, and not individual users. When an HR employee leaves the company, and a new one is hired, the employee only need be added to the right group and all access permissions will automatically apply to this user. Thus, a well-designed ACL list will leverage these groups and might look like this: Folder: E:\data\human resources Group HR Staff: read permissions Group HR Managers: read/write permissions Two benefits of the above approach: The ACL is applied to the whole folder, ensuring that all files and folders stored in that folder have the same permissions. New files will automatically share the same permissions as the folder. Permissions are assigned to groups. Thus anyone belonging to the HR Staff group to have read-only access to the files and folders, and HR Management to have full access. This reduces the workload on IT and ensures consistency. Network Shares and Conflicting Rights In addition to file and folder level ACL entries, a network share can have a separate set of permissions. In the example above, assume the location is shared on the network under the name "human resources", then the share itself can have an ACL associated with it similar to the following: Share: \\server\data\human resources Group Everyone: read If the ACL on the share were configured as above, nobody would be able to write to that folder. Both the share and the file/folder based ACL need to allow access. They are defined in two different locations and are not related to each other in any way. The best way to think of this is the most restrictive permission set wins. One other permission that you should know of besides Read, and Write is Execute. A program file requires you to have the Execute permission before you may launch it. Attributes Lastly, files and folders may have certain attributes. The Read Only attribute is significant to end users as this flag may override any write permissions set on the file. If a file is marked as Read Only, the user will be unable to modify it even if they have the write permission in the ACL and the shared folder permissions that we discussed above. This flag can usually be removed by the end user as long as the user has write access to the file. Once the flag has been removed, the file can be written to assuming the user has write access based on the ACL set. Security Warnings on Downloaded Files One last issue you may run in to from time to time has to do with files downloaded from the internet. If you are using Windows 7 or later, your computer keeps track of the source of the file and will protect you from files that originated outside of your organization. Windows uses a feature called "Alternative Data Streams" (ADS) to remember which files originated from external network sources. When Windows detects you trying to open one of these files, it will warn you. If your IT department allows you, Windows will ask for your explicit permission to open it. However, your IT department can set up your permissions so that you do not have any choice and are simply blocked from opening these file In conclusion, then - accessing files and folders in Windows is broken down into several layers of protection: 1. File/Folder based ACL assigned to Groups/Users 2. Network Share-based ACL assigned to Groups/Users 3. File-based Attributes such as Read Only 4. Downloaded file based ADS blocking access All four layers need to grant you access before you can work with a file. Also, access might be partial such as read-only or read/write only but not delete. What you should try if you have access issues: To check whether you have access to a file or folder, open File Explorer and navigate to the file/folder in question, right click and select Properties. 1. For file-based ACL rights, go to the Security tab. Click on your name or the AD group you belong to (you may need to ask IT if you do not know this) and check your permissions. 2. For network share-based ACL, locate the mapped network drive, right-click the drive and select Properties. The Security tab will show the ACL for the network share. 3. For file-based Attributes, review the General tab and check if Read-only is ticked. 4. To see if a downloaded file is being blocked (assuming you have write access to the file) right click it, select Properties and then unblock it at the bottom of the Properties window. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Have you been denied access by Windows to a file you need? Here are the Windows Security basics to aid finance in fixing the issue or communicating with IT.

READ MORE

Palmetto proves automating the Comprehensive Annual Financial Report ...

- Jamie Black

- Success Stories

- minute(s)Palmetto is a waterfront community located on the Gulf Coast of Florida, midway between Tampa to the north and Sarasota to the south. With a population of just over 14,000 residents, the City has seen dramatic growth in recent years while maintaining the “Old Florida” charm that residents and visitors have come to love. The Challenge The primary challenges for the City's Finance Department were three-fold, they needed to: Reduce Time Reduce the Risk of Errors Formalize Processes Everyone wants to reduce the time it takes to produce the Comprehensive Annual Financial Report & mitigate the risk of errors. Of particular concern for Palmetto was the impending retirement of the City's Finance Director. The finance department, made up of just four members, was very concerned about how this loss & associated "brain drain" would affect the department going forward. The Wrong Turns Not one to wait for a small problem to become large, the Finance Director anticipated the problems that would arise from her departure and took steps to mitigate them immediately. After extensive research, the finance department eliminated all spreadsheet-based applications and decided to proceed with a Comprehensive Annual Financial Report focused solution. Unfortunately, two-thirds of the way through implementing the solution, the City was abandoned by the provider. Sometimes even the best-laid plans go awry due to circumstances beyond your control. The Solution Convinced a better solution was still 'out there', the evaluation of vendors resumed. This time CaseWare International was the victor, a combination of the Working Papers & GASB Financial solution were just what the department needed. Perceived Road Blocks When asked why CaseWare was eliminated for consideration initially, the answer was simply “it was way too big for what we needed.” The perception was that the program was too large & complex, it would take too long to implement. In steps CaseWare authorized implementers F.H.Black & Company Incorporated. The Results Reduced time required to produce the Comprehensive Annual Financial Report including over 50% reduction in the time it takes to prepare Fund Statements, Reduced risk of errors, Documented, simplified & formalized processes that will ease the transition to a new Finance Director, Centralized-database for single location modification, Positioned to reclaim Government-Wide statement creation from auditors. A word of wisdom from the expert Karen Simpson, Finance Director, shared that no matter the size, “the same amount of work still has to be done.” As the number and complexity of regulations and requirements for financial reporting continue to increase, municipalities of all sizes are quickly realizing that spreadsheets and word processing software that have been used in the past to prepare financial reports are no longer sufficient. Read the full success story here. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Palmetto proves that automating the Comprehensive Annual Financial Report provides time, cost & operational savings for local governments too.

READ MORE

CaseWare Updates Now Available for 2017 Version of Connector

- Jamie Black

- What's New

- minute(s)Software: Connector Prior Version: 2017.00. New Version: 2017.00.055 Release Date: November 16, 2017. You may have received an email from CaseWare International announcing the release of, and inviting you to download, an update for CaseWare's 2017 Connector product. The update has been made available for CaseWare users in their MyCase portals. If however, you did not receive the email or cannot locate the download in your MyCase account contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes the following fixes: Fixes related to: File extensions Connector stability Links/protected documents User-defined functions. Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months talking about the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare has just released an update to it's 2017 Connector product. Download the update to apply software fixes.

READ MORE

CaseWare Updates Now Available for 2017 Versions of Working Papers & ...

- Jamie Black

- What's New

- minute(s)Software: Working Papers & Working Papers with SmartSync Prior Version: 2017.00.225 New Version: 2017.00.245 Release Date: November 16, 2017. You may have received an email from CaseWare International announcing the release of, and inviting you to download, an update for CaseWare's 2017 Working Papers & Working Papers with smart-sync products. The update has been made available for CaseWare users in their MyCase portals. If however, you did not receive the email or cannot locate the download in your MyCase account contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes the following enhancements & fixes: Enhancements related to: Fixes related to: Imports Data Store Administration Tool Tax integration Interface Page numbering/printing Synchronization functionality Automatic Documents Document Management Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months identifying the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare has just released updates to it's 2017 Working Papers & SmartSync products. Make sure to update for the latest enhancements and fixes.

READ MORE

Important Notice -CaseWare Financials Template (ASPE) Users

- Darryl Parker

- What's New

- minute(s)On Thursday, October 26th, CaseWare International sent out a email to all users that have downloaded the ASPE variant of their Financials template. This email informed users that an issue has been identified with the v15 update which was originally released in August of this year. The email did not describe the nature of the problem uncovered, but did give some detailed scenarios and steps to address the problem. Note that this problem only relates to users of the Canadian ASPE Financials template who have already performed an upgrade to v15. If you use the IFRS, US GAAP, or US GASB Financials template, there is no issue for you and no need for you to take any action. We have learned that the problem relates only to users who have added customized content to the Knowledge Libraries of the template. Unfortunately, that affects nearly every one of FHB's clients. The problem is best if caught before any additional content is added to the updated v15 template. If you have recently updated, it is strongly recommended that you revert back to your last v14 CWP file, and re-update using the newest build of the v15 upgrade patch. Complete instructions were sent in email, but of course all of our clients are invited to book a support call with one of our consultants who will be happy to discuss the issue with you and assist in taking the appropriate steps to make sure you are protected. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Working Papers users - CaseWare International announced a CRITICAL update for the ASPE Financials template. Get this update before busy season!

READ MORE