CaseWare Feature Spotlight: Importing Data

- Jamie Black

- CaseWare Feature Spotlight

- minute(s)CaseWare's financial reporting solutions have been providing massive benefits to more than 500,000 users around the world since the first version was released back in 1988. How? By providing the most sophisticated features in the industry. Each of our "Feature Spotlight" articles discuss one of these features. Importing Data Complex reports like annual financial statements, CAFRs and Budget Books are built from large, complex data sets. In fact, they may require data from several sources; general ledger data, budget data, performance measures (number of staff per department etc.), even sub-ledger data. In many tools, integration to your data sources can be difficult, time consuming and expensive. CaseWare Working Papers makes this process extremely simple. Not only does Working Papers offer dozens of direct integrations to popular ERP systems, it has a very flexible Import Wizard designed to bring data in from nearly any source. In 5 steps you (not IT and a room full of programmers) will have your data in CaseWare: Once you have identified the report(s) in your ERP or budget software that has the data you need, save it as an Excel or Text file. Identify the Excel or Text file to be imported. Define the columns of your Excel / Text file. CaseWare supports importing nearly every value and modifier you are likely to need: current actuals, prior actuals, budgets, forecasts, foreign exchange rates, and any groupings you may have already defined elsewhere. Customize the import process to create exactly the Working Papers file you need using the advanced specifications. Do you want to exclude $0 accounts? Round all of your balances to dollars?. Advanced properties can even be used to automatically calculate net activity from ending balances. Save all these settings so that next time you run the import (an hour from now or next year), all of these settings will be remembered! Want to see it in action? This 3-minute video will show you how fast and easy it is to import your data into CaseWare Working Papers: © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare features drive massive value for users. Ease and speed of importing data is just one of these features.

READ MORE

Internal Control is Key to the Success of Government Programs

- Jamie Black

- In Control

- minute(s)For most finance professionals, “internal control” is synonymous with activities designed to prevent or detect fraud. One example activity: segregating the tasks of recording deposits and making deposits. But internal control is a much broader topic than most of us appreciate. Internal Control is an entire process for assuring achievement of an organization's objectives in: operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. Segregation of duties related to making and recording deposits is a single control activity designed to deal with a single risk. The pyramid illustrating the internal control process illustrates the many elements that must fit together to provide a complete an effective internal control system. It would be better if we thought of a skeletal system when we hear the phrase “internal control”. Like a skeleton, internal control is the structure that supports the correct functioning of your organization. Without understanding internal control as a comprehensive system, it is much more difficult to maintain strong internal controls and thereby assure achievement of your government’s objectives. Need convincing? Consider the 2014 Fall Report of the Auditor General of Canada (AG). Chapter 6 of the report, focuses on Nutrition North Canada (NNC). NNC is a subsidy program provided by Aboriginal Affairs and Northern Development Canada (AANDC), designed to provide Northerners in isolated communities with improved access to perishable, nutritious food. The program pays a subsidy to retailers in eligible communities, intended to reduce the cost of nutritious foods. In a CBC radio interview, the AG states the program “wasn’t living up to what it’s intended to do” and “Senior Management at AANDC focused on what was easy to measure instead of what was critical to measure.” In other words, the AANDC is failing to achieve its objective. Why? To recast the AG’s comments from an internal control perspective, AANDC failed to mitigate risks with appropriate control activities. Consider the following table, comparing the original control activity compared with a better-designed control activity tailored to help in achieving the AANDC's objectives: Control Objective Provide funding for residents of those communities most at need Risk #1 The wrong communities receive the subsidy Current Control Activity Assess each community’s need based on historical use AG Proposed Control Activity Assess each community based on current need Risk #2 Subsidy not being passed along to consumers (kept by retailer) Current Control Activity Measure quantity of food being shipped to retailer and measure the average cost of estimated food consumption AG Proposed Control Activity Measure the actual cost paid by residents for the perishable nutritious food they purchased Table 1 - AANDC Control Activities Still need convincing of the benefit of the systemic view? Consider a personal example based on our skeletal system metaphor: if you went to the doctor with leg pain and numbness, what result would you prefer? The doctor prescribes pain pills, or; The doctor investigates, finds the cause is a compressed vertebrae and prescribes a back brace to allow the vertebrae to heal naturally. Clearly, the best choice is to find the cause and fix it. Similarly, armed with a proper systemic understanding of internal controls and how the various elements need to function together, finance officers are likely to identify the AG’s concerns as symptoms of a deeper issue. That should lead to an evaluation of the overall system of internal control. As a finance officer, you have the opportunity to have a profound impact on all aspects of your government’s operations, including program delivery. When you see symptoms of poor execution, look for the cause. A failure of internal control is often at the root of it. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Finance officers should leverage strong internal control to enable the success of their government's programs.

READ MORE

Your Guide to CaseWare 2015 Ribbon Navigation

- Jamie Black

- What's New

- minute(s)Last fall we blogged about CaseWare’s move from menu to ribbon navigation in Working Papers 2015 . Read the blog entry here: CaseWare 2015 User Interface: Why move from menu to ribbon. At that time, to reduce frustration, headaches, and inefficiency caused by the changes, we offered a training session on the new interface. If you weren’t able to join us for the webinar, you can download our guides, CaseView 2015: Ribbon Navigation and CaseWare Working Papers: Ribbon Navigation. These visual guides will walk you through the changes so you can make the most out of the ribbon and ensure you remain an effective CaseWare user. You can download them both right here. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Smooth your transition to CaseWare 2015 and the new Ribbon Navigation with our free downloads.

READ MORE

CaseWare Now Officially Supports Office 2016

- Darryl Parker

- What's New

- minute(s)Good news for those of us committed to staying up-to-date with technology: CaseWare International has announced that CaseWare Working Papers, CaseView, and Connector now official support the current version of Microsoft Office - Office 2016. We made a big deal about the importance of ensuring compatibility among your mission-critical software in a recent blog post. For us and many of our clients, CaseWare Working Papers is the cornerstone of the software on our computers, and so we held back from upgrading to Office 2016. Note that the compatibility is only officaly supported if you have Working Papers version 2015.00.164 and above, and Connector version 2015.00.050 and above. More good news: both the 64-bit and the 32-bit versions are fully compatible. Read more at CaseWare International's knowledge base article. Office 2016 comes with a refreshed user interface and better integration with internet services such as the new Smart Lookup feature. But for most users, the real wins are the improvement in sharing and collaboration. It's now more seamless co-authoring a document or analysis with your team members, but also moving from your desktop to your tablet to your smartphone is a smooth and simple process. Now that conference season is upon us and we want to be as efficient, effective, and reliable as possible in our travel, Office 2016 has some real benefits for staying productive in airport lounges and hotel rooms. You can read more about what's new and think about whether you should upgrade here at Microsoft's website. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Working Papers, CaseView and Connector now support Microsoft Office 2016

READ MORE

Tech for Execs: Ignorance is not bliss

- Waldo Nell

- Tech for Execs

- minute(s)F.H. Black & Company Inc. works with governments, universities, large companies and accounting firms. The professionals we work with are typically auditors, finance officers, accountants and CFOs. They have great expertise in accounting & management and tremendous experience in their industries. They may even spend some time to refine their skill with the specific applications that they use (Excel, CaseWare, etc). Often though, they have minimal expertise with the general computer technology infrastructure that surrounds them. Why should finance & budget officers want to become more sophisticated with technology? Increase your professional performance: Improving the general technological literacy of finance professionals can yield a tremendous increase in their overall efficiency and effectiveness. Improve your ability to assess & mitigate risk: Having at least a basic level of knowledge is essential to avoid fraud, data loss, identity theft and a myriad of other modern-day hazards. Not just personally, but as a critical part of the Internal Control process, finance's facility with technology impacts the entire organization's safety. FHB's series of articles on Technology for Executives ("Tech for Execs") will enable you to do just that - improve your fluency and ability to use technology to facilitate increasing your efficiency, effectiveness & reliability. An important starting point for this series of articles is to consider: Why it is that so many finance and budget professionals are less than perfectly conversant with computer technology? Why is the need for expertise in computer technology different than that of any other tool you rely on? A very recent addition to the world The explosion of the computer age over the last 40 years is unlike anything the human species has ever encountered before. No other technology has grown to have such a overwhelming influence on so many people in so short a time. Due to this very rapid adoption, there is a segment of the world's population that is relatively inexperienced using this new technology. That is understandable - most people aged 40 and over didn't grow up with computers, and if you are in your 50s perhaps much of your early professional career was without significant computer usage. When you combine the short time-line with the magnitude of the change, computer technology aptitude is not necessarily an easy skill to develop. A tool unlike others Regardless of age, most people use the internet like we use appliances, or our cars. We use them to provide a service to us, and don't care about its inner workings. Why would you want to understand the Otto cycle in your car? Or how the magnetron works in your microwave oven? Or how the escapement mechanism keeps your mechanical watch ticking? As long as it perform its function, we just don't care. Nor should we. You do not need to understand these things to drive your car or heat a cup of tea. If it breaks, you send it in to be repaired or you replace it. Not understanding the inner workings does not affect us negatively. With computer technology there is a superficial similarity. You do not need to understand nomenclature such as CPU, RAM, HTTPS or CHAP to be able to send a tweet, post a Facebook update or call a friend over your internet phone. But, this is where the analogy stops. Most of the technology you use today relies on connectivity. Sending email, browsing the Internet, accessing Facebook or LinkedIn means that your computer is connected to billions of other computers. This connectivity, uniquely among the tools and technologies you use, exposes you to massive risk. The difference between securing a thing like your house and securing your computer or smartphone is that for someone to break into your home, they have to be physically standing in front of your house. There are only a small number of people geographically close to you, severely limiting how many bad guys that could actually attempt to break in. With your internet connected computer, you suddenly have more than a billion people that can attack you. However, the threat gets even worse: most people do not have the knowledge or skill to even understand that they are under attack. Or even has their computer system been entirely compromised. Everyone understands how a burglar could break in to their house. He can come in through the window, pick your lock, use the roof etc. But almost nobody (statistically speaking) knows how bad guys get in to your computer. It is black magic, mysterious and spooky. This does not mean everyone should be signing up for computer security courses. Or that you even need to know what the acronyms I mentioned earlier stand for. Just like you do not need to know what the Otto cycle is to be able to recognize the danger in crossing a road filled with cars and cross it safely, we will be teaching you how to better prepare yourself for this new era of being interconnected to each other. Naturally we cannot possibly cover all aspects as this is indeed a very complex landscape requiring long, intensive study to truly master. We will merely be applying the Pareto principle in trying to teach you 20% of what you need to know to make you 80% safer. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Tech for Execs discusses why accountants, & finance professionals are likely not technology experts and why they should increase their expertise

READ MORE

The Importance of Modern Internal Control for Government

- Jamie Black

- In Control

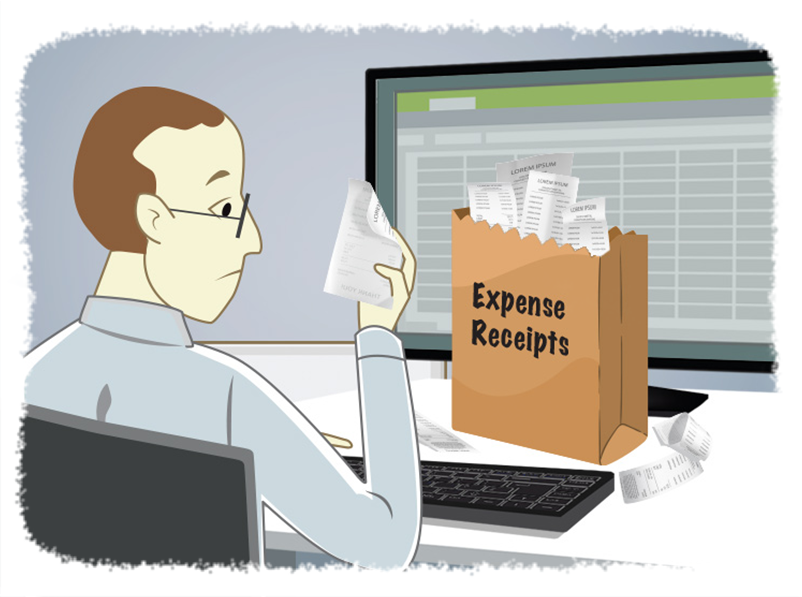

- minute(s)A cautionary tale provided by Canadian Senate Scandal If you are Canadian, no doubt you know some of the details: It is an ongoing political scandal concerning the expense claims of certain Canadian senators which began in late 2012. Senators Patrick Brazeau, Mike Duffy, Mac Harb, and Pamela Wallin claimed travel and living allowance expenses from the Senate for which they were not eligible. Duffy, Harb, and Wallin repaid ineligible amounts. Harb retired a few months into the scandal, and in November 2013, Brazeau, Duffy, and Wallin were suspended from the Senate without pay. Brazeau, Duffy, and Harb were criminally charged. Recent coverage has focused on many of the details of the scandal including the total audit cost: $23.6 million and nearly 122,000 hours. While others may be interested in the politics of the issue, the more relevant question for finance professionals is: Why were these expense anomalies not caught sooner? Our first indication of any problem was in June of 2012 when the Auditor General of Canada released a performance audit of the Senate Administration – their first since 1991! The audit found that expense claims from some senators did not contain sufficient documentation to determine if they were legitimate. By the time of the report, these expense claim irregularities had been occurring for many years. Canadian governments of all levels have a mandate to be accountable (demonstrate and take responsibility for its actions, decisions and policies and be answerable to the public at large) & transparent (conduct its business in an accessible, clear and visible manner). Taking this mandate seriously means that we must do more than merely present our financial reports on an annual basis and await the auditor’s opinion. In fact, we must do more than merely present those reports more frequently. The US Government Accountability Office summarizes this point excellently: “A key factor in improving accountability in achieving an entity’s mission is to implement an effective internal control system. An effective internal control system helps an entity adapt to shifting environments, evolving demands, and new priorities…. Internal control serves as the first line of defense in safeguarding assets. In short, internal control helps federal managers achieve desired results through effective stewardship of public resources. ” For government finance professionals, this scandal should serve as a wake-up call. Do you wait for the auditor to find anomalies or are your systems designed and maintained to prevent / detect this type of catastrophe? Are you regularly reviewing risks, leveraging data analytics and continuously monitoring control activities to ensure that they are effective? Does the frequency of these review and testing processes occur frequently enough and on a large-enough set of your transactions to provide real comfort that there is not an expense scandal waiting in your future? Unfortunately we see all too often in local government that finance resources are stretched so tight that investing in internal control is not prioritized. Consider the damage that results from a weak control system. $24 million and 120,000 hours spent auditing historic activities; an investment that has little to no future value. The Senate gives us a great example of how stronger internal controls would have spared the taxpayers millions of dollars and politicians considerable drama and wasted time. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Excellent Internal Controls are essential for efficiency, effectiveness & avoiding political scandal but traditional internal audit testing can't keep pace.

READ MORE

12 Tips for Efficient, Effective and Reliable Business Travel

- Jamie Black

- Best Practices

- minute(s)Whether you love it or hate it, business travel is often an important part of the job. This article is one in our series on how to ensure you are efficient, effective and reliable. So we ask: How do you spend as little time away as possible and make the time away as efficient as possible? How do you ensure that the many hours spent on the road are as effective as possible? How do you make sure you achieve these results reliably on every trip? Below we provide a dozen tips and tricks you can utilize to accomplish this goal while traveling. Improve Reliability Have you ever missed a flight because you thought it was at 10pm not 10am? Ever just barely miss the cut-off for check-in because you were stuck in traffic? Never be a no-show at your important meetings again with a couple little tricks. Use packing checklists. Different trips have different requirements so I recommend 3 checklists that can be used or ignored depending on the type of trip. Work Tools. I use this one while I'm packing up the office so I keep it with my laptop bag. It lists all the devices, power cords, cellphone, cellphone charger, wireless pointers etc. that I normally need. Clothes. As you might imagine this is going to be useful while going through your dresser. To ensure I never show up at a conference with only white socks again, I make sure that I list off all the items I need to guarantee a professional appearance.The list is sub-categorized into Business / Casual / Work Out. Toiletries. While ransacking the bathroom I use this list to make sure I don't get to the hotel with shave cream but no razor. Always check-in as early as possible. While online check-in has been available for a while now, smart phones allow you to easily check in for your flight up to 24-hours before departure online - from anywhere. It will save you time standing in line, and in the event that the cab is late getting you to the airport, it increases the likelihood (along with taking only carry on bags) you still get on the plane. Store boarding passes securely. Once you check in, use a smart-phone application (Passbook for my iPhone or you can try one of many options on Android) to store your boarding pass. This application allows you to automatically add the flight to your calendar (with an alert set early to allow for travel time). It also prevents accidentally deleting the email from the airline that has your boarding pass. I have done this a half a dozen times or more, which means I have had to head back to the check-in counter and get a new boardpass printed, wasting all my early check-in time savings. Maximize Effectiveness Guarantee good Internet access. Having a strong Internet connection is a must while traveling. Whether sitting in the airport or a hotel room, it can be hit or miss. Some grant free access throughout the building, while others require you to purchase it. In either case, their Wi-FI is often very slow and unreliable. For Canadians traveling across Canada a better option may be to use your own provider while on the road.If you are a Shaw or Bell Internet subscriber for your home or business, you can access their Wi-Fi networks for no charge. Shaw has 70,000 Wi-Fi hotspots across Western Canada and Bell has what appears to be nearly 10,000 across the entire country, including airports and hotels. If you are traveling internationally or are not a Canadian traveler, consider signing up for Boingo (currently advertised at $10/month). This is an International wireless service that is available in terminals around the world. With Boingo's 1 million hotspots worldwide, you'll be nearly guaranteed to have Internet access in any terminal. Take advantage of airport lounges. Frequent fliers benefit from the use of Airport Lounge Access like the Maple Leaf Lounge by Air Canada. These lounges offer a business service centre, refreshments, magazines, and a refined area to work or relax. Even if you aren’t a "Super Elite" frequent flyer, you may be able to access these lounges with a purchased day pass. Want to cut out the pain of trying to negotiate the myriad of options and requirements airport by airport? If you travel frequently you may want to consider either the Regal Card or Priority Pass. These services give you access to their lounge network worldwide. For example, Regal Card boasts 830 (Priority Pass is 850 World Wide) lounge locations worldwide as well as a number of other benefits. Here is one (although potentially biased in favour of Regal Card as it is from their site) comparing these two competitors: Work on-line while in the air. Wi-Fi while in the air is now becoming more common too. American, Alaska, Delta, Virgin & even Air Canada are offering WI-Fi on some of their flights so be sure to watch when you book so you can take advantage while in the air. Catch-up on your reading. Have you heard of Texture yet? If you have a tablet (phone is too small a for me) it is an incredibly good way to stay on top of your business (or personal) magazine reading. I have been very impressed with the ease of downloading magazines (including back issues), searching for and sharing articles. I used to think I did not have time for the 5 - 10 magazines I subscribe to. Now, one flight and I am all caught up! Increase Efficiency Simplifiy travel arrangements. By now, I am sure nearly everyone has used an online booking systems of some sort. From Airline specific sites (Air Canada, West Jet, American Airlines) to those that allow for comparing flights and adding on hotel & car rental options (Expedia & Travelocity are examples) there are almost too many options. One service that provides some unique features that many folks don't seem to know about is Google Flights. As you would expect, their service searches across all airlines at once (saving time) but it gives you many handy features to look at the numerous travel options you have. For example, you can see the lowest prices in a calendar view, identifying better travel options (assuming you have some flexibility in your dates of travel). It also gives you many options to filter out the options it returns. For example you can opt to only view those options with 1 or fewer stops, connecting through Calgary where Departure time is between 10am and 1pm. Finally if you don't see any great options for that airport, the map view shows you alternate nearby destinations and their cost. You note in this example I would save about $45 by flying into Detroit instead of Toronto, and considering I am visiting a client in Windsor, it would likely be a better option. Carry-on only. Unless you're going to be gone for an extended period of time, consider not checking luggage so you do not have to hang around the baggage carousel and instead can jump in the first cab (before the line forms). For up to a 5 day trip, a computer bag and carry-on baggage should be more than enough. This allows you to skip the lines at the baggage counter. Want to make your life easier? Consider a new carry-on that is designed to be as effective as possible. Better yet, consider smart luggage that comes with location tracking, a built in scale and remote locking! Pack for Screenings. The one part of plane travel that takes the most amount of time is the security screening. Speed up this necessary step by making sure to have all your liquids in one container that you can easily remove from the carry-on. This holds true with computers and tablets. Also, wear slip-off shoes so you can remove them without issue. All of this makes walking through security as easy as possible. Take Advantage of Frequent Travel Programs. Traveling for work? That doesn't mean you can't sign up for frequent traveler programs and collect the points yourself. No need to let those go to waste. Plus, if you travel a great deal, try to focus on using the same airlines, hotels & car rental agencies. You'll eventually land in an elevated class, which allows for earlier boarding (start working on the plane faster), the chance at seat, room & car upgrades, and potential access to airline lounges for free. Ship everything you can't fit in your carry-on. Do you have materials for your business presentation? Trying to bring these along with you is just going to slow you down, and increase stress levels. Pre-shipping well in advance often this saves you time and money, allows you to avoid carrying the large packages around, and it simply makes travel easier and more efficient. Bonus tip: Keep cell phone and hotel keys apart. The battery from a cell phone can easily deactivate the magnetic strip on your cell phone. There is nothing more frustrating than getting to your room late (usually with your arms full) and finding your room key doesn’t work. Sign up for our Blog and continue to receive updates and news from F.H. Black & Company Incorporated. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Business travel on your 2016 calendar? Make your time away as efficient, effective and reliable as possible with these business travel tips.

READ MORE

University of the Fraser Valley Automates Financial Reporting

- Jamie Black

- Success Stories

- minute(s)In the beautiful Fraser River Valley, just east of Vancouver, British Columbia, lies the University of the Fraser Valley (UFV), a fully accredited, public university enrolling approximately 15,000 each year. UFV is consistency ranked as one of the top universities in Canada by the Globe and Mail’s Canadian University Report. In addition to its main campus, the University supports four satellite campuses throughout the region and has a growing presence in Chandigarh, India. UFV implemented CaseWare Working Papers and ASPE Financials as part of an effort to automate and streamline its financial reporting. University Enrolls CaseWare UFV first saw Working Papers demonstrated at a finance conference, where CaseWare consultants F.H. Black & Company Incorporated were highlighting the success of another university’s experience with the solution. “We had heard of CaseWare, of course,” says Nicole Adams, CGA, the Associate Director of Finance for UFV. “As an accountant, I know its reputation well. Many Canadian accountancy firms use CaseWare. Until then, though, we hadn’t really thought of its application to a university like ours. It’s actually a good fit for us.” Style and Substance Like many institutions, UFV relied on spreadsheets and text documents to produce its financial statements. And like many institutions, it struggled to ensure that the reports produced in this way were accurate and properly formatted. Adams says the university has seen a huge improvement in the professionalism of its financial statements. “There is consistency in fonts, columns, spacing, and tables that was very hard to maintain in Word® and Excel®. The statements truly look great.” While the overall appearance of the financial statements is important, accuracy is the critical factor, and using Working Papers gives the university even greater confidence in the quality of its statements. “Adjustments are simple to complete and flow automatically through the statements so we’re assured everything is updated correctly,” explains Adams. “Our schedules and working papers are linked to the statements which efficiently organizes the statements and supporting documentation in one place.” PSAB Compliance Simplified In addition to the university’s desire to automate and streamline its financial reporting tasks, it was facing a required transition to the Public Sector Accounting Standards (PSAS), necessitating significant changes to the way it had been presenting its financial statements. In order to meet transition deadlines, UFV engaged F.H. Black & Company Incorporated to assist with the implementation of Working Papers and to customize the templates to accommodate the university’s Public Sector Accounting Board (PSAB) compliant financial statements. “It went very smoothly,” Adams recalls. “F.H. Black & Company Incorporated understood our goals and objectives and got us operational very quickly. We continue to receive excellent support from them. They go above and beyond to assist us.” Year-Round Value In addition to the annual financial statements, UFV has leveraged its investment in and knowledge of the solution to help produce quarterly reports as well. The university downloads trial balance data from its SCT Banner® accounting system and uploads that data into Working Papers. “We can then produce a quarterly balance sheet and statement of operations,” says Adams. “CaseWare is proving to also be a great tool for interim reporting and being able to use it in this way streamline quarterly reporting requirements.” Time Savings With the efficiencies provided by CaseWare, UFV is able to quickly respond to auditors’ questions and efficiently make late period adjustments. “We’ve shaved a lot of time off the creation of the statements themselves as well,” says Adams. “We can have draft-ready financial statements in just a couple of days.” Adams concludes, “We consider the implementation of CaseWare for our financial statements and supporting documentation a complete success.” F.H. Black & Company Incorporated has helped dozens of governments, universities, large corporations and accounting firms automate their financial reporting tasks. Interested in learning more about what CaseWare Working Papers could do for your organization?Take the first step and sign up for a webinar today. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

University of Fraser Valley uses CaseWare Working Papers to automate PSAB financial reporting

READ MORE

2015 FIR Automation Tool (Alberta version) Released

- Darryl Parker

- What's New

- minute(s)Municipal government finance departments have another way to leverage their investment in CaseWare Working Papers by automating their Municipal Financial Information Return ("MFIR"). Each year, F.H. Black & Company Incorporated helps a number of governments across the country prepare not only their annual audited financial statements, but also other mandatory provincial reporting such as Alberta's MFIR. This week, FHB released the 2015 FIR Automation Tool (Alberta Edition) to assist in calculating the balances that appear in that Excel template using the same trial balance which generates the financial statements. Why Automating the MFIR with CaseWare is Important One of the hardests tasks in preparing the Financial Information Return is ensuring agreement with the audited financial statements. Hisotrically, every change arising from the audit had to be painstakenly chased through all of the schedules of the MFIR. That last minute adjusting entry from the auditor doesn't pose a challenge any longer. Just post the adjustment in your Working Papers file, and see its effect ripple through your financial statements, notes and schedules, as well as the related items on your automated FIR schedules. Changes in the 2015 MFIR Minimal The Ministry publishes a manual each year for the MFIR which notes any changes to the MFIR compared to prior years. Luckily, this year there are no changes to the MFIR Excel template at all - it is literally exactly the same set of lines and columns as the 2014 veresion of this report. The manual does note one important change to accounting policy: Liabilities for Contaminated Sites (PS3260). However, that change in policy will have an impact on the liabilities you report - not the format of your reporting them (at least with respect to the MFIR). Want to learn how you too can automate the MFIR? Sign up for one of our upcomming webinars to learn more. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

the 2015 version of the FIR Automation Tool for Alberta municipalities has just been released.

READ MORE

CaseWare Tips and Tricks: 5 Steps to Solving Out of Balance Issues

- Jamie Black

- Tips and Tricks

- minute(s)Everyone responsible for financial reporting wants as fast and as simple a quarter-end or year-end as possible. Your organization uses CaseWare Working Papers specifically to achieve this goal. It has many excellent tools to prevent mistakes and reduce the time invested by your finance team. It is THE tool that makes finance look good and prevents them from having to spend their evenings and weekends in the office. An obvious prerequisite for this faster financial reporting is starting off with good data. No system, no matter how amazing, is going to help if we start off with a GL that doesn't balance. As a result, another of our CaseWare Tips and Tricks is to immediately confirm the GL in CaseWare Working Papers foots to zero when you have completed importing your account balances. To do this, click on the Trial Balance button on the Navigation toolbar. Now look at the very last line (note it may take a moment to calculate if you have a very large GL). It should appear like this: Depending on your budgeting practices, it may be the case that your budget values may not foot to zero so in this case, a non-zero balance in the budget column could be acceptable. But what if one or more of the "actual" columns do not foot to zero? Step 1 - Repair File On occasion - typically due to either a crash of a work station or a network interruption - your Working Paper's file may need a recalculation. This is essentially what the Repair File feature does. On the Tools tab of the Ribbon, select Repair File. Click all the boxes and select OK. Working Papers will prompt you to make a back up of your data file. We strongly recommend you to say "YES" to this prompt. The repair file may take a few moments, and you will see a number of progress bars appear on your screen. Once completed, go back and review the totals at the bottom of the Working Trial Balance and see if they are now set to zero. If they are now all set to zero, you are able to carry on with the month / quarter / year end. If not, continue on to step 2. Step 2 - Determine What is Out of Balance Review the total row of the Working Trial Balance and note exactly which columns do not equal $0.00. Budget Column If it is the budget column, as we mentioned above, you may not have a problem. Adjustments Column If the Adjustments column does not foot to zero, it means one or more of your adjusting entries are not in balance. You can quickly find these entries by choosing Diagnostics from the Tools tab of the ribbon. Set the Report type to "Out of Balance Entries," choose the 1st option and click the OK button. Any entries that are out of balance will be listed and you can now review and correct them. Opening Balance Column If the column that is out of balance is the Opening Balance column, there could be a number of causes and further investigation is warranted. One thing to be aware of is that this column is editable. Meaning we can not exclude the possibility that someone modified one or more accounts intentionally or otherwise. With this one point in mind, we encourage our clients to see if there are other discernible causes. Step 3 - Sum balance columns in Excel Most of our clients import their end-of-period balances into the Opening Balance column of Working Papers from a Microsoft Excel file, and the remainder of this guide is written based on that common scenario. If you're out of balance after Working Papers generated an opening balance as part of the year-end close process, or if you are importing the Opening Balance directly from an accounting package, contact us to help in troubleshooting your file. When you have populated the Opening Balance column via an import from Excel, it makes sense to check the Excel file to confirm that the balances being imported were good to begin with (i.e. sum to zero). If the Excel file is also out of balance, there could be a number of causes. To start, determine if there is a setting in your ERP that excludes some accounts from the export to Excel. Even scarier, perhaps the GL in your ERP system does not balance to zero.You will want to check on that too. If the balance columns in Excel do balance to zero, move on to Step 4. Step 4 - Look for duplicate accounts in Excel By default if CaseWare encounters two accounts with the same entity and account number it behaves in a very specific way. To understand, let's consider the following example: In the above example, on import, CaseWare would update the Opening Balance column of account 101 Petty Cash to $200. Then when it comes across the second instance of account 101 (with the same entity) on the fourth row, it will update the balance to $1,000. The result is your Working Trial Balance will be out out of balance by $200. Now you must determine why you are getting the same account multiple times in your Excel file. This will likely require some investigation back in your ERP system. In the event that you determine that it is appropriate to have the same account / entity combination presented multiple times with different values, you will need to modify the import layout file to accumulate balances. On the last page of the Excel File Import wizard titled "Advanced Specifications," you need to enable the checkbox for "Accumulate Balances." With this setting enabled, in the above scenario CaseWare will add together the $1,000 balance and the $200, keeping the Working Trial Balance footing to zero. If you could not find any duplicate accounts in Excel, we are now left with three possible causes: Manual over-ride. Intentionally or unintentionally a balance was changed in the Opening Balance column in CaseWare some time after import. Changed Entity - The entity assigned to an account was changed in CaseWare after import.The reason this is a problem may not be immediately apparent however. Consider the following example: On import account, account 107 was associated with Entity GG. Some time after to import, the entity was changed. You may have done this to move a balance from one of your consolidation entities to another. Imagine you opened the "Assign Entities" interface from the Account Ribbon and dragged 101 from the "GG" entity to the "PS" entity. On re-import, if the Excel file still has the account being assigned to GG, CaseWare will not update the manually changed PS-107. It will instead ADD a "new" account GG-107, thereby throwing the GL out of balance. Omitted Accounts - One of the accounts that has a balance in CaseWare is no longed included in Excel file you are importing. This is a problem because by default, CaseWare only updates account values that are in the Excel file. Thus, if an account is not in the Excel file, the old balance will be retained, throwing your GL out of balance. The solution to all three of these final causes is the same, a re-import done properly. Step 5 - Delete Opening Balance column and Re-Import If you have gotten this far, the final step is to re-import your Excel file. But first, we will eliminate existing balances (Note - now is a great time to take a backup of your CaseWare file!). In the Working Trial Balance, right-click on the Opening Balance column header. Choose "Select Column". Then press the Delete key on your keyboard. This will set every account balance to $0. Now you are ready to re-do your import. 99.9% of the time these steps will guarantee you a balanced GL after the import completes. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Tips and Tricks - solve out of balance issues easily to ensure a fast, trouble-free year end

READ MORE