Has Artificial Intelligence improved your finance department yet?

- Jamie Black

- Finance Evolved

- minute(s)Finance has always utilized technology. From the humble abacus (2700 - 2300 BCE) to adding machines (1642 CE), to today's PCs. The last 40 years have seen even ‘Moore’ (excuse the pun, couldn’t resist) spectacular technological advancement, as discussed in our Tech for Execs: Ignorance is not bliss article. The questions we tackle here are what will the future bring, how disruptive will this change be for the finance department and what can we do today? Future Technology - Artificial Intelligence (AI) In short, AI refers to a device that perceives its environment and takes actions that maximize its chance of successfully achieving its goals. This definition is intentionally broad as AI could refer to a software application designed to perform bank reconciliations or Terminator robots. When we think about AI in terms of software, one guide is that the application can do things that it was not specifically programmed to do. It learns based on the outcome of previous events. There are two categories of artificial intelligence: 1) Narrow AI Narrow AI is focused on one very specific topic. Still, in its early stages, we can already see developments in narrow AI. AlphaGo Zero is a computer program that taught itself the board game Go by playing against itself. Within days it was better than the best Go-playing applications which themselves beat the best human Go players. Then in 4 hours it taught itself Chess and could beat the best Chess programs in the world (the ones that beat the best humans). Finally, it taught itself Shogi (a Japanese version of Chess played on a bigger board) in 2 hours and was better than the world's best Shogi program. Some other interesting examples: Google's self-taught Go playing AI crushes the best human player, AI in Tesla will predict your destination, MIT's autonomous cheetahs figure out how to navigate obstacles entirely on their own, Boston Dynamics SpotMini locating, recognizing and opening a door, Amazon's use of AI to improve their business processes 2) General AI General AI (sometimes called Artificial General Intelligence or AGI) is a hypothetical machine that exhibits behavior at least as skillful and flexible as humans across a broad set of topics. This is the Hollywood sci-fi that many people immediately think of. Should AGI become a reality, it promises to change every aspect of our world fundamentally. Many experts in the field are in fact worried that it will lead to disaster. To learn more, I recommend an excellent Ted Talk by Sam Harris or Nick Bostram's great book on the topic. AI & the finance department What will AI (narrow or general) mean for the finance department? In the near term, repetitive and time-consuming tasks are being automated at an accelerating pace driving massive improvements in efficiency. These advancements tend to be less risky and relatively low cost and thus are immediately appealing. The benefits are enormous, freeing your team from the mundane, repetitive work allowing them to tackle the difficult, often more rewarding tasks that they may not have time to tackle today. As the technology improves, analyzing data and making decisions based on this analysis are also likely to be automated. We expect that the move to rely on AI for these most complex and difficult tasks - the ones that require years or decades of experience in humans - will be initially slow and cautious. Nearly all studies suggest that the entire finance function (like many others) will be entirely automated by AI exclusively or a human-AI hybrid. The process has begun. Recent research indicates 46% of CFOs in large companies already use narrow AI in some role in their organization and another 30% are investigating its use. Today's Technology - Robotic Process Automation (RPA) For decades finance departments leveraged spreadsheets and more recently databases. These technologies allow for simplistic automation such as calculations or manipulating manually defined groups of data. While basic, this automation has allowed finance departments to complete larger & more complicated tasks with fewer hours of investment. RPA takes automation to the next level and can be considered a pre-cursor to AI. The three characteristics generally associated with RPA: It does not require programming skills on the part of end users, It does not require complex, disruptive integration with existing systems, It is designed to be managed and even implemented by a business user, Some simplistic examples: data analytics & monitoring systems that check thousands of variables in the way it’s been taught, against the benchmarks that have been provided. When exceptions are identified appropriate individuals are notified automatically and escalations occur at pre-determined intervals. automation of reconciliations between any data sources with automated adjustments when common deviations (think bank charges in the context of a bank rec) occur. automated modification of language in your MD&A based on the significance of an identified variance. So if the variance between actual and budget is greater than a predetermined threshold, entire sections of the report turn on and standard analysis is performed, automated analysis of documents to find violations of integrity, automated balancing of amounts across large complex documents. Take advantage now It's clear that technology has, does & will continue to influence the role of finance. While the exact timeline may be difficult to predict, the importance of continuously evaluating and embracing technology is indisputable. It is likely that many of the tools you use today include RPA functionality that is not being utilized. Further, you can expect to see a lot of narrow AI tools specifically targeted at finance in the very near future. Spending a bit of time to leverage these tools can provide your finance department with significant benefits at a very low cost. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

AI is coming and it will dramatically improve your finance department's efficiency. It is already starting and many of us don't know it yet.

READ MORE

Palmetto proves automating the Comprehensive Annual Financial Report ...

- Jamie Black

- Success Stories

- minute(s)Palmetto is a waterfront community located on the Gulf Coast of Florida, midway between Tampa to the north and Sarasota to the south. With a population of just over 14,000 residents, the City has seen dramatic growth in recent years while maintaining the “Old Florida” charm that residents and visitors have come to love. The Challenge The primary challenges for the City's Finance Department were three-fold, they needed to: Reduce Time Reduce the Risk of Errors Formalize Processes Everyone wants to reduce the time it takes to produce the Comprehensive Annual Financial Report & mitigate the risk of errors. Of particular concern for Palmetto was the impending retirement of the City's Finance Director. The finance department, made up of just four members, was very concerned about how this loss & associated "brain drain" would affect the department going forward. The Wrong Turns Not one to wait for a small problem to become large, the Finance Director anticipated the problems that would arise from her departure and took steps to mitigate them immediately. After extensive research, the finance department eliminated all spreadsheet-based applications and decided to proceed with a Comprehensive Annual Financial Report focused solution. Unfortunately, two-thirds of the way through implementing the solution, the City was abandoned by the provider. Sometimes even the best-laid plans go awry due to circumstances beyond your control. The Solution Convinced a better solution was still 'out there', the evaluation of vendors resumed. This time CaseWare International was the victor, a combination of the Working Papers & GASB Financial solution were just what the department needed. Perceived Road Blocks When asked why CaseWare was eliminated for consideration initially, the answer was simply “it was way too big for what we needed.” The perception was that the program was too large & complex, it would take too long to implement. In steps CaseWare authorized implementers F.H.Black & Company Incorporated. The Results Reduced time required to produce the Comprehensive Annual Financial Report including over 50% reduction in the time it takes to prepare Fund Statements, Reduced risk of errors, Documented, simplified & formalized processes that will ease the transition to a new Finance Director, Centralized-database for single location modification, Positioned to reclaim Government-Wide statement creation from auditors. A word of wisdom from the expert Karen Simpson, Finance Director, shared that no matter the size, “the same amount of work still has to be done.” As the number and complexity of regulations and requirements for financial reporting continue to increase, municipalities of all sizes are quickly realizing that spreadsheets and word processing software that have been used in the past to prepare financial reports are no longer sufficient. Read the full success story here. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Palmetto proves that automating the Comprehensive Annual Financial Report provides time, cost & operational savings for local governments too.

READ MORE

CaseWare Updates Now Available for 2017 Version of Connector

- Jamie Black

- What's New

- minute(s)Software: Connector Prior Version: 2017.00. New Version: 2017.00.055 Release Date: November 16, 2017. You may have received an email from CaseWare International announcing the release of, and inviting you to download, an update for CaseWare's 2017 Connector product. The update has been made available for CaseWare users in their MyCase portals. If however, you did not receive the email or cannot locate the download in your MyCase account contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes the following fixes: Fixes related to: File extensions Connector stability Links/protected documents User-defined functions. Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months talking about the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare has just released an update to it's 2017 Connector product. Download the update to apply software fixes.

READ MORE

CaseWare Updates Now Available for 2017 Versions of Working Papers & ...

- Jamie Black

- What's New

- minute(s)Software: Working Papers & Working Papers with SmartSync Prior Version: 2017.00.225 New Version: 2017.00.245 Release Date: November 16, 2017. You may have received an email from CaseWare International announcing the release of, and inviting you to download, an update for CaseWare's 2017 Working Papers & Working Papers with smart-sync products. The update has been made available for CaseWare users in their MyCase portals. If however, you did not receive the email or cannot locate the download in your MyCase account contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes the following enhancements & fixes: Enhancements related to: Fixes related to: Imports Data Store Administration Tool Tax integration Interface Page numbering/printing Synchronization functionality Automatic Documents Document Management Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months identifying the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare has just released updates to it's 2017 Working Papers & SmartSync products. Make sure to update for the latest enhancements and fixes.

READ MORE

CaseWare Working Papers 2017 Released

- Jamie Black

- What's New

- minute(s)Software: Working Papers Prior Version: 2016.00.181 New Version: 2017 Release Date: Ongoing A new version of CaseWare Working Papers is currently being rolled out on a staged basis to users. Remember that once you open a Working Papers file in the 2017 version, it cannot be accessed using the older 2016 software. For this reason, all of your staff who collaborate on files in common should be upgraded at the same time. You may have received an email from CaseWare International announcing the release and inviting you to download the installation files. If, however, you do not have that email, contact the CaseWare Sales department at +1 (416) 867-9504 or sales@caseware.com to request your download. Details: This new version includes many enhancements & fixes: Enhancements related to: Fixes related to: Cloud Integration Cloud Integration SmartSync & SmartSync Sever SmartSync & SmartSync Sever Roles Interface Tracker Imports Performance & Stability Document Management PDF exports Automatic Documents Mapping & grouping Calculations Document Management Cells Automatic Documents Calculations Export Interface Cells Graphs Look for more blog posts and Feature Spotlight articles from FHB in the coming weeks and months talking about the enhancements and improvements in the latest version of the software. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

CaseWare Working Papers 2017 was just released with many fixes and enhancements.

READ MORE

Spreadsheets vs. Databases: How to weigh the Tech Benefits

- Jamie Black

- Tech for Execs

- minute(s)No doubt you have read many articles decrying the use of spreadsheets due to the myriad of disasters that have resulted from their use. We have a long history of ranting about their weaknesses when it comes to complex reporting tasks like generating a set of financial statements/Comprehensive Annual Financial Report. We have even written articles about how to avoid these mistakes, and about how to determine (calculate) if a spreadsheet is the right tool for a given task. What we have never done is present the technical reasons that spreadsheets are ill-suited for the job and why database-driven applications are far superior. That is what we will do in this article. Before we dive in, we should state a couple of items (before the hate mail comes pouring in): There are many spreadsheet applications & database-driven tools. Clearly, we cannot discuss each one and their differences in detail. Instead, we will speak generally about typical, common features found in products like Microsoft Excel/Google Sheets and Microsoft SQL Server. Spreadsheet applications have gotten increasingly sophisticated, have remained inexpensive and easy to use, which has naturally lead to their use for more complex tasks. If left to choose between using a spreadsheet or paper & pen, we would recommend the spreadsheet. Some of the problems people have with spreadsheets occur because they fail to follow best practices. Thus, some of the highly publicized disasters reflect a skill/experience problem, not a software problem. We are active proponents that just because you CAN use a tool for a task, does not mean that it is the BEST tool for the job. Similarities Spreadsheets provide a rapid, powerful, generic way to manipulate numbers in any form or fashion your heart desires. The intersection of columns and rows allows you to enter data or formulas to generate a wide range of results. A database-driven application extends the concept of a spreadsheet. A very rough comparison is that each “tab” in a spreadsheet workbook is equivalent to a database table, with each table consisting of rows and columns. A database is a collection of these tables and other metadata, just like a spreadsheet is a compilation of sheets. To be clear, we are using the term database here as it is the common expression. Differences Spreadsheet Database Driven Application Data (Transactions) User(s) performs data entry on the same spreadsheet that houses all the data. Two major approaches, both of which prevent the user from directly affecting previously recorded data: The user completes a Form & the system validates the data and if acceptable, adds it to the appropriate Table(s). The user imports large volumes of data. This data is validated to ensure acceptability, and it is added to appropriate Table(s). Calculation(s) User(s) adds calculations/formulas to Cells that reside with the raw data. Calculations are performed as needed, either on a Report or Form. Formatting Like calculations, formatting is usually applied by the user to a selection of Cells. Formatting is applied to the Report that pulls data from one or more Tables. Validation When used (infrequently in our experience) user(s) adds to a selection of Cells. Applied centrally to all actions involving data (importing, deleting, adding new records, etc.). Data Integrity No certainty that data added was added correctly & completely. Generally speaking, considerable technology is dedicated to ensuring integrity. For more details see this article on ACID. Scalability Has improved over time but is not designed to handle massive volumes of data. Depending on the particular database technology selected, capable of handling millions of records. Audit/Logging Some support with major gaps. Secure logging of essentially any & every item determined valuable is possible. Security Can be set at the Cell level but roles & groups are not supported. Extensive ability to assign roles & groups and specify permissions at any level. Spreadsheet weaknesses The argument for continuing to use spreadsheets is obvious - they are inexpensive and easy to use at a basic level. The problem with them is considerable however and can be seen in a common theme running through the comparison above. The major technological problem with the spreadsheet is the collapse of many elements into one sheet or even down into one cell. In a spreadsheet, the "data table" IS the report. Entering new "transactions" means being able to edit existing rows. This makes the large, complex spreadsheet very fragile. Make a mistake entering a formula and everything breaks. It is like a tower of Jenga blocks waiting to fall. Some of you may be typing a furious email to me right now saying "You can solve these issues in a spreadsheet. Just design it like a database and use all of its features, like macros." It is true, some of these issues can be handled IF you design your spreadsheet correctly and have extensive IT and programming skills; essentially, if you build an application inside your spreadsheet. Thus the argument for continuing use of spreadsheets for complex tasks is not compelling for 3 reasons: Untrained operators - It is great to say "develop the spreadsheet properly" but consider the typical spreadsheet developer. They are often accountants/finance professionals. Because anyone can use spreadsheets & they are so easy, people with no particular development training build incredibly complex documents. Consequently, these documents rarely conform to the best practices that an experienced developer would insist upon. In general, errors seem to occur in a few percent of all [spreadsheet] cells, ...In programming, we have learned to follow strict development disciplines to eliminate most errors. Surveys of spreadsheet developers indicate that spreadsheet creation, in contrast, is informal, and few organizations have comprehensive policies for spreadsheet development. Ray Panko - What We Know About Spreadsheet Errors Too little control - Spreadsheet tools are just not designed to enforce or in some cases even support best practices. One example of this is that many elements are combined/mixed together within each spreadsheet, sometimes even within one cell. Recall, spreadsheets are a generic tool designed to fit as many use-cases as possible. Thus, the user must: Know they need a given feature (like validation), Have the skills (which might include programming) to build it, Spend the time to build it, Technical Inability - Even if you have tremendous IT skills some actions are very difficult bordering on impossible within a spreadsheet: Managing large data sets - if you need to deal with millions of records, spreadsheets can not help you. Logging - It can be very difficult to determine which user added row 7 in our example. Or if you are dealing with thousands of rows, which rows were added and when? Documentation - if the person who created the spreadsheet leaves the organization, who else in the organization will know how to use what is essentially a custom application? There is no easy way to direct subsequent users where to start etc. other than some notes that you hope are updated and then followed by subsequent users. Database weaknesses All the power, validation and speed of a database driven solution comes at a cost. Depending on the exact database selected, the costs can be significantly higher than a spreadsheet and specialized hardware may be required. Further installing, configuring and maintaining a database takes specialized knowledge. Finally, one of the benefits of the database-driven application is one of the challenges- it constrains the user. In contrast to the Jenga metaphor of the spreadsheet, the database application can be thought of like a Rubiks Cube. The user can only do certain things in certain ways. Unlike the spreadsheet, there are rules about how the system can be used. The Bottom Line We have previously developed a detailed calculation to determine exactly when to use a spreadsheet but if you want to keep it simple, here is the cheat sheet for choosing between the two tools: Choose a spreadsheet (and follow best practices in how you build and use it) if the task is: simple, only used by one or two people, using a small set of data which will only be used once. Invest in a database driven application if the task is: complex, used by multiple people, standardized, may house a moderate to large data set and reoccurs. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

When & why should you upgrade from a spreadsheet to a database-driven application? The technological differences are significant & shouldn't be overlooked.

READ MORE

Is your finance department prepared for these 5 colossal changes?

- Jamie Black

- Finance Evolved

- minute(s)Perhaps the biggest failure of corporate governance today is its emphasis on short-term performance. Corporate Governance 2.0 - Harvard Business Review You may not realize it yet, but your organization is in the early stages of being hit by massive, interconnected and occasionally opposing global changes. These changes are likely not going to reach full strength for 10 or 20 years. None the less, it will take time, planning, and some hard work to get prepared. If these changes turn out to be as big as predicted, being ready may mean the difference between an organization that prospers and one that perishes. In our blog series "Finance Evolved", we consider major trends & forces and how they may affect the finance department to aid in your planning & preparation. Here are the big 5 looming trends: 1) Demographics The population of North America is aging in a way not seen before. This will cause havoc for businesses, governments and the economy generally. 2) Skills Recent surveys reveal gaps between the finance skills required by organizations and those possessed by entry-level management accounting and finance professionals. As the pace of change increases, the successful individual finance professional and the successful finance department will need perpetual skills development. 3) Productivity Despite technological improvements, the pace of growth in productivity has been slowing globally since the 90s. This has already impacted wages and may contribute to income/wealth inequalities and job insecurity in the future. 4) Budgets We see increasing levels of pressure for finance to accomplish more, faster with stagnant or decreasing budgets. Given the other big forces in this list, there is every reason to believe that this pressure will intensify. 5) Technology To say we are living in a time of rapid, continuous technological change is a cliche. There are signs that while the current rate of technological improvement may be slowing, the effects may well be poised to more dramatically affect the finance department than ever before. Be ready for the future Train & mentor staff - The difficulty you have today finding qualified, appropriately skilled staff is going to become much worse. Your best bet is to retain and develop your current team. Document & standardize - Expect the loss of a significant percentage of your most experienced, knowledgeable workforce in the next 2 decades. Without excellent organizational supports, this will come with a consequent decline in organizational productivity. Plan ahead - Governments at all levels will see reduced revenue growth and increased expenses, further straining budgets. You can expect reduced governmental services and/or increased taxation. Streamline & automate - Organizations of all types will be under growing pressure to increase productivity. Software and automated systems are your best tool to do more with less. Upgrade your skills - The requirement for greater productivity will mean that your value will be increasingly tied to your ability to lead, to streamline, to automate and to improve. Conversely, if your skills are primarily data entry/bookkeeping, you are likely to be automated into the unemployment line. Do you have the skills to leverage technology to help you address the dramatic staffing, efficiency, and budget challenges we will see in the next 10 to 20 years? Watch for future articles in our Finance Evolved series which will dive deeper into these topics and explore additional strategies designed to aid the transition to world-class finance organization. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

To function effectively & efficiently in the coming decades, your finance department must plan for these 5 major changes right now.

READ MORE

How to prepare a better solution requirement list for IT project ...

- Jamie Black

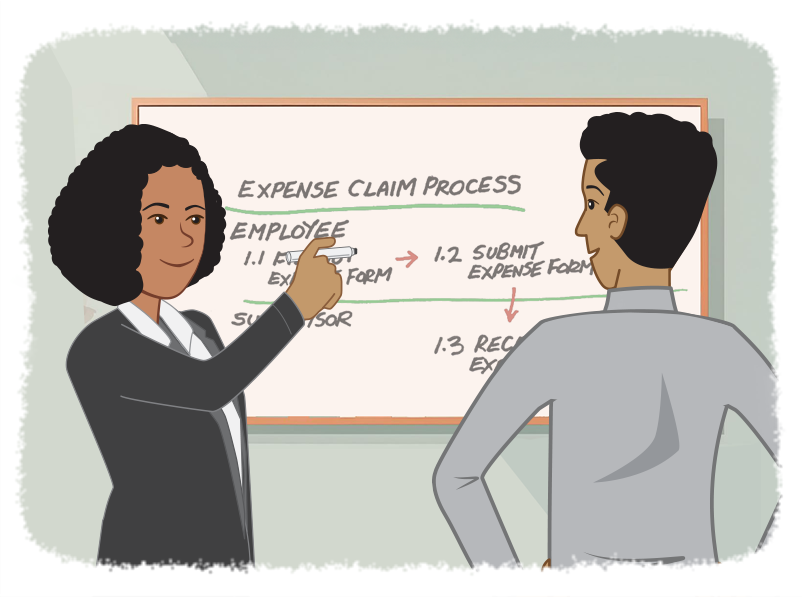

- Efficient, Effective and Reliable

- minute(s)Many of our articles address factors related to IT project success and the significant rate at which these projects fail. There are many causes for failure; first among them is choosing a solution that does not meet the needs of your organization. Typically, selecting an IT solution begins with the Request For Proposal (RFP) process. The process seems logical—state your needs and ask vendors to supply a price to meet those needs. If you're buying a commodity with little differentiation among options, developing a list of requirements is important. But if you're buying an intangible like an IT solution, with unlimited variables and options, that list becomes absolutely critical. Unfortunately, it is very common to see software requirement lists for Annual Comprehensive Financial Report automation or Continuous Controls Monitoring (CCM) systems with requirements: That are very broad Derived exclusively from a vendor's list of features Copied from another, theoretically similar organization's RFP To see the error in this approach, imagine buying an expensive suit. After noticing it hanging in the store and being impressed with what you see, the next step is always to try it on. Why? It is the only way to guarantee it fits you. Even though the tag says it's your size, that is no guarantee of fit, is it? Take that suit home without trying it on and it might fit exactly (unlikely); it might need some alterations, or it might be completely wrong for your body. Why do so many organizations have such ill-defined requirements? The most common reasons include: The team disagrees that implementing a new IT system is like buying a suit; they see it as more like the purchase of socks—one size fits all. The team did not have time to formally document their needs, but felt that a good compromise was to use someone else's. The team did not have a clear idea of how to document their needs, so they chose to leverage those published by vendors or peers. How to document your needs If you fall into the third category above, you can improve the probability of your IT solution's success by applying these seven steps: Document your current business processes. Start by writing down each step. Visit the people who perform each step and ask them what they do, in what order, and why. Be prepared for some surprises. There will be steps you did not know about and shortcuts you never imagined. The benefits of this documentation process can go beyond selecting the right new system. For example, it can be the critical first step to updating your internal controls risk assessments or training materials. Prepare process diagrams. There are many ways to create this material, but we firmly recommend modeling your business process graphically. Business process diagrams (or models) are excellent at displaying process gaps or errors in understanding in a way that descriptions like those gathered in Step 1 will not. We recommend swimlane diagrams like this: Many applications can be used to create these diagrams. The most commonly used is Microsoft Visio but we also like Lucid Chart and Creately. Gather copies of any inputs (forms, authorizations, etc.) or outputs (reports) of your business processes as attachments to your documentation. Be sure to label the diagram to show where in the process they apply. Consider what could/should be improved: What is difficult today? Which steps in the current process take a long time? What would the value to the organization be if you could eliminate or shorten this time? Are all steps necessary? Could we remove any steps and still achieve our desired results? Often these opportunities will jump out at you in the diagram. They may appear as many steps that loop back on top of themselves, for example. Create new diagrams of the optimal future process, incorporating the items identified in Step 4. This improved process is a better representation of what you want your new system to support. Transform the new business process steps into a requirements list. For example, if a step in your diagram is, "Batch email statement," the requirement might be, "Ability to email statements to all accounts that have an outstanding balance without any manual intervention." Finally, now is the time to consider vendor feature lists or the needs documented in other, similar organizations to see if there are any items you may have overlooked. By applying these seven steps, you can tailor your software requirements list to your organization, and more likely find the solution that provides the greatest value. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Follow these 7 steps when preparing a technology requirement list to ensure your next solution meets your needs.

READ MORE

Improve your Internal Controls to Lower Audit Fees

- Jamie Black

- In Control

- minute(s)If you're a typical finance department, discussions about Internal Controls are probably not part of your daily work day. In our experience, accounting teams start thinking and discussing Internal Control when they have: found an alarming incidence of error in their business processes are subjected to a performance audit (if they are a local government) heard of another organization falling victim to fraud Outside of these scenarios, the strength of internal controls systems doesn't often get a lot of finance's attention while they take care of payroll, budgeting, management reporting, financial reporting and so much more. There is a large, but often overlooked reason to focus on your internal controls system, an opportunity to reduce audit fees. Audit Fees Increase with Poor Internal Controls Poor internal controls and/or poor documentation of existing controls directly lead to increased audit fees. Why? Auditors must increase the amount of testing performed (sample size) when they determine that internal controls can not be relied upon (International Standard on Auditing - 530 Audit Sampling) to reduce audit risk to an acceptable level (International Standard on Auditing - 330 Auditor Responses to Assessed Risk). Specifically: "Deficiencies in the control environment, however, have the opposite effect; for example, the auditor may respond to an ineffective control environment by: • Conducting more audit procedures as of the period end rather than at an interim date. • Obtaining more extensive audit evidence from substantive procedures. • Increasing the number of locations to be included in the audit scope. The evidence of this direct relationship between audit fees and internal controls abounds. In December 2016, the Financial Executives Research Foundation (FERF) survey of more than 6,000 organizations found that reviews of internal controls continue to be one of the three major driving factors behind rising audit fees: More than 20% of the respondents that had audit fee increases cited a “review of manual controls from [Public Company Accounting Oversight Board] inspections.” Companies that cited ineffective internal controls as adding to audit fees experienced a 5.1% median increase, almost two percentage points higher than the median increase for all other filers. 3 Recommendations to Reduce Audit Fees In their follow up article "Mitigating Increases in Audit Fees" the FERF interviewed preparers and auditors to understand causes and develop recommendations. Several recommendations focused specifically on Internal Controls improvements that drive lower audit fees including: Align key controls with key risks: Ensuring the organization has strong controls to address the most significant risks will give management and auditors increased confidence. Document internal controls: If an organization has very light or poorly organized documentation, or hasn’t thought through all the branches in a process, attestation becomes difficult for the auditor — and more costly for you. Evaluate the latest technology: External and internal auditors are both using data analytics and continuous controls monitoring technology to increase audit quality, work smarter and potentially reduce costs. There are many great reasons to focus on improving your organizations' internal controls. Lower Audit fees is another good one. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Finance professionals know the importance of strong internal controls for managing but overlook the opportunity to reduce audit fees.

READ MORE

7 Steps to Avoiding the Cheap IT Solution Selection Trap

- Jamie Black

- Efficient, Effective and Reliable

- minute(s)According to information technology research firm Gartner, 50–75 percent of IT projects fail. We've written a number of articles offering guidance for achieving better outcomes through the solution selection and implementation processes, but there is one trap we haven't addressed—and we see clients succumb to it all the time. Price Clouds Everything Consider the Canadian government's recent Phoenix payroll software debacle. They elected to have a payroll system custom developed by IBM, and have had nothing but problems with it. According to one assessment: "... the Harper government put so much emphasis on saving money that it undermined efforts to ensure that the system would function well...instead of saving the government 70 million Canadian dollars this year, as promised, Phoenix has cost the government an extra $50 million (about USD $37 million), including $6 million in additional fees paid to IBM to fix it." When participating in an IT system evaluation, if you find your team leaning toward the low-cost choice instead of the high-value solution, beware. No one wants to pay more for something than they need to. In government in particular, you may even have the obligation to choose the low-cost solution. This default preference/requirement is understood by IT solutions sales representatives and is often relied upon to accelerate the sales cycle and "close the deal." Even if you're not being exploited by sales teams, the Phoenix case shows how this low-cost bias can lead to dysfunction. Here are two questions to ask yourself to avoid a bad deal when considering the "cheap" IT solution: 1) Is it truly cheaper? In one respect, it is obvious; if the number at the bottom of the RFP response or quote is lower, then it's the less expensive option. While technically true, that is only a valuable assessment if you are comparing apples to apples. Before you look at the price, you need to know whether you'd be getting the same thing for the money. With an intangible product like software, it can be difficult to ensure you're making an apples-to-apples comparison. If you bought the Chevette above based solely on the price, you could be stuck with the wrong car if acceleration and top speed are necessary features. Alternatively, you might decide you do not need a Corvette, that a Chevette will do. The point is, they have different features and capabilities, and comparing the two options based solely on price obscures those differences. RECOMMENDATION: Before assessing products, explicitly and formally define your needs/requirements and evaluate your choices based on fit first. Don't allow the price to hijack the process. Use ROI instead of price to select among solutions that fit some/all of your requirements. 2) Why is it cheaper? There's no such thing as a free lunch. - Milton Friedman You've assessed the options based on fit. Then you calculated ROI. The cheaper solution comes out on top. What now? RECOMMENDATION: Treat the low-cost solution with extreme suspicion. This is your warning sign to bolster your due diligence. We recently watched one "low-cost" vendor in the reporting automation industry cease operations and advise their existing clients that they are on their own. For some of these folks, this happened while they were implementing the software. The Action Plan: 7 Steps to Better Due Diligence Double-check fit-assessment. If you have any doubt, have the low-cost vendors re-demo the product to confirm it meets your needs. Double-check standard pricing variables: Modules/features Number of users Number of people being trained Duration and extent of support period These are all variables that might account for significantly reduced cost. Remember, you want to compare apples to apples. Also, recall that skimping here may cause cost overruns later when you determine you did need more training or support. Assess the vendor track record. How many clients do they have? How many times have they solved the problem(s) you have? Ask about failed implementations and what caused them to fail. Be suspicious of anyone who says they don't have any. Closely assess their implementation team. Does the vendor have in-depth knowledge of not only the tool but your business process? Have they been "on your side of the table"? Have they been an HR manager or comptroller or auditor or finance officer and done the tasks that their tool addresses? Contact numerous clients that are currently using their product. Spot check the specific features you are counting on using to see if the reference is using them. We have seen vendors provide references that did not even use the product being evaluated! If the vendor can not provide an extensive list of clients who use the product, or they do not have extensive experience solving your exact issue, determine whether your organization is prepared to be a guinea pig. We have seen numerous organizations stuck in limbo for years while their vendor tries to build what was promised. Go back to the expensive vendor(s) and ask why they are so expensive. Do they charge a premium because of their brand? Did they consider something the others didn't? Was there an error in one of the pricing variables (point 2 above)? Assess the low-cost vendor's stability. One way to do this is to consider their financial health, if possible. If the company is publicly traded, have they ever shown a profit? Do their financial statements look like those of a stable, successful company? If the vendor provides their software as a service (SaaS), there may be other considerations for evaluating performance. You can find some interesting articles on SaaS performance here and here. If the company is not publicly traded, it can be hard to perform this analysis, and you may need to rely more heavily on steps 1–6 above. It's a good idea to follow these steps even when there is no major pricing disparity. They become absolutely essential when you're presented with what seems like a sweetheart deal, and you want to avoid the cheap solution trap. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

During selection of a new IT system beware of defaulting to the low-cost solution. 7 easy steps steer you away from project failure.

READ MORE