The quick & easy way to import into CaseWare

- James Goligher

- Tips and Tricks

- minute(s)To take full advantage of CaseWare's power to automate your reports, you must first import your data. There are numerous accounting software packages that CaseWare imports from directly. Even if your package is supported, however, we do not typically recommend you use the "Accounting Software" method. Instead, we advise using the "Excel File" import feature. Why? There are two key benefits: Consistency. Perhaps you work in an accounting firm and need to import from dozens of different accounting packages. Rather than learn different processes for each, you can learn just one - Excel. Data Integrity. Working with Excel you can review data and ensure it balances before you import. Many folks identify a drawback, however - speed. With Excel, users must specify numerous options before import, which can be both confusing and time-consuming. If that's your experience, this blog is about to save you that most valuable of assets, time. Most users don’t know about the ‘Record Layout File’ option. Simply put, it’s a way for you to automatically populate all options in the Excel Import Wizard. Making the import a 4-second process. No more identifying rows to be excluded, no more labeling columns, no more selecting advanced options every time you import. Instead define these criteria a single time, save a record layout file and apply it subsequent imports. NOTE - to take advantage of this process, you will want to have the Excel file in the same format every time you import it. So, it is best to find the right report in the accounting software, and export that same one every time. For more information on importing from Excel to CaseWare Working Papers, including a demonstration of how to get from import to draft Financial Statements in under 3-minutes, see our CaseWare Feature Spotlight: Importing Data blog. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

There are many ways to import data into CaseWare. But, only one applies to all users, takes under 5 seconds, and can be reliably executed time after time.

READ MORE

How to prepare a better solution requirement list for IT project ...

- Jamie Black

- Efficient, Effective and Reliable

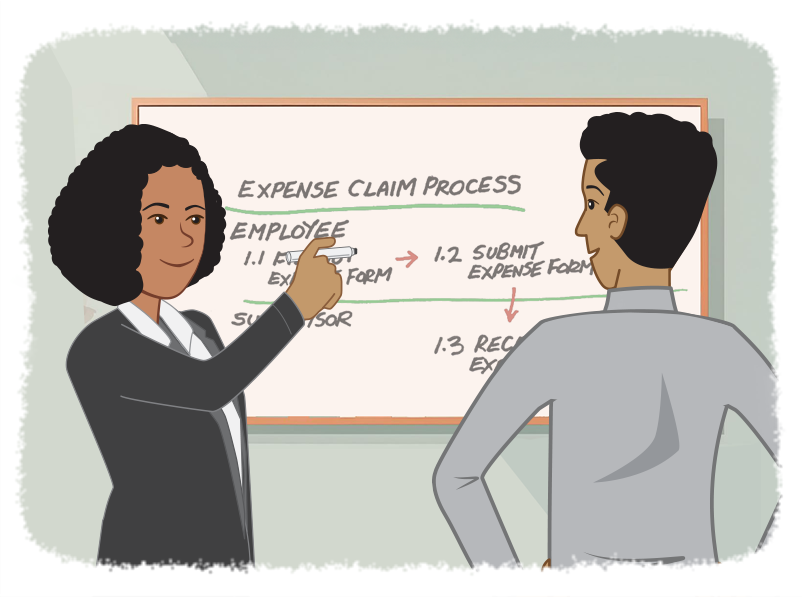

- minute(s)Many of our articles address factors related to IT project success and the significant rate at which these projects fail. There are many causes for failure; first among them is choosing a solution that does not meet the needs of your organization. Typically, selecting an IT solution begins with the Request For Proposal (RFP) process. The process seems logical—state your needs and ask vendors to supply a price to meet those needs. If you're buying a commodity with little differentiation among options, developing a list of requirements is important. But if you're buying an intangible like an IT solution, with unlimited variables and options, that list becomes absolutely critical. Unfortunately, it is very common to see software requirement lists for Annual Comprehensive Financial Report automation or Continuous Controls Monitoring (CCM) systems with requirements: That are very broad Derived exclusively from a vendor's list of features Copied from another, theoretically similar organization's RFP To see the error in this approach, imagine buying an expensive suit. After noticing it hanging in the store and being impressed with what you see, the next step is always to try it on. Why? It is the only way to guarantee it fits you. Even though the tag says it's your size, that is no guarantee of fit, is it? Take that suit home without trying it on and it might fit exactly (unlikely); it might need some alterations, or it might be completely wrong for your body. Why do so many organizations have such ill-defined requirements? The most common reasons include: The team disagrees that implementing a new IT system is like buying a suit; they see it as more like the purchase of socks—one size fits all. The team did not have time to formally document their needs, but felt that a good compromise was to use someone else's. The team did not have a clear idea of how to document their needs, so they chose to leverage those published by vendors or peers. How to document your needs If you fall into the third category above, you can improve the probability of your IT solution's success by applying these seven steps: Document your current business processes. Start by writing down each step. Visit the people who perform each step and ask them what they do, in what order, and why. Be prepared for some surprises. There will be steps you did not know about and shortcuts you never imagined. The benefits of this documentation process can go beyond selecting the right new system. For example, it can be the critical first step to updating your internal controls risk assessments or training materials. Prepare process diagrams. There are many ways to create this material, but we firmly recommend modeling your business process graphically. Business process diagrams (or models) are excellent at displaying process gaps or errors in understanding in a way that descriptions like those gathered in Step 1 will not. We recommend swimlane diagrams like this: Many applications can be used to create these diagrams. The most commonly used is Microsoft Visio but we also like Lucid Chart and Creately. Gather copies of any inputs (forms, authorizations, etc.) or outputs (reports) of your business processes as attachments to your documentation. Be sure to label the diagram to show where in the process they apply. Consider what could/should be improved: What is difficult today? Which steps in the current process take a long time? What would the value to the organization be if you could eliminate or shorten this time? Are all steps necessary? Could we remove any steps and still achieve our desired results? Often these opportunities will jump out at you in the diagram. They may appear as many steps that loop back on top of themselves, for example. Create new diagrams of the optimal future process, incorporating the items identified in Step 4. This improved process is a better representation of what you want your new system to support. Transform the new business process steps into a requirements list. For example, if a step in your diagram is, "Batch email statement," the requirement might be, "Ability to email statements to all accounts that have an outstanding balance without any manual intervention." Finally, now is the time to consider vendor feature lists or the needs documented in other, similar organizations to see if there are any items you may have overlooked. By applying these seven steps, you can tailor your software requirements list to your organization, and more likely find the solution that provides the greatest value. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Follow these 7 steps when preparing a technology requirement list to ensure your next solution meets your needs.

READ MORE

Improve your Internal Controls to Lower Audit Fees

- Jamie Black

- In Control

- minute(s)If you're a typical finance department, discussions about Internal Controls are probably not part of your daily work day. In our experience, accounting teams start thinking and discussing Internal Control when they have: found an alarming incidence of error in their business processes are subjected to a performance audit (if they are a local government) heard of another organization falling victim to fraud Outside of these scenarios, the strength of internal controls systems doesn't often get a lot of finance's attention while they take care of payroll, budgeting, management reporting, financial reporting and so much more. There is a large, but often overlooked reason to focus on your internal controls system, an opportunity to reduce audit fees. Audit Fees Increase with Poor Internal Controls Poor internal controls and/or poor documentation of existing controls directly lead to increased audit fees. Why? Auditors must increase the amount of testing performed (sample size) when they determine that internal controls can not be relied upon (International Standard on Auditing - 530 Audit Sampling) to reduce audit risk to an acceptable level (International Standard on Auditing - 330 Auditor Responses to Assessed Risk). Specifically: "Deficiencies in the control environment, however, have the opposite effect; for example, the auditor may respond to an ineffective control environment by: • Conducting more audit procedures as of the period end rather than at an interim date. • Obtaining more extensive audit evidence from substantive procedures. • Increasing the number of locations to be included in the audit scope. The evidence of this direct relationship between audit fees and internal controls abounds. In December 2016, the Financial Executives Research Foundation (FERF) survey of more than 6,000 organizations found that reviews of internal controls continue to be one of the three major driving factors behind rising audit fees: More than 20% of the respondents that had audit fee increases cited a “review of manual controls from [Public Company Accounting Oversight Board] inspections.” Companies that cited ineffective internal controls as adding to audit fees experienced a 5.1% median increase, almost two percentage points higher than the median increase for all other filers. 3 Recommendations to Reduce Audit Fees In their follow up article "Mitigating Increases in Audit Fees" the FERF interviewed preparers and auditors to understand causes and develop recommendations. Several recommendations focused specifically on Internal Controls improvements that drive lower audit fees including: Align key controls with key risks: Ensuring the organization has strong controls to address the most significant risks will give management and auditors increased confidence. Document internal controls: If an organization has very light or poorly organized documentation, or hasn’t thought through all the branches in a process, attestation becomes difficult for the auditor — and more costly for you. Evaluate the latest technology: External and internal auditors are both using data analytics and continuous controls monitoring technology to increase audit quality, work smarter and potentially reduce costs. There are many great reasons to focus on improving your organizations' internal controls. Lower Audit fees is another good one. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Finance professionals know the importance of strong internal controls for managing but overlook the opportunity to reduce audit fees.

READ MORE

7 Steps to Avoiding the Cheap IT Solution Selection Trap

- Jamie Black

- Efficient, Effective and Reliable

- minute(s)According to information technology research firm Gartner, 50–75 percent of IT projects fail. We've written a number of articles offering guidance for achieving better outcomes through the solution selection and implementation processes, but there is one trap we haven't addressed—and we see clients succumb to it all the time. Price Clouds Everything Consider the Canadian government's recent Phoenix payroll software debacle. They elected to have a payroll system custom developed by IBM, and have had nothing but problems with it. According to one assessment: "... the Harper government put so much emphasis on saving money that it undermined efforts to ensure that the system would function well...instead of saving the government 70 million Canadian dollars this year, as promised, Phoenix has cost the government an extra $50 million (about USD $37 million), including $6 million in additional fees paid to IBM to fix it." When participating in an IT system evaluation, if you find your team leaning toward the low-cost choice instead of the high-value solution, beware. No one wants to pay more for something than they need to. In government in particular, you may even have the obligation to choose the low-cost solution. This default preference/requirement is understood by IT solutions sales representatives and is often relied upon to accelerate the sales cycle and "close the deal." Even if you're not being exploited by sales teams, the Phoenix case shows how this low-cost bias can lead to dysfunction. Here are two questions to ask yourself to avoid a bad deal when considering the "cheap" IT solution: 1) Is it truly cheaper? In one respect, it is obvious; if the number at the bottom of the RFP response or quote is lower, then it's the less expensive option. While technically true, that is only a valuable assessment if you are comparing apples to apples. Before you look at the price, you need to know whether you'd be getting the same thing for the money. With an intangible product like software, it can be difficult to ensure you're making an apples-to-apples comparison. If you bought the Chevette above based solely on the price, you could be stuck with the wrong car if acceleration and top speed are necessary features. Alternatively, you might decide you do not need a Corvette, that a Chevette will do. The point is, they have different features and capabilities, and comparing the two options based solely on price obscures those differences. RECOMMENDATION: Before assessing products, explicitly and formally define your needs/requirements and evaluate your choices based on fit first. Don't allow the price to hijack the process. Use ROI instead of price to select among solutions that fit some/all of your requirements. 2) Why is it cheaper? There's no such thing as a free lunch. - Milton Friedman You've assessed the options based on fit. Then you calculated ROI. The cheaper solution comes out on top. What now? RECOMMENDATION: Treat the low-cost solution with extreme suspicion. This is your warning sign to bolster your due diligence. We recently watched one "low-cost" vendor in the reporting automation industry cease operations and advise their existing clients that they are on their own. For some of these folks, this happened while they were implementing the software. The Action Plan: 7 Steps to Better Due Diligence Double-check fit-assessment. If you have any doubt, have the low-cost vendors re-demo the product to confirm it meets your needs. Double-check standard pricing variables: Modules/features Number of users Number of people being trained Duration and extent of support period These are all variables that might account for significantly reduced cost. Remember, you want to compare apples to apples. Also, recall that skimping here may cause cost overruns later when you determine you did need more training or support. Assess the vendor track record. How many clients do they have? How many times have they solved the problem(s) you have? Ask about failed implementations and what caused them to fail. Be suspicious of anyone who says they don't have any. Closely assess their implementation team. Does the vendor have in-depth knowledge of not only the tool but your business process? Have they been "on your side of the table"? Have they been an HR manager or comptroller or auditor or finance officer and done the tasks that their tool addresses? Contact numerous clients that are currently using their product. Spot check the specific features you are counting on using to see if the reference is using them. We have seen vendors provide references that did not even use the product being evaluated! If the vendor can not provide an extensive list of clients who use the product, or they do not have extensive experience solving your exact issue, determine whether your organization is prepared to be a guinea pig. We have seen numerous organizations stuck in limbo for years while their vendor tries to build what was promised. Go back to the expensive vendor(s) and ask why they are so expensive. Do they charge a premium because of their brand? Did they consider something the others didn't? Was there an error in one of the pricing variables (point 2 above)? Assess the low-cost vendor's stability. One way to do this is to consider their financial health, if possible. If the company is publicly traded, have they ever shown a profit? Do their financial statements look like those of a stable, successful company? If the vendor provides their software as a service (SaaS), there may be other considerations for evaluating performance. You can find some interesting articles on SaaS performance here and here. If the company is not publicly traded, it can be hard to perform this analysis, and you may need to rely more heavily on steps 1–6 above. It's a good idea to follow these steps even when there is no major pricing disparity. They become absolutely essential when you're presented with what seems like a sweetheart deal, and you want to avoid the cheap solution trap. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

During selection of a new IT system beware of defaulting to the low-cost solution. 7 easy steps steer you away from project failure.

READ MORE

How to Improve IT Project Success with One Calculation

- Jamie Black

- Efficient, Effective and Reliable

- minute(s)Information Technology projects can be the most complex and high-profile you will encounter as a finance team member. Perhaps you have read about the trouble with the Phoenix payroll system implemented by the Canadian public service. Or maybe you have direct experience with severely compromised IT investments at your place of work. There is no shortage of such examples. So, what can finance do to help? In October of 2016, the Auditor General of British Columbia made some suggestions in their report "Getting IT Right: Achieving value from government information technology investments." A 60-Second Overview Regardless of your industry, the report is a valuable read for accountants, and we recommend reading it in full. Here is a quick summary of its major points: IT is important because "every aspect of government depends on IT." Globally, only 29 percent of IT projects are rated "successful." Success is defined as: On Time On Budget Achieving Expected Value Success depends on: People Planning Consultation Governance The report is an absorbing read, but it fails to elaborate on a significant element: What is "value," and how do you calculate it? What about "Value"? The report uses the word "value" 57 times without defining it explicitly. The only comment on how to achieve it is to assess: Alignment of the project with the organization’s specific needs, priorities, and strategies Contribution to the organization’s desired outcomes Cost Level of risk While these are good points, they provide no particular direction to those attempting to assess a project's value or measure the success of a project during or after completion. ROI to Assess Value Before & After Perhaps it's because we believe that numbers are the key to all universal truth (no really, we do), but we argue that finance should calculate proposed and achieved value for IT projects. The accountant in us is very comfortable with Return on Investment (ROI) calculations: This type of calculation should be used to determine optimal use of your organization's investment. But in our experience, these calculations are rarely utilized when considering IT solutions, particularly in the public sector. Why? There are at least two problems with the word "profit" in the context of public sector IT projects. Public sector organizations typically do not think in terms of profit. Even if you work outside the public sector, you may reasonably ask, "How does an ERP system (for example) generate profit for any organization?" "Profit" (and therefore "ROI") may seem like a non-starter. But with a minor change in terminology—replacing "profit" with "calculable benefit"—the concept is applicable to the public sector. The "calculable" part is important; you don't want this exercise to dissolve into imprecise speculation about intangible benefits. Those may also warrant a discussion, but you should not give up the important quantitative analysis. You should focus on those aspects to which you can assign a real dollar value. There are two broad categories of calculable benefits that you should consider: Efficiency of Staff Resources Your staff spends their entire working lives involved with IT systems. A more efficient, convenient, and highly automated solution will help them do their work faster, more reliably, and with less cross-checking and manual review required. If you estimate the hours that a new IT system might save, and multiply it by your staff's hourly cost, you can measure the economic impact of those time savings. Reduction or Avoidance of Direct Expenses There are many direct expenses that a new IT system can help reduce or eliminate. You pay fees to an external accountant—would those fees be reduced if you automated a significant portion of the work they performed? What if your new system could help avoid late payment of invoices and thereby reduce your late fees and penalties to vendors? Perhaps a new system would provide a reduction of ongoing annual maintenance and support costs. An Example Consider a scenario in which your current ERP system is no longer supported. You determine that the risk level of continuing with an unsupported system is unacceptable. You have identified three possible solutions and are working through the selection process. You have seen demonstrations and received fee estimates. You have contacted references and determined each option's strengths and weaknesses. Clearly, there are many considerations (some of which are intangible). But don't underestimate the value of performing an ROI calculation. Calculable Benefit: How much money will we save with each solution? For example, estimate the following separately for each solution: Hours of staff time saved by reduced data processing Hours of staff time saved by automating report creation Estimate avoided late payment fees to vendors due to improved A/P processing abilities Decreased finance costs due to accelerated AR collections Cost: What is the cost of each solution including all features/modules etc. necessary to facilitate the above benefits over a 5 or 10 year period? 3 Advantages of This Approach 1) Forces Detailed Assessment: All too often we see clients who have only a general understanding of how a particular system will help them. Vendors often do little to help, aside from offering marketing double-talk: "Work Smart", "Improve Productivity", or "Improve Efficiency." These aspirational comments are great, but you need measurable results. 2) Easy Comparison of Alternatives: You can immediately begin to see some interesting relationships between the options that were hard to see at first: Solution 3 is four times as expensive as Solution 1, but it provides 4.5 times the value. If all else is equal, and the organization can find the $100,000 budget, Solution 3 is the better choice for your organization. Solution 2, while more expensive than Solution 1, does not provide a commensurate increase in benefit. Thus, if the budget did not allow for $100,000 investment, the next best option is Solution 1. 3) Clear Monitoring of Performance: Another advantage of this approach is that your team has identified very specific, measurable goals to monitor the project and assess success. For example, you estimated a calculable benefit value based on specific time savings in report creation and data entry. These time savings should be measured to determine whether you achieved the benefit. Moreover, if your vendor is confident in their abilities to deliver these time savings, you can attempt to include attainment of the advantages in the contract. "IT-enabled projects aren’t just about technology—they involve substantial changes to an organization’s culture, business processes, and customers. These projects are really IT-enabled business change. A successful project improves services and allows for more effective use of taxpayer money. And their success or failure is about more than just being on time and on budget, it’s also about achieving expected value." –Carol Bellringer, FCPA, FCA Auditor General, British Columbia In sum, ROI calculation is an important tool that allows finance teams to estimate, measure, and demonstrate the value of their IT project. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

From replacing your ERP to implementing a new payroll system we illustrate just how powerful ROI is for setting & measuring IT project success.

READ MORE

How to improve CaseWare performance by 20%

- Darryl Parker

- Tips and Tricks

- minute(s)During our introductory CaseWare training sessions, we focus on the fundamentals. To move users beyond these basics and ensure an even faster year end, we regularly provide CaseWare tips & tricks in this blog series. Our advice in this article is simple: eliminate unnecessary groupings from your file. It nearly always means better performance and less confusion! Why Purge? Why should you care about cleaning up (purging) your mapping and grouping codes? You want as comprehensive a grouping structure as possible - initially.That way you know you have an appropriate location for every G/L account. Once you have grouped all your accounts though, a typical file will have a large number of groupings that are not necessary. Those unnecessary groups slow down the file. They also slow you down, as you have to scan through long columns full of zeros and determine whether they are noteworthy. $0.00 of "Fishing Revenue" might be expected for your statements, but what about $0.00 of Account Receivable? That's why purging the map numbers or group numbers in any file can be a significant improvement. It moves the file from a generic setup to one tailored exactly for this year-end. In large, complex files we see dramatic results: Opening large financial statements: up to 10% faster. Opening group assignment window: up to 10% faster Opening grouped lead sheets and trial balances: up to 60% faster. In one of our large IFRS client files, cleaning up the groupings resulted in a more than 20% improvement in speed across a simple set of tasks (opening the file, reviewing the consolidation and mapping, and looking at automatic documents and the financial statements). Note - in a very simple file, the speed improvements may not be noticeable but the benefits of a file that is easier to navigate remain. We’ve posted recently about the standard Mapping Purge feature in CaseWare Working Papers. Read that article for an understanding of the built-in features, and then get ready for a more advanced map purge that addresses the limitations of the standard one. The Advanced Purge tool Perhaps you tried the regular map purge in your own Working Papers files. Or maybe you read about the problems that the built-in mapping purge has (can only work on mapping, cannot check account assignment, required knowledge of dBase filters) and thought it was not a good fit for your organization. We want you to be able to quickly and easily clean up the unneeded grouping numbers in your file so you have an even faster year-end. So, we built a tool to allow you to do just that. And we are providing it to CaseWare users for free. The Advanced Purge Tool will: Allow you to choose any of the mapping or 10 grouping structures to clean up. Never delete a map/group number with any adjustments related to it. Never remove a map/group number with any account allocated to it or any of its child map/group numbers. Check three years of historical balance data to determine if prior year adjustments should preclude deletion of a map/group number. Allow you to choose whether calculated map numbers should always be saved, or should apply the balance-checking logic to them. Define a “root” or “base” map number length that will not be deleted under any circumstance. BEFORE YOU START - A Word of Warning!!! The Advanced Purge tool will delete group numbers out of your Working Papers file, and there is no undo button. You must take a backup before running a purge. Even better, take a disposable copy of your file and thoroughly test a purge and verify its effects before running it in your live file. And even then, you should take a backup of that live file in advance of running your thoroughly tested purge! To use the tool: Download the tool. It is a compressed (Zip) file so you will need to extract it after downloading. The tool is a single CaseView document. After extracting, drag and drop this document onto the Document Manager of the file to be improved. Launch the CaseView document. Confirm you understand the risks of purging groups. Choose the grouping mechanism from which you wish to eliminate zero balance. Choose what balance type to examine for balances and if Other Basis entries should be considered. Specify if you want to keep calculated group numbers. Specify if you would like to keep base group numbers. If selected, you must also note how many digits are represented in your definition of a base group number. Once completed, select Perform Purge. When finished (it may take awhile), you will get a confirmation of how many unused groups have been eliminated. You can get a copy of the tool to see how it will simplify and streamline your own data files. All you have to do is click the image below! Consider our more advanced CaseWare training if you want your CaseWare Black Belt! © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Our tip in this article is simple: purge unnecessary groupings from your file to improve CaseWare Working Papers performance by up to 20%

READ MORE

CaseWare Feature Spotlight: Diagnostics

- Darryl Parker

- CaseWare Feature Spotlight

- minute(s)CaseWare's financial reporting solutions provide massive benefits to finance professionals. How? By providing the most sophisticated features in the industry. We've developed this article series to outline many of these features to: help prospective users appreciate all of CaseWare Working Papers' power, and encourage existing users to maximize their utilization of the software. "Tick & Tie" for hours & hours All of us know the pain of manually footing and cross-footing and cross-checking a large financial report. It's time consuming and the risk of error is significant. Even worse, as soon as you have an adjustment or update to the numbers, you've got to do it all over again. That's why the ability to automate the diagnostic tests for correctness in your reports is so important. One professional we respect greatly (Joy Richardson) explains the power of this feature set as follows: In addition to making the import of data simple and providing tons of grouping flexibility, Working Papers allows the user to define and enforce rules about their data. We have already discussed one example of this; Automatic Rounding. Diagnostics is a broader - and in some ways, a more powerful - feature that users can and should take advantage of. Rules-Based Data Management When data is imported, we define the nature of accounts that have been imported. This is done by assigning group codes to each account. CaseWare's understanding of accounting principals allows it to perform validation and testing of the resulting financial reports. For example, when we assign an account to a group called "Allowance for Doubtful Accounts", CaseWare is able to automatically determine: this account belongs on the balance sheet (or statement of financial position if you prefer), normally the balance is a credit, this account should be netted against our Accounts Receivable accounts when we present A/R Net of Allowances, If I define these as rules within Working Papers' groupings, Diagnostics will monitor my data and find any examples of where these definitions are violated. What happens if someone modifies these assignments? As you see in the following clip you will be notified: Working Papers also notifies end-users of common issues that might occur inside your reports: Finally, Working Papers' Custom Diagnostics feature allows end-users to define their own rules within their reports - without the help of a programmer! If these rules are broken, you will know about it immediately: Diagnostics are another example of the features that enable CaseWare users to dramatically reduce the time spent on the creation of complex reports while eliminating errors. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare's diagnostics significantly reduces time spent to generate CAFRs, annual financial statements, budget books and other complex reports.

READ MORE

Is Self-Implementation right for you?

- Jamie Black

- Efficient, Effective and Reliable

- minute(s)For government finance officers looking to make the most of tight budgets, efficiency is key. The RIGHT tools and technology can significantly improve efficiency, provided you can muster the resources to purchase and implement them. Many of our clients are looking to implement technology as inexpensively as possible. Some consider self-implementation. How do you know when this approach is right for your finance, budget, or audit department and when it is a mistake? Here, we'll examine the criteria that determine whether you are likely to succeed in self-implementing a new finance-related system (ERP, payroll, Annual Comprehensive Financial Report (ACFR), financial statement automation, etc.). Over the past 30 years, we have implemented hundreds of technology solutions for clients—ACFR and financial statement automation systems, custom-designed mobile applications, ERP systems, local and wide area networks, servers, and of course, continuous monitoring systems. During the course of these implementations we have tried any number of models: 100% delegation of implementation tasks to client's staff 100% of implementation tasks completed by our team Every task-sharing split in between We have achieved successful outcomes with each of these options. But frankly, we have also had some disappointments. Our wealth of experience has informed the following guidelines for determining the right approach. Self-implementation Requirements: When you engage consultants/vendors to help with implementation, they provide two major benefits: relevant expertise and time to dedicate to the project. As you consider whether your organization can successfully self-implement a particular system, assess your team to determine whether you have the "right stuff" in each of these categories. 1) Expertise: An objective assessment of your team's expertise is critical to ensure you are capable of taking on the implementation yourselves. Technology: The initial configuration of some systems requires considerable technical knowledge, at a level above what's necessary for day-to-day operations. Server setup, database configuration and optimization, and development of custom code for integration with existing tools, are a few common areas of expertise required for initial setup. Do your team members have this expertise already? If not, you should carefully consider whether it is wise to invest your time and money to develop the expertise internally in order to self-implement the project. On the other hand, some systems do not require such sophisticated technological expertise with regard to support systems. Perhaps strong knowledge about that particular application and its day-to-day features is the only requirement for self-implementation. In some cases, an experienced user of Microsoft Windows and Office might have all the technical expertise required for self-implementation. Questions for the software vendor: What technology does your system rely on? Are there servers to set up or databases to administer? Is there any programming or scripting required to implement this system? Specific subject-matter: The level of subject-matter expertise required depends upon the system you are implementing. If you are implementing a new ERP system, are you expert in the functioning of your current system? Have you worked with many different systems? Have you ever been responsible for administering a new ERP system? If you are considering self-implementing a year-end reporting automation tool (ACFR/financial statements), does your team have ample experience preparing those reports today? Do you understand how balances come together and know what G/L accounts should be grouped into each number on your statements? Or perhaps this your first year-end cycle, and you do not have the support of those who prepared prior year reports? Questions for the software vendor: What subject-matter skills do you require of your implementation consultants? What level of experience is essential to lead a successful implementation? When you have seen implementations fail, what skills were implementation team members lacking? Project management: The size and complexity of the project will determine how sophisticated your project management skills will need to be. For example, if the project requires collaboration across a large team, over many months/years, with many individual milestones, lots of complexity, and great risk in the event of failure, you will want a very seasoned, professional project manager. On the other hand, if the project will involve only one or two people, is reasonably straightforward, and you have a great fallback plan in the event of delay or failure, basic project management skills may suffice. At a minimum, we recommend assigning project management duties to someone who exhibits great attention to detail and strong organization and communication skills. For some systems, this approach might be sufficient to guide self-implementation. Questions for the software vendor: How long and complex is a typical implementation project? Do you offer project management services if we decide they're necessary? What guides or checklists can you offer us to assist in managing a self-implementation? 2) Staff Availability: Many organizations pay for professional implementation not because of a lack of expertise, but because they lack available staff time. Being short-staffed or overloaded with work likely means that you will not be able to prioritize required implementation tasks, in which case you will wind up with a system that is never fully/properly implemented. For many systems, considerable time is required to successfully implement the tool. The tasks may or may not be complex from either a technical or subject-matter perspective, but they may take considerable time. You need a clear understanding of how much time is required of your team and how much time your team has available. Consideration should also be given to how frequently you will need to break off from the project to tackle other duties. The more frequent the interruptions, the more difficult it will be maintain momentum, retain instructions, etc. Questions for the software vendor: How much time would you allow for your consultants to implement this system for our organization? How much more time should we allow, given our lower level of experience? Should we multiply the vendor's time estimate by 2? By 3? Measure Your Options As you obtain answers from your vendor, score and plot the responses on a graph like the one pictured here. Projects that fall into the green zone are obvious "self-implementation" candidates. If you plot your project in the yellow or orange zones, the demands of the project are higher and careful consideration of your availability and/or expertise is warranted. Should you determine that the project falls into the "red zone" it usually means that it would be wise to abandon self-implementation and investigate other options. Joint Implementation The choice between self-implementation and fully outsourced implementation is not an all-or-nothing decision. Another option to consider is sharing the workload with the vendor in a joint implementation. You may be able to complete large portions of the work yourselves, yielding significant savings, and make strategic use of the vendor team's expertise and time. Use their team to provide oversight, ballast any expertise weaknesses, or cover any resource availability issues you may experience. By balancing the use of your time, your expertise, and your budget for external services, you can often develop an implementation plan that provides the highest return on your technology investment. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

To implement technology as inexpensively as possible many governments consider self-implementation. How do you know if this is right for your organization?

READ MORE

Lipstick on a Pig: 6 Spreadsheet-based Financial Reporting Tool Flaws

- Jamie Black

- Automating Financial Reporting

- minute(s)You may be familiar with the expression "Lipstick on a pig". Variations of the expression date back nearly 130 years but the meaning has not changed; Superficial improvements that do not change the underlying nature of something. Spreadsheets by any other Name We have seen an increasing number of spreadsheet-based reporting automation tools promoted as ultimate solutions for Comprehensive Annual Financial Reports & Budget Books. This is ironic considering many organizations are using spreadsheets today and are looking for a better approach. Sometimes these solutions are desktop add-ons to enable better connections to a source of data. Sometimes these are cloud-based solutions that rely on spreadsheets to maintain their data and develop their reports. Hard to Tell They are Spreadsheets The fact that these are spreadsheet-based tools may be hard to tell on initial review. You can spend hours reviewing their websites and sitting in presentations and still not recognize it. It's not surprising they don't advertise their reliance on spreadsheets given the scientific evidence of their weaknesses and the numerous stories of very public disasters caused by spreadsheets. The Lipstick In fairness, these tools often have improvements over the desktop spreadsheets you are used to, such as: Better collaboration abilities for sharing comments, tracking changes or assigning tasks. Better audit trails and change management. Ability to tie supporting documents to a given value / cell. More granular security / permissions. The Pig But the core of these products are still spreadsheets. That means they suffer from the traditional spreadsheet weaknesses: No database - All data resides in spreadsheets / workbooks not in a database. This means you must build all your own personalized systems to: ensure your G/L balances identify the 100 - 1000 new G/L accounts added each year No processes/workflow - There is no structured system that you can leverage to support industry best practices. What steps should be followed and in what order? You must develop all of these processes on your own and maintain them separately from your reporting environment. No grouping mechanisms - The G/L accounts that sit in your spreadsheet must be summarized in numerous different ways (by object, by fund etc.) to power your Comprehensive Annual Financial Report or Budget Book. If you use spreadsheets, formulas must add the right accounts together. This is fragile and susceptible to error. Moreover, unless you interrogate every formula, there is no way to know what is being included in a given number; there is no legend. Assuming you do get this right in year one, all the new accounts next year means these formulas must all be updated. Tons of custom formulas - All values are derived by "linking" - which is to say writing spreadsheet formulas of varying complexity. Any mistakes you make means errors in your report. Consistency in how these formulas are written or maintained is entirely dependent on the user's expertise, accuracy and completeness. No content libraries - Reporting standards are continually evolving. There are new GASB pronouncements all the time and keeping up with them and what new statements, schedules or footnotes are required this year can be daunting. Spreadsheet solutions do not come with any content. It is entirely up to you to figure out what must be presented and how. No adjusting journal functionality - Adjusting or changing balances is an absolute requirement for financial statement /Comprehensive Annual Financial Report production. In spreadsheets you are left with no tools for the following: The values in your G/L are typically maintained on a modified accrual basis. For many of your statements, you need full accrual. Debit balances in A/P accounts or credits in A/R are just two examples of balances you need to reclassify. Prior year adjustment / restatement caused by changes in accounting policy. Our message in this post is not that the additional features - the "lipstick" - have no value, or that there is no situation when spreadsheets should be used. We are saying that when finance & budget officers evaluate possible solutions for their most complex reporting tasks (Comprehensive Annual Financial Reports & Budget Books), they must exactly match the critical requirements of their processes to the solution's abilities. If they do this carefully, they will find that spreadsheet-based "solutions" are only marginally better than their own collection of desktop-based spreadsheets. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Comprehensive Annual Financial Reporting and Budget Book tools based on spreadsheets are all the rage. Don't overlook their considerable weaknesses.

READ MORE

5 Best Practices for Updating Critical Software

- Waldo Nell

- Tech for Execs

- minute(s)Finance officers, accountants and auditors are expert in a very specific field of knowledge. Generally speaking that does not include great depth related to IT systems and best practices. Yet finance officers, accountants and auditors rely on software (and hardware) to allow them to complete their work, often under very tight deadlines. This article will layout the case for finance involvement in the process and provides 5 key steps for finance. Running with Scissors Almost certainly all of your critical applications (ERP, budget, HR, financial reporting, payroll etc.) get updated from time to time. For many of our clients, finance leave this process entirely in the hands of IT. Often finance does not even know updates have occurred until they come in Monday morning and detect that something looks different. This is a very dangerous approach. Updates are risky. Kind of like running with scissors. You may have done it a hundred times with no problems, but one little misstep and it can be disaster. You may appreciate this if you ever lived through a failed update. To give you a little more control and allow you to better mitigate this risk, we recommend our clients follow a 5 step process to manage their updates. 1) Work with IT - Make sure IT knows that they need to include finance in all critical update processes. This does not mean sending an email to finance when the job is done. It does mean advising finance before anything happens (ideally when updates are first made available) so you can work collaboratively to ensure everything works well. 2) Know the benefits - Ensure you have a clear idea of what the benefit to the organization of the upgrade will be. Amazing new features that you have been dying for? Major bug fixes that will prevent lots of errors? If not, the right answer may be to sit this upgrade out, unless the upgrade is required to improve upon network security for example. 3) Don't upgrade during critical periods - Now that IT is communicating with you when updates are pending, you can advise IT when a good time for finance to do the update is. For example, in the middle of year-end is NOT a good time for just about anything, let alone an update to your Comprehensive Annual Financial Report / financial statement software. Now some processes never stop (payroll for example). For systems that relate to these processes, look for the least-bad time periods to do upgrades. 4) Test first - Develop a testing plan to ensure that all features function acceptably in your environment with your data, before you roll them out to the live system. This will involve several steps: Install in a test environment first or take full backups of all data before installing the new versions, and plan for some downtime if you need to roll back in the latter approach. Get key system users to test all functions that they rely on to ensure they perform as expected. Note - if you used the backup live data option above you will need to notify users that the system will be unavailable while testing is occurring. If the new version passes all testing, take a backup of the live data and update the real / live server or environment. If you did not have a test environment and took backups of data before testing, you have no more work to do other than advising users they can use the application again. 5) Plan for failure - Develop a plan to deal with failed test results. If you followed steps 3 & 4 above, even with failed tests you are safe, no harm done. If you took a backup and then installed over the previous version of the software, now is the time to recover from the backup. Next, communicate the problem with the vendor about the problem. If it takes the vendor a month to resolve your issue, day-to-day operations have not been effected and while not optimal it is survivable. When they give you a new update version, start at Step 1 above and repeat. Following this simple 5 step approach is guaranteed to limit your stress, and avoid the vast majority of problems that haunt the dreams of finance officers everywhere. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

You rely on your key applications but updates and upgrades can be risky. Here are 5 steps to mitigate risk and guarantee better outcomes.

READ MORE