2016 CaseWare Working Papers: Talk to IT Now

- Darryl Parker

- What's New

- minute(s)On July 20, 2016 CaseWare Working Papers users started to receive email notifications that Working Papers 2016 was released and available for download. The annual release is much-anticipated, and for those of us who have been around the CaseWare world for a few years, perhaps somewhat routine. But the latest release email has some very important technical information that could have implications for your use of the software. If you ignore this and fail to take action, you could find yourself with a significant technical problem next year. We summarize the issues into two categories. 1) Today you WANT to be on 64-bit Windows Contained in CaseWare International's announcement was the fact that within a few months we will have a 64-bit version of Working Papers 2016 available to us!!! Not excited by that? It's a technical matter that your I.T. department will appreciate. For many years now we've all been using computer hardware that can hold and manage very large chunks of memory, but we've been using software that can't take advantage of it. With the replacement of our older 32-bit software with the newer generation 64-bit software, we'll be able to hold a lot more information in our computer's RAM. More RAM on your computer likely means more RAM for CaseWare which translates to better performance in certain scenarios and ability to store and process much larger data sets. To utilize the new 64-bit release of Working Papers you need to be running a 64-bit version of Microsoft Windows. If you are still on a 32-bit version of Windows, you will not be able to realize the benefits. 2) Next year you MUST be on 64-bit Windows In the email announcing the Working Papers 2016 version, CaseWare made an important statement that is especially important to people currently using a 32-bit version of Microsoft Windows. Starting with the 2017 release of Working Papers, CaseWare International will only offer a 64-bit version. No 32-bit version of the software will be available. If CaseWare International follows through with their currently-stated position, some of you may find yourself unable to upgrade to Working Papers 2017 until you get a 64-bit version of Windows. Start the Conversation with I.T. NOW In some organizations, especially large ones with dedicated I.T. departments, the decision to upgrade Microsoft Windows is a major one, and does not happen quickly. There is usually an extensive review, testing and deployment project that you should discuss with them NOW. Don't leave this conversation until you get that 2017 release email telling you that you cannot install the new version on your computer. A good way to start is to forward this blog post to your I.T. department right now. Want to provide I.T. with our recommended hardware configuration so you can use the 64-bit version of CaseWare? We wrote an article for just this purpose! F.H. Black & Company Incorporated will continue to follow this important development in the Working Papers ecosystem and update as we learn of changes. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn the significance of CaseWare's 64-bit announcement for Working Papers 2016 and 2017.

READ MORE

CaseWare Feature Spotlight: Document Management

- Jamie Black

- CaseWare Feature Spotlight

- minute(s)CaseWare Working Papers is recognized as a global leader in the Financial Reporting industry. This is a well-deserved reputation. However, it's a mistake to think of CaseWare as "just" a report writer - it contains a huge number of features and tools to assist the entire financial reporting work flow. We've developed this article series to outline many of these features and demonstrate how to maximize your utilization of the software. Clients want to save time and they would love to lower audit fees. One of the many features of CaseWare that delivers these very benefits is often-overlooked: Document Management. Document Management When preparing a year end file, Finance needs to be able to support the values they are presenting, both for their own certainty as well as for the auditor. Note 6 to your financial statements says total receivables are $12,932,000 with a table showing the aging analysis. We must evidence the underlying accounts that comprise this total. The first line of your Balance Sheet (Statement of Financial Position for Canadians) presents your current year cash balance of $3,866,345. How can the auditor be sure this is correct? The answer is (of course), we provide documentation that supports these values. CaseWare Working Papers provides a completely customizable Document Manager for generating & collecting all the documentation you require. Below is part of a document manager we use in our presentations to represent a typical local government Document Manager: Automatic Leadsheets The first, most obvious type of support to a financial balance on a statement, schedule or note is a leadsheet. CaseWare's Automatic Leadsheets are maintained by the system and provide a detailed listing of all the G/L accounts that comprise a total. These leadsheets are automatically updated every time data is imported, journal entries are recorded or G/L accounts are re-grouped. The example below shows a lead-sheet that has been grouped into meaningful sub-totals which facilitate more detailed reporting in notes. Clicking on the + sign to the left of any of the subtotals shows all the G/L accounts that make up the total: These documents are incredibly important for understanding why a number is what it is. The second step for many balances is providing other supporting documents (bank statements, reconciliations, contracts etc.). Supporting Documents In the image above, we see a Receivable - Utilities account with a balance of $23,578. We know the auditor is going to need to see the lists of individuals / corporations that owe that money. This is likely easy to generate from your ERP system. With CaseWare, all you need to do is drag and drop it onto the document manager to ensure you have one central repository. CaseWare intelligently numbers the supporting document and makes it available to your team and your auditor (assuming you provide your CaseWare Working Papers file to them) for subsequent review. Placeholders You determined you needed to support Receivables - Utilities, went to your ERP system and printed the report. Very likely, you will need to support this amount next year too. CaseWare will maintain the list of required supporting documents. On any supporting document, mark it to "Roll Forward as Placeholder". When a roll forward is performed, CaseWare finds every document with this property, removes the current year's content and replaces it with a shell (a placeholder). These placeholders are clearly identified so you can find what support you still need to provide. And then you can hand the complete file over to your auditor, fully supported and referenced. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

One of the CaseWare's unsung features is Document Management - the easy for Finance to support their reports.

READ MORE

CaseWare Working Papers 2016 Released

- Jamie Black

- What's New

- minute(s)Software: Working Papers Prior Version: 2015.00.192 (Release 3) New Version: 2016.00.065 Release Date: Jul 20, 2016 A new version of CaseWare Working Papers was released last week. We recommend our clients schedule the update. Remember that once you open a Working Papers file in the 2016 version, it cannot be accessed using the older 2015 software. For this reason, all of your staff who collaborate on files in common should be upgraded at the same time. You may have received an email from CaseWare International announcing the release and inviting you to download the installation files. If, however, you do not have that email, contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes many enhancements & fixes: Enhancements related to: Fixes related to: Issues Copy Components Excel Export Check In/Check Out Annotations New File Adjusting Journal Entries PDF Export Mapping and Grouping Excel Export Year End Close Annotations Document Manager Calculations Connector Add-on Imports Automatic Documents Document Manager Calculations Automatic Documents Export Packager Interface Calculations Cells Cells Graphs Exports Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months talking about the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Working Papers 2016 was just released with many fixes and improvements.

READ MORE

CaseWare Feature Spotlight: Rounding Relationships

- Jamie Black

- CaseWare Feature Spotlight

- minute(s)CaseWare's financial reporting solutions provide massive benefits. Auditors in public practice, finance officers in government, and controllers in large corporations use CaseWare to automate their most complex financial reports faster, with fewer errors, and more reliably than with any other tool. How? By providing the most sophisticated features in the industry. Each of our "Feature Spotlight" articles discuss one of these features. Rounding Relationships Reduce Risk Rounding is a very challenging problem. We have discussed techniques for addressing it in Excel on several occasions. Because of the complexity and the frequency that accountants, auditors and finance professionals encounter rounding errors, CaseWare Working Papers provides a number of tools to solve this problem. In this post we'll review one of them: rounding relationships. In many scenarios (like the ones described here), differences can be expected. But typically the difference is an immaterial amount. To deal with this issue, we have CaseWare's Rounding Relations feature. Rounding Relations allows the end user to define an unlimited number of relationships to monitor and automatically resolve out-of-balance issues. To use this feature, all that is necessary is: Identify two cells to compare (Difference cells), identify a third cell (Plug cell) which, when adjusted, will cause one of the first two cells to change Set the maximum amount of the adjustment (Limit) Once the accountant has these options configured and enabled, CaseWare continuously monitors the cells and keeps them in balance. No computer programmer or external consultant required. We can even be a bit more sophisticated if we like. Using the Advanced option for the plug cell, we can specify a Plug Condition. The Plug Condition is the condition that makes this cell get skipped as the plug cell. That is, if the condition for a plug cell is evaluated to be true, the difference is not plugged to that cell and the next Plug Condition in the Rounding Relationship is evaluated. If the condition for a plug cell is evaluated to be false, the amount necessary to resolve the disagreement between the difference cells is plugged to that cell. Should the disparity between the "Difference cells" exceed the defined "Limit", CaseWare will immediately notify the end use of the problem complete with hyperlinks allowing you to jump to all the cells involved. This notification ensures discrepancies are not overlooked and allows the end user to investigate the cause and resolve the underlying issue. You're not forced to constant re-read the report, scanning for disagreements, and that directly translates into less time spent reviewing to ensure agreement. It also guarantees fewer errors in your reports. CaseWare Working Papers has multiple systems available to warn you of discrepancies and/or automatically fix them. Look for upcoming CaseWare Feature Spotlight articles to talk about how to get closer and closer to fully automated, agreed financial reports! © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

If reducing the risk of errors while decreasing time investment is your goal, the rounding relationship is one feature of CaseWare Working Papers you need.

READ MORE

CaseWare Feature Spotlight: Modifiable Groups

- Jamie Black

- CaseWare Feature Spotlight

- minute(s)CaseWare's financial reporting solutions provide massive benefits to more than 500,000 users in 130 countries. Accountants, from auditors in public practice to finance officers in government, use CaseWare to automate very complex financial reports faster, with fewer errors, more reliably than with any other tool. How does CaseWare do this? By providing the most sophisticated features in the industry. Each of our "Feature Spotlight" articles discuss one of these features. Groups For a report of any sophistication, you need to group items (general ledger accounts, performance metrics etc). In fact it is typical that you need to combine those accounts in several different ways in a single report. For example one schedule may show expenses grouped by nature, and another schedule shows expenses grouped by department. Further, because you may want to generate reports that the software vendor might not have anticipated, you need modifiable groups. In other words, customizable by you and not require a consultant or the software vendor's intervention. All of this is true of CaseWare. CaseWare provides standardized groupings to simplify your reporting For example, CAFR groupings are provided in the GASB template. You can also modify or import your own groupings if you have them defined elsewhere. In fact, CaseWare Working Papers has this and more. 10 Groupings that can be named and organized any way you need (note Group 3 in the screenshot below called "Any Name I Want"). Each grouping can have 40-digit codes and 50-character names all specified by you. They also have some sophisticated features: Flipping - consider AR & AP. Imagine that this year one of your receivable accounts has a credit balance. No problem - in CaseWare you can configure the group code to automatically "flip" that account to the payables group code with no intervention from the user required! Calculation - Consider AR. Most often you will want to show receivables net of allowances for doubtful accounts. Not always though. Calculated groups allow you to instantly add other groups (the AR group and the Allowance group) together to get AR Net of Allowances. Extended & Calculated Descriptions - Need a longer description? How about changing the description automatically in the situation where the "Due To" becomes a "Due From"? Check & Check! Mapping has all the features of the above groups and a number of extra features too. Mapping allows you to default account properties and automatically assign any or all of the other 10 groups. Map numbers can be 40 digits long with 50-character names, all fully modifiable by the end user. Entity code - this mechanism is often overlooked by CaseWare users. Not only does it do all the work of the other 10 groupings but it also gives you a very simple way to create what Excel users call a pivot table. This turns out to be an amazing feature when trying to tackle complex governmental reporting (GASB / PSAB) or dealing with large consolidations. Entity numbers (called abbreviations) can be 40 digits long and the descriptions can be 100 characters long. If you are keeping track that is 12 concurrent grouping mechanisms that can all be customized and modified by the end user! PS: There are actually 2 more ways to combine accounts: Tax Export Code & GIFI. Both of these are used to automate the population of your corporate tax software (very useful for public accountants and accountants in large corporations). We have not counted these two as true grouping mechanisms as they are built for very specific purposes, and are not that modifiable. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Customizable groupings are key to saving time, reducing errors, reducing audit fees & improving the reliability of your reports. CaseWare has you covered.

READ MORE

Best Practices for Financial Reporting - Eliminate rounding errors

- Jamie Black

- Excel

- minute(s)Complex reports (Financial statements / Comprehensive Annual Financial Report, Budget Book, etc) often present the same value in multiple locations in multiple ways. For example: on page 5 we show total revenue, on page 100 revenue is broken down by type, and on page 200 revenue is broken down by source. The trouble is, the value on page 5 and the total of the break-downs on pages 100 & 200 must all agree. The most common reporting tools (Word & Excel) do not have good methods to confirm and enforce that agreement (see how CaseWare Working Papers solves this problem here). You're left with a manual, error-prone process. The amount of detail provided in even a moderately complex report means rounding errors likely occur hundreds of times. This requires massive time investment during the reporting process to check & double check & triple check as your proceed through the reporting process. This article will explore just one of the common causes of disagreement between these values and suggest best practices to minimize failures of agreement. Different Rounding Approaches Lead to Disagreement As we have examined in our post Best Practices for Financial Reporting with Excel (Step 2), the optimal method for dealing with these 3 different revenue presentations is by linking back to central data source. We will assume you are following this advice. Let's use the following as our central data source (G/L): Approach 1 On page 5, where we just need total revenue we would enter a formula that adds all of the individual account values and rounds the result. Your page total 5 will show total revenue as $804. Approach 2 But what about on page 100 where we present revenue by type? The problem becomes apparent. When we need to present more detail, we round each individual account value and then add up those rounded values. Your page 100 will show total revenue as $801, which does not agree to the total of $804 presented on page 5. In other words the problem is we use different approaches to rounding: Approach 1 adds raw values and rounds the total Approach 2 rounds raw values and then adds them The Solution This problem may seem trivial: "Just link the values together!" For example, the value on page 5 might be a cell reference formula to the total of the revenue by type on page 100. As we discussed in our post Best Practices for Financial Reporting with Excel (Step 2) this causes other problems and only "solves" this problem in one location. It does not address the total on page 200 or any of the other locations that we provide break downs. A better way to address this problem is to attack the foundation of it; always use a single approach to rounding! We must choose one of the two approaches. Given that we must provide detailed disclosures which must be presented rounded to the nearest dollar in many locations we are forced to select the rounding model used in the detailed break-down schedules everywhere. So the recommendation is: If you must present detailed but also rounded disclosures, round all account values in your report and then add them. Thus the value on page 5 becomes $801 which will agree "per-force" with all other presentations. By following this model you will immediately eliminate all of your "true" rounding issues. In coming articles we will discuss some of the other causes of disagreements. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Many finance departments use spreadsheets where rounding errors are a continual struggle. This article presents best practices to minimize rounding errors.

READ MORE

In Control: Internal Control - More than Just Segregation of Duties

- Holly Ueland

- In Control

- minute(s)We strike up conversations about all manner of topics with finance professionals across North America, but discussions about Continuous Controls Monitoring (CCM) can be difficult. In part it is challenging because not many of us have extensive experience with Internal Control. For example, on numerous occasions we've heard comments like “Yes, our internal controls are great; we have segregation of duties!” With this in mind, and in consideration of the problems that a weak system of Internal Control causes, we thought we would explore some of the basics in this post. Perhaps the simplest way is to use an analogy: Imagine you are driving in your vehicle. Your objective? To safely get to the grocery store and back, taking the most efficient route possible. On your route, there are risks - other vehicles, pedestrians, traffic lights - which threaten to slow you down or even derail you completely on your journey. But you're not powerless. Your car has a number of features that allow you to navigate these dangers - the mirrors, the steering wheel. the turn signals, etc. The skillful use of these features can greatly increase the likelihood of you getting to the grocery store. More than just Segregation of Duties Imagine you climbed into your vehicle and all you found was a brake pedal - no steering wheel, no turn signals, no headlights.... Would you start off on your trip? Most likely not - a single safety feature is not enough! You need a wide array of components working as an integrated system in order to have a safe and efficient trip. Your organization's internal control system is the same. Segregation of duties is an important component (see Control Activities below) of the system. But it alone is not enough to protect your organization and ensure the attainment of your goals. What is needed is an entire framework of internal control. There are a number of different frameworks but the most popular and the one recommended by the GFOA is COSO. Below, the COSO pyramid illustrates the components of a their framework: Control environment This is often referred to as “tone at the top” and represents the many elements of the internal environment that define how the entity will conduct its activities overall. These include “soft controls” such as shared values, high ethical standards and expectations, and openness. However, it also includes “hard controls” such as formal job descriptions and performance reviews, and enforced disciplinary practices for violations from expected behavior. It is hard to over-estimate the importance of this component. In fact, in January of this year the GFOA published a best practice regarding the control environment we strongly encourage you to read. Risk assessment Risk is defined as an event that will impact the achievement of one or more objectives. Risk assessment involves the identification and assessment of likelihood and impact of relevant risks. Control activities Control activities are those actions carried out to mitigate risk in order to increase the likelihood that objectives will be achieved. Generally they break down into two categories: Preventative & Detective. Preventative: Authorization and approval: These activities provide the go-ahead to act on the entity’s behalf. A common example is purchase approval limits, whereby individuals can commit up to a specific amount of the organization’s funds to obtain goods and services. Physical controls: This includes activities that ensure the physical security of assets, such as pass cards to restrict building access to only authorized personnel. Detective: Verification: Verification assists in determining if a transaction is legitimate and based on valid information. For example, ensuring that purchases are made only from approved vendors. Reconciliations: The most common type of this control is bank account reconciliations. However, any activity that ensures two or more types of information agree can be defined as a reconciliation, such as a 3-way match between a purchase order, receiving documents and the invoice received from the vendor. Here we see the role of segregation of duties. It is an example of one type of control activity (preventative). It involves separation of the responsibility for the various aspects of a transaction – initiation, custody, recording and reconciling. For example, separating the approval of a purchase (initiating), the ability to create a purchase order (custody), actually creating the purchase order (recording), and performing the 3-way match mentioned above (reconciling). Information and communication Communication is the glue that holds this system together. Information is obtained both from internal activities, such as transaction data, and external sources, such as regulatory requirements. Appropriately and effectively communicating information across and outside the entity is essential for the achievement of objectives. Monitoring How do you know the control activities you are counting on are present and functioning? This is the role of monitoring. Unfortunately it is all-too-frequently overlooked. Your control monitoring system can either be based on manual effort from staff, or automatic checking from one of your computer systems. The other important aspect of your monitoring system is its frequency: periodic or continuous. Manual monitoring very rarely approaches continuous unless you have the resources for MANY dedicated internal auditors. It's much more likely that it will be periodic. Your automated monitoring protocols are more likely to be continuous, although the way you implement them will determine their frequency. Monitoring tends to be one of the weakest elements in most organization's internal control structure for two reasons: Time-intensive: Let's say your organization processes 12,000 A/P disbursements per quarter and you are worried about duplicate payments. To ensure your control activities are working (monitoring), you need to find over 600 randomly sampled disbursements. Once you have this random sample, you now must find and review all the supporting documentation to ensure that there are no duplicates. For most organizations this is several weeks of work. Ongoing: You need to monitor all the time. The more infrequent the monitoring, the less confidence you have that your control activities can be relied on to mitigate risk. If you spend weeks of time looking for duplicate payments, how likely are you to tackle monitoring of duplicate payments every quarter? For most of us, we don't have the time available to dedicate to this rigorous of a protocol, despite how high-risk this area is. Improve Your Framework of Internal Control It should be clear now that breaking some high-risk tasks into a pieces and segregating them among different staff is just one small (but important) piece of an effective internal control system. But it's not nearly enough. Developing a proper framework involves much more, and relies on a robust, continuous monitoring program in order to safely "drive" your organization to your objective. Click the image below to learn more about how to ensure a more efficient, effective and organization. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Understanding internal control components is essential for finance officers & is the first step in understanding the benefits Continuous Controls Monitoring CCM

READ MORE

CaseWare Feature Spotlight: Map Purge

- Darryl Parker

- CaseWare Feature Spotlight

- minute(s)As Certified Consultants and Trainers for CaseWare International, the group at F.H. Black & Company Incorporated gets a chance to talk to Working Papers users from all over the world about how they use the software to do their daily work. Often people don't appreciate the full depth and breadth of the software's abilities and we get the chance to help long-time users get even better at using the software. These "Feature Spotlight" blog posts are designed to: Help those considering CaseWare understand how the solution can transform their reporting processes amd introduce existing users to some of these power features and techniques and help you to become a true "black-belt" masters of the software. One of the features that many people do not know about or are not comfortable using is Mapping Purge. This blog post will introduce the Map Purge, and its strengths and weaknesses. What Problem Does Mapping Purge Solve? In short, too many groupings. CaseWare International releases several standard map number typologies in North America: for GAAP and for IFRS. These map numbers are attempts to provide a comprehensive and standardized way to report all common types of assets, liabilities, equity, revenues, and expenses. However in any one Working Papers file, it is likely that many, many of those map numbers have gone unused. Just take a look at the Other Revenue map numbers available in the standard GAAP mapping: That's a big long list of $0.00 map numbers for you to constantly scan and consider. Further, every map number represents another value that must be calculated and recalculated by CaseWare. These extra, unnecessary calculations can dramatically slow down your Working Papers file. Wouldn't it better if the unused map numbers were removed from the file, and you only had to review and consider the relevant ones? That is the problem that Map Purge was created to solve for you. How to Create Map Purges First, if you're lucky you already have some map purges defined in your Working Papers file. Writing map purges is something the typical user will do very rarely - once you have a good purge, you can simple use the Copy Components tool in Working Papers to copy it among your files. BEFORE YOU START - A Word of Warning!!! Map purges will delete map numbers out of your Working Papers file, and there is no undo button. You must take a backup prior to running a mapping purge. Even better, take a disposable copy of your file and thoroughly test a purge and verify its effects before running it in your live file. And even then, you should take a backup of that live file in advance of running your thoroughly tested purge! If you don't have the map purge that you need, here's the process to create it: Open your Working Papers file On the Tools Ribbon, click the Options item Select Mapping -> Purge in the left sidebar Click the New button Give your map purge a short name in the "Filter ID" text box Type a description that you could expect your colleagues to read and understand the goal of the purge in the "Description" text box. Decide whether you are writing a filter to delete the map numbers that match your criteria, or keep only the map numbers which match your criteria. Select the appropriate radio button. NOW, here's the hard part: write the filter expression. This is a Boolean dbase filter expression that resolves to "true" or "false". The meaning of the "true" depends on your selection to the radio button in the step above. It will either mean that the map number should be deleted, or it should be retained. Finally, decide what should happen if an Unassignable map number has all of its subsidiary map numbers removed by the purge. Check or uncheck the checkbox based on the appropriate behavior. Click OK. Your map purge is made. Just select it from the list and hit that "Purge Now" button The Weakness of the Map Purge feature The concept of a Map Purge is a powerful one and when it works well for you it can have a dramatic effect on your Working Papers file. The purge pictured above removed more than 500 map numbers from the Samp01 file in about 10 seconds. However, there are some serious limitations to what a dbase filter expression can achieve for you. In particular, you cannot filter your map numbers based on whether or not accounts are assigned to it, only if the accounts have specific balances. Consider: What about a Due To / Due From map number that is expected to balance to $0 for the parent in your consolidation, but will have balances for the subsidiaries? What about map numbers that sometimes have important balances in some interim periods, but get adjusted to $0.00 at the end of the year? The map purge feature cannot help you in these situations; the dbase filter cannot differentiate between the case of a set of accounts which net to $0 or the case of there are no accounts at all. It cannot help you if there are accounts in the map number in a period or balance type that you hadn't anticipated and included in your filter expression. Look for an upcoming article where we help you resolve this problem with Map Purges and truly clean up your Working Papers file for maximum performance and efficiency. Want to become a CaseWare Master? Click below to see our upcoming training courses. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Feature Spotlight: Map Purges reduce file size, improve speed and generally simplify your CaseWare Working Papers file.

READ MORE

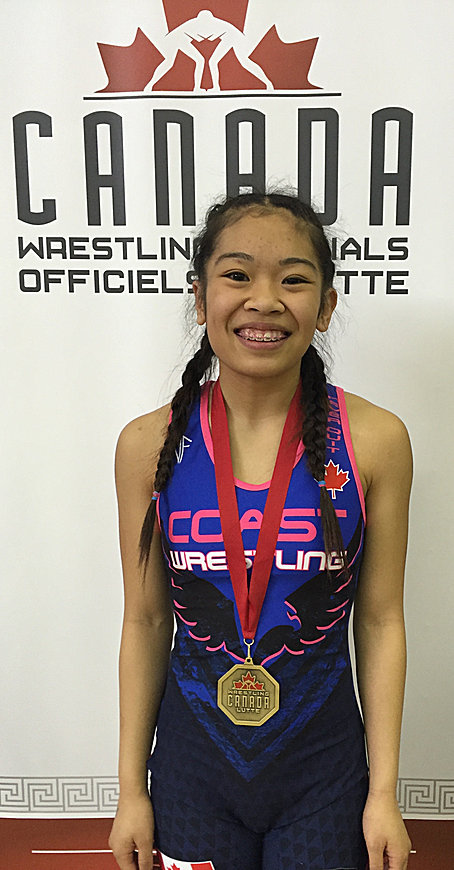

Go Cali Go!

- Jamie Black

- About FHB

- minute(s)We want to share an amazing story of a young woman fulfilling her dream of participating on the Cadet Canadian Wrestling Team. At only 15 years old, Calista (Cali) Espinosa trained for years and recently won a spot on the national wrestling team, which means she will be travelling the globe to compete and train. She has worked hard to get where she is and is determined to work even harder as a member of the national team. Cali comes from a supportive family of four in Richmond, B.C. and as many sports parents can attest, financial obligations of being on any athletic team, let alone a national team, can be very expensive. At F.H. Black & Company Inc. we recognize the importance of sports for our young people. Participating in sports creates leaders, builds confidence and teaches kids how to be good team players. F.H. Black & Company Incorprated is matching all donations to the Go Cali Go fund. It’s our way of supporting an amazing young athlete and helping her dreams come true. To learn more about Cali’s wrestling career and promising future – and to make a donation, visit her website. We hope you will join us in helping Cali celebrate her hard work and pursue her dreams. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

We want to share an amazing story of a young woman fulfilling her dream of participating on the Cadet Canadian Wrestling Team.

READ MORE

6 Reasons to prioritize Continuing Professional Development in 2016

- Jamie Black

- Continuing Professional Development

- minute(s)No one can deny the benefits of networking; you hear about it all the time. Popular websites like LinkedIn exist to facilitate networking, and if you open any professional magazine, there is bound to be an article telling you how important it is. Now, stop and consider how many times have you heard someone speak of the benefits of continuing professional development ("CPD")? Too often, accountants approach CPD with the attitude that it is a unavoidable, distasteful necessity. Perhaps you feel you already know everything you need to, or that taking a course will take away valuable time from your other responsibilities. But today more than ever before, professional development is one of the most valuable parts of your long-term career plans. Consider all the important benefits you get from continually developing your skills: 1) Refresh Unused Skills While you may feel that you and your team are up to date on a particular skill set, a periodic refresher can be very beneficial. If a skill is not used frequently, it becomes rusty and is not as effective when needed. Was your last training session years ago? Research tells us your abilities have likely degraded significantly. How much? In one study of CPR training for medical professionals, the researchers found that degradation due to non-use approached 100%. "By 12 months after training the scores in both groups were similar to the pre-training scores". 2) Get Prepared for Change No matter the field you participate in, your business environment will change: staff change business processes change, software and hardware you use are likely updated with new features and capabilities each and every year. Over the larger time frame, these technological changes can be dramatic. There are always new pronouncements in your reporting standards (PSAB, GASBE, IFRS etc) and Your own job could change! Education is essential to take advantage or be prepared for all the above change agents. 3) Connect with Other Professionals Remember that bit we mentioned about networking earlier? Professional development provides a special kind of networking opportunity. Not only will you meet new professionals, you immediately have a topic for discussion - the course material! If the course is online, networking can be an even stronger benefit. After all, you could be connecting with professional from around the country or even around the globe. Now the caveat here is "does your online course emphasize networking"? Look to see if you can get contact details of other attendees and if sharing and chatting is encouraged during and after the session. 4) Break Out of Old Ways of Thinking You work side by side with your team every day. As a group, you are exposed to the same opinions and perspectives day in and day out. Professional development opportunities expose you and your team to new voices, fresh approaches and new perspectives. Do you have a problem that you're stuck on, where you have been spinning your wheels trying to solve it without success? Relevant CPD can be the catalyst to bring fresh ideas and practices to your organization and take your performance to the next level. 5) Motivate your team Nothing drains enthusiasm from a team like the same-old, daily grind. Knowing that some repetitive (let's say annual) task is coming and that it will be just as horrible this year as it was last year can really demotivate and demoralize the troops. You can help! Continuing education is a wonderful opportunity to show initiative and bring up-to-date information and current industry best-practices back into the fold. Be the leader in your team who comes back with new ideas, approaches and plans. 6) Meet your Professional Requirements This is for you pessimists: You have to take some CPD don't you? Chartered Professional Accountants (CPA), the Government Finance Officers (GFOA), the Institute of Internal Auditors (IIA) and just about every other profession you care to name require their professionals to invest in on-going education. They may call it Continuing Professional Development (CPD) or Continuing Professional Education (CPE) but they mean the same thing; you are required to participate in a certain number of education hours. When selecting courses, be sure the course meets your verifiable CPD requirements and not only will you be furthering a skill, but you'll be meeting an association requirement. We provide an overview of CPA requirements in a previous blog, For Canadian CPAs, what qualifies as CPD? A couple quick tips to ensure you get the most from your CPD: Consider selecting the course type and format that best suits your organizational and individual employee's needs. For example: Is travel necessary or is there a local or online solution? Will the session occur shortly before the need to use the skill? If so, this will minimize any memory lapses. Have you come prepared with questions to ensure you get the most out of your course? To get more tips, download a no-charge copy of "Maximize the Return from Your Online Training Investment" where we share 20 tips to prepare you for a better online education. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Professional development training sessions are perhaps one of the most valuable tools in an employee's tool bag. It's simply a matter of perspective.

READ MORE