CaseWare Feature Spotlight: Modifiable Groups

- Jamie Black

- CaseWare Feature Spotlight

- minute(s)CaseWare's financial reporting solutions provide massive benefits to more than 500,000 users in 130 countries. Accountants, from auditors in public practice to finance officers in government, use CaseWare to automate very complex financial reports faster, with fewer errors, more reliably than with any other tool. How does CaseWare do this? By providing the most sophisticated features in the industry. Each of our "Feature Spotlight" articles discuss one of these features. Groups For a report of any sophistication, you need to group items (general ledger accounts, performance metrics etc). In fact it is typical that you need to combine those accounts in several different ways in a single report. For example one schedule may show expenses grouped by nature, and another schedule shows expenses grouped by department. Further, because you may want to generate reports that the software vendor might not have anticipated, you need modifiable groups. In other words, customizable by you and not require a consultant or the software vendor's intervention. All of this is true of CaseWare. CaseWare provides standardized groupings to simplify your reporting For example, CAFR groupings are provided in the GASB template. You can also modify or import your own groupings if you have them defined elsewhere. In fact, CaseWare Working Papers has this and more. 10 Groupings that can be named and organized any way you need (note Group 3 in the screenshot below called "Any Name I Want"). Each grouping can have 40-digit codes and 50-character names all specified by you. They also have some sophisticated features: Flipping - consider AR & AP. Imagine that this year one of your receivable accounts has a credit balance. No problem - in CaseWare you can configure the group code to automatically "flip" that account to the payables group code with no intervention from the user required! Calculation - Consider AR. Most often you will want to show receivables net of allowances for doubtful accounts. Not always though. Calculated groups allow you to instantly add other groups (the AR group and the Allowance group) together to get AR Net of Allowances. Extended & Calculated Descriptions - Need a longer description? How about changing the description automatically in the situation where the "Due To" becomes a "Due From"? Check & Check! Mapping has all the features of the above groups and a number of extra features too. Mapping allows you to default account properties and automatically assign any or all of the other 10 groups. Map numbers can be 40 digits long with 50-character names, all fully modifiable by the end user. Entity code - this mechanism is often overlooked by CaseWare users. Not only does it do all the work of the other 10 groupings but it also gives you a very simple way to create what Excel users call a pivot table. This turns out to be an amazing feature when trying to tackle complex governmental reporting (GASB / PSAB) or dealing with large consolidations. Entity numbers (called abbreviations) can be 40 digits long and the descriptions can be 100 characters long. If you are keeping track that is 12 concurrent grouping mechanisms that can all be customized and modified by the end user! PS: There are actually 2 more ways to combine accounts: Tax Export Code & GIFI. Both of these are used to automate the population of your corporate tax software (very useful for public accountants and accountants in large corporations). We have not counted these two as true grouping mechanisms as they are built for very specific purposes, and are not that modifiable. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Customizable groupings are key to saving time, reducing errors, reducing audit fees & improving the reliability of your reports. CaseWare has you covered.

READ MORE

Best Practices for Financial Reporting - Eliminate rounding errors

- Jamie Black

- Excel

- minute(s)Complex reports (Financial statements / Comprehensive Annual Financial Report, Budget Book, etc) often present the same value in multiple locations in multiple ways. For example: on page 5 we show total revenue, on page 100 revenue is broken down by type, and on page 200 revenue is broken down by source. The trouble is, the value on page 5 and the total of the break-downs on pages 100 & 200 must all agree. The most common reporting tools (Word & Excel) do not have good methods to confirm and enforce that agreement (see how CaseWare Working Papers solves this problem here). You're left with a manual, error-prone process. The amount of detail provided in even a moderately complex report means rounding errors likely occur hundreds of times. This requires massive time investment during the reporting process to check & double check & triple check as your proceed through the reporting process. This article will explore just one of the common causes of disagreement between these values and suggest best practices to minimize failures of agreement. Different Rounding Approaches Lead to Disagreement As we have examined in our post Best Practices for Financial Reporting with Excel (Step 2), the optimal method for dealing with these 3 different revenue presentations is by linking back to central data source. We will assume you are following this advice. Let's use the following as our central data source (G/L): Approach 1 On page 5, where we just need total revenue we would enter a formula that adds all of the individual account values and rounds the result. Your page total 5 will show total revenue as $804. Approach 2 But what about on page 100 where we present revenue by type? The problem becomes apparent. When we need to present more detail, we round each individual account value and then add up those rounded values. Your page 100 will show total revenue as $801, which does not agree to the total of $804 presented on page 5. In other words the problem is we use different approaches to rounding: Approach 1 adds raw values and rounds the total Approach 2 rounds raw values and then adds them The Solution This problem may seem trivial: "Just link the values together!" For example, the value on page 5 might be a cell reference formula to the total of the revenue by type on page 100. As we discussed in our post Best Practices for Financial Reporting with Excel (Step 2) this causes other problems and only "solves" this problem in one location. It does not address the total on page 200 or any of the other locations that we provide break downs. A better way to address this problem is to attack the foundation of it; always use a single approach to rounding! We must choose one of the two approaches. Given that we must provide detailed disclosures which must be presented rounded to the nearest dollar in many locations we are forced to select the rounding model used in the detailed break-down schedules everywhere. So the recommendation is: If you must present detailed but also rounded disclosures, round all account values in your report and then add them. Thus the value on page 5 becomes $801 which will agree "per-force" with all other presentations. By following this model you will immediately eliminate all of your "true" rounding issues. In coming articles we will discuss some of the other causes of disagreements. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Many finance departments use spreadsheets where rounding errors are a continual struggle. This article presents best practices to minimize rounding errors.

READ MORE

Go Cali Go!

- Jamie Black

- About FHB

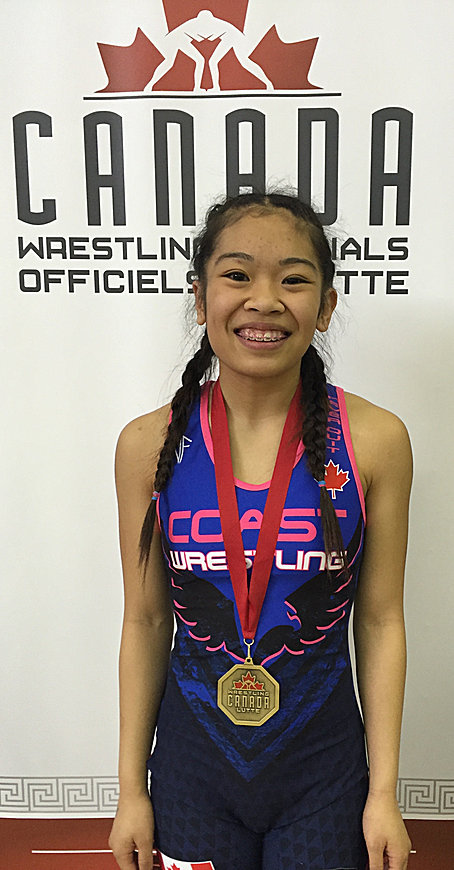

- minute(s)We want to share an amazing story of a young woman fulfilling her dream of participating on the Cadet Canadian Wrestling Team. At only 15 years old, Calista (Cali) Espinosa trained for years and recently won a spot on the national wrestling team, which means she will be travelling the globe to compete and train. She has worked hard to get where she is and is determined to work even harder as a member of the national team. Cali comes from a supportive family of four in Richmond, B.C. and as many sports parents can attest, financial obligations of being on any athletic team, let alone a national team, can be very expensive. At F.H. Black & Company Inc. we recognize the importance of sports for our young people. Participating in sports creates leaders, builds confidence and teaches kids how to be good team players. F.H. Black & Company Incorprated is matching all donations to the Go Cali Go fund. It’s our way of supporting an amazing young athlete and helping her dreams come true. To learn more about Cali’s wrestling career and promising future – and to make a donation, visit her website. We hope you will join us in helping Cali celebrate her hard work and pursue her dreams. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

We want to share an amazing story of a young woman fulfilling her dream of participating on the Cadet Canadian Wrestling Team.

READ MORE

6 Reasons to prioritize Continuing Professional Development in 2016

- Jamie Black

- Continuing Professional Development

- minute(s)No one can deny the benefits of networking; you hear about it all the time. Popular websites like LinkedIn exist to facilitate networking, and if you open any professional magazine, there is bound to be an article telling you how important it is. Now, stop and consider how many times have you heard someone speak of the benefits of continuing professional development ("CPD")? Too often, accountants approach CPD with the attitude that it is a unavoidable, distasteful necessity. Perhaps you feel you already know everything you need to, or that taking a course will take away valuable time from your other responsibilities. But today more than ever before, professional development is one of the most valuable parts of your long-term career plans. Consider all the important benefits you get from continually developing your skills: 1) Refresh Unused Skills While you may feel that you and your team are up to date on a particular skill set, a periodic refresher can be very beneficial. If a skill is not used frequently, it becomes rusty and is not as effective when needed. Was your last training session years ago? Research tells us your abilities have likely degraded significantly. How much? In one study of CPR training for medical professionals, the researchers found that degradation due to non-use approached 100%. "By 12 months after training the scores in both groups were similar to the pre-training scores". 2) Get Prepared for Change No matter the field you participate in, your business environment will change: staff change business processes change, software and hardware you use are likely updated with new features and capabilities each and every year. Over the larger time frame, these technological changes can be dramatic. There are always new pronouncements in your reporting standards (PSAB, GASBE, IFRS etc) and Your own job could change! Education is essential to take advantage or be prepared for all the above change agents. 3) Connect with Other Professionals Remember that bit we mentioned about networking earlier? Professional development provides a special kind of networking opportunity. Not only will you meet new professionals, you immediately have a topic for discussion - the course material! If the course is online, networking can be an even stronger benefit. After all, you could be connecting with professional from around the country or even around the globe. Now the caveat here is "does your online course emphasize networking"? Look to see if you can get contact details of other attendees and if sharing and chatting is encouraged during and after the session. 4) Break Out of Old Ways of Thinking You work side by side with your team every day. As a group, you are exposed to the same opinions and perspectives day in and day out. Professional development opportunities expose you and your team to new voices, fresh approaches and new perspectives. Do you have a problem that you're stuck on, where you have been spinning your wheels trying to solve it without success? Relevant CPD can be the catalyst to bring fresh ideas and practices to your organization and take your performance to the next level. 5) Motivate your team Nothing drains enthusiasm from a team like the same-old, daily grind. Knowing that some repetitive (let's say annual) task is coming and that it will be just as horrible this year as it was last year can really demotivate and demoralize the troops. You can help! Continuing education is a wonderful opportunity to show initiative and bring up-to-date information and current industry best-practices back into the fold. Be the leader in your team who comes back with new ideas, approaches and plans. 6) Meet your Professional Requirements This is for you pessimists: You have to take some CPD don't you? Chartered Professional Accountants (CPA), the Government Finance Officers (GFOA), the Institute of Internal Auditors (IIA) and just about every other profession you care to name require their professionals to invest in on-going education. They may call it Continuing Professional Development (CPD) or Continuing Professional Education (CPE) but they mean the same thing; you are required to participate in a certain number of education hours. When selecting courses, be sure the course meets your verifiable CPD requirements and not only will you be furthering a skill, but you'll be meeting an association requirement. We provide an overview of CPA requirements in a previous blog, For Canadian CPAs, what qualifies as CPD? A couple quick tips to ensure you get the most from your CPD: Consider selecting the course type and format that best suits your organizational and individual employee's needs. For example: Is travel necessary or is there a local or online solution? Will the session occur shortly before the need to use the skill? If so, this will minimize any memory lapses. Have you come prepared with questions to ensure you get the most out of your course? To get more tips, download a no-charge copy of "Maximize the Return from Your Online Training Investment" where we share 20 tips to prepare you for a better online education. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Professional development training sessions are perhaps one of the most valuable tools in an employee's tool bag. It's simply a matter of perspective.

READ MORE

A Bright Solution for Sunshine Coast Regional District

- Jamie Black

- Success Stories

- minute(s)Sunshine Coast Regional District (SCRD) is the regional government serving the residents of the Sunshine Coast, a picturesque area located along the southwest coast of mainland British Columbia. SCRD’s 313 employees provide the region’s 32,170 residents with a wide range of diverse services, from recreation to regional water. When we met the District's team, they managed their complex and highly specific financial reporting needs with Caseware Working Papers. 95+ Distinct Entities Create Complexity The complexity of SCRD’s financial reporting requirements is due in part to the more than 95 distinct services it provides. “It is appropriate to think of each of our different services as a separate company,” explained Tina Perreault, Treasurer for SCRD. “Each has its own set of financials, and we need consolidated reporting as well.” With an annual report more than 50 pages long, the work required to gather financial statement data was extensive, and potentially error-prone. Changing Requirements SCRD began using Working Papers in the late 1990s, but as changing public-sector accounting requirements demanded adjustments to financial reports, the District relied more and more on spreadsheets to balance components of the financial statements. “We knew that [our platform] was more than capable of handling the new requirements, but we didn’t have the knowledge to make the necessary adjustments,” explained Tina. “So, instead we used dozens of different methods to balance sections within the financials, from leadsheets to spreadsheets. When a change was required, we had to make adjustments to each component.” SCRD was looking for a better way. Review Reaps Rewards “We met F.H. Black & Company at a GFOA (Government Finance Officers Association) conference and spoke to them about our situation,” Perreault recalls. “The firm’s knowledge of both governmental accounting [and our chosen platform] is impressive. I was quickly convinced they were the partners we wanted,” said Tina. F.H. Black performed what it calls a Health Check of the District's use of Caseware, and provided a list of resultant recommendations. As an example, FHB suggested using the GAAP Financial component of Working Papers; the results of its application have been significant. “We learned that there are a number of things that we could have been using [the platform] for, to help streamline our operations,” said Tina. “[It] offers extensive forecasting, budgeting, and statistical analysis capabilities that we can now use to our advantage.” Saving Time, Effort, and Money “We are saving so much time and effort,” said Tina. “F.H. Black was able to precisely duplicate our financial reporting structure... so we get the results we need with a fraction of the effort.” SCRD’s auditing firm uses the same platform, which Tina anticipates will result in lower audit fees for the organization. “Our auditors will be able to gather the information they need much more quickly, and it’s in the format they are already using. They spend less time, and it will save us money,” she said. Training the District's staff was a simple task thanks to [the software’s] intuitive nature. “After an introductory class, they can navigate and problem-solve easily,” noted Tina. “It is a tremendous benefit to the organization to have multiple people capable of sharing the workload. In the past, we really had only one person who understood the whole system, and that is risky for the organization.” Visibility and Control Tina appreciates the level of control SCRD maintains by producing financial statements in-house. “We are working to more fully automate our entire audit process, and [the software] is making that possible,” she said. “We have visibility into our statements long before we hand the data off to the auditors. Having this information more quickly helps us be even better at what we do,” she said. Ongoing Return on Investment Tina reports that obtaining funding for the software review and implementation of GAAP Financials was a simple matter. “Our Board recognizes the value of investing in technology,” she said. “We were able to communicate the benefits, and [the platform] has delivered on those.” Tina concluded, “I speak to local governments like ours about [automating financial reporting] and I’m always astounded when they say they still rely on spreadsheets and pivot tables. [Modern tools] are relatively inexpensive for the value they deliver, and the return on investment is rapid and ongoing. Frankly, I think it would be crazy not to use [them].” © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

F.H. Black & Company performed a Health Check of the Sunshine Coast Regional District & optimized their Caseware usage.

READ MORE

Budget Book VS. Financial Statements: What's Worse?

- Jamie Black

- Automating Financial Reporting

- minute(s)Finance professionals in government and education have several daunting (frustrating, annoying, I could go on..) reporting challenges to address each year: the Annual Audited Financial Report, the Budget Book and some special purpose reports like the FIR for governments in Alberta & Ontario or the CAUBO report for universities & colleges While automating the annual financial statements is generally recognized as a major win for your finance team, perhaps an even bigger win is automating the budget book. To an outsider, this might be a surprise. Isn't going through an audit the worst thing possible? Admittedly, it's not a lot of fun and yes it is incredibly time consuming; but the budget book is worse. Here's why.. 1) Much more content How long are your annual financial statements? For many of our clients (governments, universities & colleges, large publicly traded companies) a typical set of statements include: a cover page a table of contents 4 statements 20 - 30 notes 4 - 6 schedules All told, the report is perhaps 30 pages. For a regional district or a local government in the USA that must prepare a Comprehensive Annual Financial Report the page count is likely to increase to 200 + pages. In any case, there is a lot of complexity to these reports. A budget book (sometimes called the "financial plan") is almost always much larger. 200 or 300 pages is actually a small budget document. For those clients that participate in the GFOA Distinguished Budget Presentation Awards program, their guidelines tend to result in very large budget books. Some even approach 1,000 pages! All of this content means more work. More tables, more text, and more numbers that must reconcile. 2) Considerable emphasis on non-financial data For the most part, financial statements are focused on financial data. There are text portions (the policies and notes), but even then they are either relatively static (e.g. your revenue recognition policy is not changing year-by-year) or primarily about details of the financial data. In contrast, it is very common for the budget book to contain hundreds of pages of narrative. Large narrative discussions of the following are required of GFOA Distinguished Budget Presentation Award Program participants in a budget book: the budget process, entity-wide long-term financial policies, organizational charts and descriptions of the organization, its community, the population and background information related to the services provided. Why does this make the process harder? More content means more page breaks, larger table of contents, more pages to number etc. In short, it means more elements to have problems with. Secondly, much of this narrative changes year after year, necessitating a process of collecting, organizing and updating hundreds of pages of content. 3) Graphs & pictures Annual Financial Statements rarely include graphs & pictures. They tend to be very utilitarian documents, comprised almost exclusively of tables of data and a few pages of narrative in the notes section. Very few of our clients even add a logo or picture to the cover page! Contrast this with the budget book. The vast majority of these documents contain many graphical elements including: organization charts graphs pictures of ongoing projects, the finance team, local wild life etc. A quick review of one of the budget book for one of our clients showed that in the 425 pages, there were nearly 300 graphical elements! Just like the challenges listed above in large narrative sections, graphical elements must be managed and updated year after year. To make matters worse, consider that many finance professionals are not expert in how to use graphical elements to maximize communication effectiveness. 4) A much broader collaboration In most organizations, assembling the annual financial statements is primarily the task of the core finance team. While dozens of folks may contribute reconciliations and supporting documents, perhaps only a handful of people contribute to the statements directly. For the budget book, dozens or even hundreds of people contribute to that huge volume of text we mentioned earlier. It might only be a few paragraphs per person, but it seems like every Tom, Dick & Wendy contribute to the budget book content. That means the team that assembles the book needs to track who is contributing to each section. Then they need to know if that individual provided their content yet, and when they do provide the content someone has to make sure that it gets reviewed, approved and finally correctly inserted into the end report. That is a lot of little steps which must be repeated potentially hundreds of times to arrive at the completed book. The End Result The end result of these four points is one absolute fact. If your budget document is hundreds of pages bigger than your financial statements, budget book automation will be an incredibly valuable accomplishment for your organization. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Budget book automation provides massive value for universities & governments by reducing time investment, eliminating errors & more. Here's why...

READ MORE

Learn how the City of Saint John Modernized Its Financial Reporting

- Jamie Black

- Success Stories

- minute(s)Saint John is the largest city in the province of New Brunswick, but it is even more notable as the oldest incorporated city in all of Canada. The city is home to 70,000 residents, with a nearly equal number in the surrounding metropolitan area. Its location on the Bay of Fundy at the mouth of the St. John River gives the city a rich maritime history. Today’s Saint John is also well-known for its research and technology sectors, its large arts and culture community, and broad tourism base. The City of Saint John, with an operating and capital budget of $226 million, is charged with administering city services, including police and public safety, parks and recreation, roads and transportation, fire and rescue, water and sewage, and many more. To meet its complex municipal, provincial, and federal reporting requirements the City of Saint John relies on CaseWare Working Papers and Financials. Change In Accounting Standards Assistant Controller, Hilary Nguyen, CGA, MBA, took on the financial reporting responsibilities for the City just as it was facing new reporting requirements for the upcoming year. “We had to begin reporting under the Public Sector Accounting Standards (PSAS),” she recalls. “This represented a huge change from our previous fund-based reporting format.” Up until this point, the City of Saint John was producing its financial statements using Excel® and Word®. It was a cumbersome process, but doable. With the new requirements, though, continuing without a purpose-built reporting tool would have been tremendously difficult. “We have well over one hundred different city functions and 17 separate entities that have to be consolidated and integrated,” explains Nguyen. “It would have been challenging, if not impossible, to accomplish in Excel.” Meeting a Tight Timetable Nguyen’s predecessor had already identified CaseWare Working Papers and Financials as the ideal solution for the municipality. F.H. Black & Company Incorporated, an Authorized CaseWare Consultant, was initially engaged to duplicate the City’s existing financial statements using CaseWare, satisfying the current year’s reporting requirements. “They are recognized experts in both CaseWare and municipal reporting requirements,” notes Nguyen. “We value that experience and look to them for assistance developing best practices for our reporting cycles going forward. Our province has additional unique requirements. F.H. Black was familiar with these requirements and could help us meet them using CaseWare.” Consultants’ Help Adds Value F.H. Black first helped the City of Saint John build fund-based reporting templates in CaseWare that matched the existing reporting format. The City next engaged F.H. Black to help it meet the new Public Sector Accounting Board (PSAB) required statements for the upcoming year. “We initially planned to have F.H. Black create the templates and we’d take it from there. Due to our short timeline and our small staff, though, we engaged F.H. Black to build both the financial statement templates and assemble the actual financial statements,” says Nguyen. “It was a good decision for us. F.H. Black met our deadlines and our statements are precisely how we need them to be.” Once the rush of the reporting cycle was complete, F.H. Black gave Nguyen and her staff more extensive training in CaseWare, empowering them to take over the task in the coming years. “The people at F.H. Black make a tremendous difference,” says Nguyen. “They are responsive and efficient and always provide us with a very high level of service.” Reporting Success Using CaseWare, the City of Saint John successfully generated their annual PSAB-compliant financial statements. With the templates in place, Nguyen expects to substantially reduce the time spent on the process in coming years. “We can roll the numbers forward and easily import the new year’s figures,” she says. “CaseWare is a highly efficient tool. If we need to make a change, that change automatically flows to the appropriate sections of the report. With Excel, we had to be extra cautious to ensure we updated every reference.” Leveraging CaseWare’s Capabilities for Financial Reporting Automation The successful project of converting its financial statements to the PSAB format with CaseWare prompted the City of Saint John to consult with F.H. Black about other ways to leverage the software within the municipality. “They’ve since built additional templates for some of our distinct entities that file separately,” says Nguyen. “And we’re speaking with them now about how to use CaseWare to produce our quarterly and annual reports.” She concludes, “CaseWare represents a huge improvement over our old reporting process. It allows us to be more efficient, minimizing the manual data entry and the opportunity for errors that come with manual processes. I would definitely recommend CaseWare to other municipalities - it’s an easy decision.” © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn how the City of Saint John successfully tackled financial reporting automation and PSAB with CaseWare & F.H. Black & Company Incorporated.

READ MORE

3 questions to answer before report design

- Jamie Black

- Style & Substance

- minute(s)When finance is asked to prepare a new report or redesign an existing report (financial statements, budget book, quarterly forecast, MD&A, etc) the decisions made can dramatically impact understanding. In our experience, formally dealing with these decisions (the design stage) is rare. As we have discussed in Style & Substance before, there seems to be little formal direction on how to design reports. Combine this lack of direction with an abbreviated, overlooked design process, and you run the risk of having some fundamentally flawed reports; reports that confuse, distract and obfuscate the data. When tackling a new report or re-developing an old one, these three questions need to be asked during the design phase: Who will use the report, What must be reported, and How should it be presented This article examines the best practice for communicating financial information and why adhering to it is essential to improve your financial reporting. Question 1 - "Who" Knowing who the likely user of the report is, should make a critical difference in report design decisions. For example, if the likely user is the senior management team, perhaps very general introductions and explanations are unnecessary as you can be certain they have great knowledge about the organization. On the other hand, if the users are likely to be non-finance experts, new to the organization (newly elected council members for example), or external to the organization, then the use of jargon or omitting general introductions or explanations may well be unwise. Are the users technologically adept? If so, providing the report electronically may be the best option. Electronic distribution is especially powerful if the board/council will want to make & share notes, and create action items based on the report. On the other hand, if the user is not comfortable with technology, a well crafted, printed document is likely a superior choice. Why does technology matter when designing a new report? If the destination is paper & ink, then you are bound to designing a report to fit on 8.5" x 11" paper, printed in portrait orientation. If the ultimate destination is an iPad or a computer screen, you may be able to abandon these constraints. Question 2 - "What" The first, most fundamental "What" question is "What answers are readers trying to get with this report?" This is an absolute prerequisite before creating the report. Consider some examples - If finance is reasonably confident that users of the report are looking to understand profitability, they will tailor the "What" to show the variables that are most explicitly tied to profit. In many cases, this is where finance's expertise comes in. Likely their experience means they have a very clear understanding of the relationships that affect profit. Now is finance's opportunity to leverage the report to communicate their knowledge to the user(s) of the report. If you are in the automotive sales industry, you might know that region, and product category most directly affects profit. You would then omit or summarize data if it confused the topic. Thus the design must allow the user to see the relationship clearly. Do they need to know how much budget is available for a specific department, fund or program? If so, this information should be displayed with priority. Too often reports are generated without first establishing very clearly what answers the user needs. If this failure occurs, end users of the report are often left to dump a report out to Excel to manipulate the data to find the answers they seek themselves. The next step in report design is asking, "What data should be included in this report to answer the readers' questions?" In our experience, these sorts of questions are fairly straightforward and easily answered by the finance team. Examples include: What type of data should be presented? Actuals, Budget, Forecast or all three? Revenues, Expenses, Operating, Capital What date range will this report cover? Current Year to Date, Current Period, Prior Year(s) What level of detail must be presented? Individual GL accounts? Or should the accounts be grouped on some basis? Question 3 - "How" For finance professionals, the "How" can be more challenging. This is because formal training on how to present the data and how presentation choices can affect interpretation is not commonplace. Consequently the answer to "How?" is often "Let's throw the data in a table with several columns and rows. That'll satisfy them!" As a means of helping our would-be report creators, here are some guideposts (at a high level) for how best to present our data. There are 3 different devices we might use to communicate our message: Tables: A table encodes quantitative data as text. Table are the right choice when: the exact value is important. For example, budget officers might need to know that Public Works is precisely $101,985 over budget. comparison of exact values is important. there are multiple units of measure to be displayed together. For example, the quantity of 911 calls, dollars of expense for the Policing department and variance against budget as a percentage. Graphs: A graph encodes quantitative data visually. They are best used when: the message you wish to communicate is best understood in patterns, relationships among and between quantitative values & exceptions. there is no need for precise numbers or to compare individual values. For example, budget officers only need to know that Public Works is approximately $100k over budget. there is a need to show much more complex relationships. vary large data sets must be presented. Narrative/Text: Complements graphs and tables. Consider using narrative text to: Introduce a topic, a problem, a business process or other item the reader might not be fully conversant on. Explain the graph or the table so the reader does not miss any nuances. Highlight or calling out a particular point in a table or graph. Label a particular data point in a graph, or columns or rows in a table. Recommend appropriate next steps or actions. In subsequent articles, we will delve deeply into Tables, Graphs, and Text to layout their use and how they fit into the best practices in financial reporting. If you are interested in further reading on these topics we strongly recommend a couple of authors who have fundamentally informed & challenged our opinion over the years. Stephen Few & Edward Tufte are both incredibly insightful and helpful on all topics associated with communicating complicated information. As an added bonus, the hardcover versions of their books are very close to works of art! © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

When finance is tasked with creating a new report, best practice for financial reporting says there are 3 essential questions to answer before you begin.

READ MORE

Best practices for communicating financial information

- Jamie Black

- Style & Substance

- minute(s)Our appetite for reporting is insatiable. Every time finance professionals turn around there is some new disclosure required. Non-finance folks often do not appreciate how much work each new request entails. After all - designing the report and obtaining the right data is often a great deal of work and there is no magic shortcut (once the design is done however there are tools that can dramatically accelerate the generation of the reports). When designing some reports, we are constrained by a financial reporting standard (PSAB, GAAP, GASB, IFRS etc.). These standards are very prescriptive; they guide professionals about what data must be presented and how it is to be presented. What about those other reports you prepare and present that may not have such absolute standards to guide you? Reports like the budget book, management discussion & analysis (MD&A), and quarterly variance reports are often complex documents full of images, graphs, tables and narrative that must combine to tell a comprehensive story to the reader. Where do you get direction on what these reports should look like and what they should include? Very often the What is based on broad guidance from an authority (GFOA perhaps), past experience, custom, what your competitor/neighbor has done and your understanding of reader preference. Significant weight is often given to recreating the same information which appeared in past iterations, especially when presenting to board/council that are not finance experts. Our experience tells us your recipe starts with "that's what we have always done", and is updated based on the questions your receive from council or board of directors. And the How? The answer is the same as for the "What", supplemented by the Communication department. In many organizations, there is a Communications department that specifies fonts and spacing guidelines and such. Despite these "guides", there are still a lot of questions left to the finance professional to answer: Should you use tables, graphs or prose to communicate a particular point? Is a pie, bar, line, column, area, scatter, bubble, doughnut or radar chart/graph best in this situation? What colours should we use in our charts/graphs? Should we put labels in the chart/graph, below in a legend, or both? Finance & budget professionals who are given the responsibility of making these decisions may not be well-trained in the How, and their choices will affect how the data is read and understood. Consider the graph below: Is the reader now likely to better understand your data as a result of this graph? Unequivocally, "NO" is the answer. These decisions are far too important to leave to the flip of the coin or a personal sense of style, especially if you are presenting financial data to non-finance experts. In this series, we will provide finance & budget officers with best practices they should employ when presenting financial data. We will explore many of the Do's and Do Not's and will endeavor to show examples (good and bad) to illustrate the point. For example, not sure why we say the graph above is horrible? Continue reading this series and you will learn this and much more! To make sure you do not miss any of our Style & Substance posts, be sure to sign up for our blog today. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Finance officers are often unaware of the best practices in communicating complicated information. The result can be confusion, and poor decision making.

READ MORE

The City of Lacombe Saves $45,000 on Audit Services Thanks to CaseWare

- Jamie Black

- Success Stories

- minute(s)Nestled in one of Central Alberta’s most fertile valleys between Calgary and Edmonton lies Lacombe, a historically rich and picturesque city of 12,000. The City of Lacombe is responsible for providing residents with essential services, utilities, and amenities including fire and rescue, water and sewer, transit, and recreational resources. The City of Lacombe implemented Working Papers and Canadian Financials as part of an effort to improve and modernize the production of its annual financial statements. Not only has CaseWare Working Papers delivered on those expectations, it is delivering time and financial savings well beyond the City’s expectations. Saving $45,000 in Fees “We implemented Working Papers in 2013 and used it that first year to produce the City’s financial statements, plus the statements for five of our entities. It was a complete success,” recalls Theresa Musser, Financial Services Manager for the City of Lacombe. “Shortly after we implemented Working Papers, we were able to renegotiate our audit services contract with our accountancy firm - for a savings of $45,000.” From Months to Weeks Like many municipalities, the City of Lacombe had been producing its annual financial statements using Excel® and Word®. There were literally dozens of complex and interlinked spreadsheets involved in the process that typically took four months to complete. “It was very time consuming,” Musser recalls. “With six separate entities to report on, we sometimes needed to request an extension in order to complete the filings.” Using Working Papers, the City shaved that four-month cycle down to just two weeks. “It’s so much more streamlined and straight forward now,” Musser notes. “And we’ve dramatically cut down on the paper used, since all of our data and supporting documents are now stored electronically in the CaseWare files.” Without the need to print and route paper files throughout the office and to and from auditors, the entire process is more visible, trackable, and accountable. Streamline Audit Cycle The City’s audit firm also uses Working Papers, which further speeds and simplifies the statement production process. “The auditors have easier access to our data now; they can quickly find the files they need to review, and can follow a clear audit trail to where our numbers are coming from,” Musser says. “Before CaseWare, our auditors were typically on site for ten days. Now they only need three days on site. We are realizing an overall annual savings of 25 percent. This is a huge benefit to Lacombe.” Now, rather than providing numbers and supporting data to the audit firm for compilation of the financial statements, the City is generating its own financial statements using Working Papers. “This is important,” says Musser. “It makes for a pure audit, where the accountants are auditing our work, not their own efforts.” Partner Adds Value The City of Lacombe engaged F.H. Black & Company Incorporated, a CaseWare Certified Consultant, to implement Working Papers. “F.H. Black is just fantastic at what they do. They thoroughly understand the software and the nuances of municipal accounting,” says Mussser. “They set up our templates, provided us with great training, and help us understand additional ways we can leverage Working Papers.” Leverage the Tool One of the additional ways the City of Lacombe is leveraging Working Papers is by using it to produce its Financial Informational Return (FIR) and quarterly financial reporting. “F.H. Black prepared the templates for us and now producing these reports is very straightforward and efficient,” says Musser. “We had never even attempted quarterly reporting before because we saw it as too labour intensive.” Improve Confidence in the Numbers In addition to the substantially reduced audit fees and a faster year end attributed to Working Papers, the City also has improved overall confidence in its financial statements. “When you’re relying on spreadsheets, you must constantly double and triple check formulas and formatting for accuracy,” notes Musser. “There was always a concern that as we copied worksheets, something would get dropped or broken. With Working Papers, we have no such concerns.” We Love It CaseWare has provided a much simpler year end for the City of Lacombe. Musser concludes, “Our auditors love it. Our Council loves it. Our Commissioners love it. And we love it!” © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Lacombe implemented CaseWare Working Papers & Financials and are realizing time and financial savings well beyond expectations.

READ MORE