[Workiva + Adra]: An Integration Powered by FHB

- Jamie Black

- Workiva

- minute(s)Adra is a leading software for the automation of the financial close process, while Workiva offers a cloud-based, collaborative platform connecting reports and data. Both solutions are known to save users time and money while improving accuracy and repeatability. And together, they equal more than the sum of their parts. FHB recognized that the combination of Workiva and Adra would offer a uniquely transparent, accurate, and controlled solution for financial close and statutory and regulatory reporting, while streamlining workflow across the entire record-to-report (R2R) process. So, we developed an integration tool to bring you the best of both worlds. Introducing: [Workiva + Adra] At FHB, we have one focus—streamlining and automating processes to lighten the workload of public sector finance and budget teams across North America. To that end, we partner with industry-leading software companies, providing custom implementation of the best available solutions to meet our clients’ needs. Workiva and the Adra Suite of Solutions by Trintech are two such valued partners. Learn more about [Workiva + Adra]. To find out how [Workiva + Adra] can work for you, schedule a call with our expert team. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Reap the combined benefits of Workiva and Adra with FHB's integration tool.

READ MORE

Discovery as a Foundation for Success

- Jamie Black

- Best Practices

- minute(s)Why Is Discovery Such a Crucial Step? Discovery sessions are key to ensuring that a project will result in the desired outcome for our clients, our partners, and ourselves. They provide a forum for all stakeholders to build a common understanding of the challenges of the current processes and tools; the needs that must be addressed by the solution; project objectives; and potential hurdles and pitfalls. A productive discovery session resolves misunderstandings and sets the tone for open, clear, and consistent communication. It is a critical first step to ensuring team buy-in and is essential to maximizing the benefit you receive from the project. Learn more about managing change. How Can We Ensure a Fruitful and Effective Discovery Session? Have the right people in the room. First and foremost, you must include those in the trenches who perform the process. The more people with this perspective you can include, the better. Only they can offer an intimate look at process details; practical feedback regarding shortcomings, nuances, and time involved in the current approach; and a thoughtful wish list of essential features in a new solution. They will ask the right questions, and their answers will provide invaluable insight. Next, be sure to include senior management and the business process owner(s). These are the people who understand the big picture—e.g., political implications, budget and time constraints, your organization’s vision, and overall goals. They can speak to how process challenges impact the execution of your organization’s strategy. Be completely candid. It’s important to make the discovery session a safe place to voice concerns and provide honest feedback, even if the conversation becomes uncomfortable. Are you short-staffed? Is your team relatively inexperienced? Are they lacking technological savvy? The more we understand your true challenges, the better we can design an implementation plan to tackle them. If We Don’t Include the Right People, What Could Go Wrong? In a word, everything. Without the right people in the room, you risk wasting countless hours, and losing hundreds of thousands of dollars. Failing to reveal key considerations up front can lead to process gaps you may not have the budget to fix. You might end up having to change or shrink the scope of your project. You might have installed the wrong software and be forced to start over. Worst case scenario, your implementation could result in complete failure. After all, a whopping 70% of IT projects fail. Change management research has revealed that making a decision about a significant change without input from your whole team will likely engender frustration and resentment, creating project adversaries instead of advocates. If We Prioritize Discovery, What Could Go Right? When all stakeholders have a voice in discovery and project goals are on target, everyone wins. As the US Navy Seals say, “Slow is smooth, smooth is fast.” When you focus on conducting each step of the implementation—starting with discovery—correctly and completely, you will see your desired results more quickly. In the words of our President, Jamie Black, “Take your time. Do it once, do it right.” "I have been involved with this kind of software implementation system upgrade for many, many years...when I started to go through the procurement process, I could never imagine it would have gone so smoothly, with this level of success." -Dongmei Li, Assistant Controller–Corporate Accounting at Chicago Public Schools © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn why discovery sessions are so important, who should attend, and what should be discussed.

READ MORE

Change Management: An Introduction

- Jamie Black

- Best Practices

- minute(s)Key Considerations for Managing Change The way our clients react to change and their level of change acceptance can influence their success as much as their budget, choice of software, or technical aptitude. How do we know? We’ve been helping public sector finance and budget departments across North America improve and automate their most time-consuming and tedious business processes for nearly 30 years. So, we thought it might be helpful to share highlights from research behind the importance and key features of change management. What Is Change? Change is both the process through which something is made different (a verb) and the result of that process (a noun). The adaptation, growth, and very survival of human beings has long depended on our ability to manage change. Consider the crucial advent of fire-building or weapon-making, or the more contemporary prerequisite of technological savvy for success in the modern workplace. Organizational Change Change management within an organization involves the activities, functions, and tools it uses to deal with something new. As an example, institutions of all kinds use the tools of training and development to ensure their employees’ sustained competence and efficacy amid the ever-changing dynamics of the workplace. Global research and advisory company Gartner reports that today’s average organization has undergone five significant organizational changes in the past three years—and almost 75% of those expect to expand major change initiatives over the next three years. Change initiatives range in scope and complexity from process improvements to mergers and acquisitions. Timeframes for organizational change can range from slow and gradual, like rethinking each individual step in a process over time, to quick and total, like suddenly adopting an entirely new system or approach. As with individuals, an organization’s ability to survive, stay relevant, compete, grow, and last, depends on its ability to manage change—both internally and externally. WANT TO LEARN MORE? In his 1996 book, “Leading Change,” John Kotter was among the first to apply the academic theory of change management to the world of business. His eight-step change management process remains relevant to this day. Other notable change management models include Lewin’s Change Management Model, and Prosci’s ADKARⓇ Model Change Is Difficult Despite the inevitability of change, people (by nature) prefer stability over anything new or unfamiliar. Known as cognitive bias, this tendency is thought to be an unconscious process, whereby people cling to a belief system despite being presented with a better solution. DID YOU KNOW? One 2019 study found that monkeys (capuchin and rhesus macaques) were “significantly more likely to adopt new and more efficient shortcuts to attaining their goals than humans.” The McKinsey consulting group reports that 70% of all change initiatives fail. The reasons for failure include: Misalignment of values reflected in the change itself and values of the people experiencing the change Failure to manage employees’ attitudes toward change Lack of awareness of change’s potential benefits Change is seen as unfair or punishment Staff members may fear: A shift in duties Losing their job to automation Revealing weakness/incompetence in technology or role Loss of control Ripple effects More work An unrealistic timeline or insufficient employee participation in training can further hinder the success of a change initiative. Unsuccessfully managing a workforce through change can be costly; dissatisfied employees are known to be less productive and are more likely to leave an organization. The development of negative attitudes and adverse reactions toward change is known as resistance to change. Research suggests that employees’ readiness for change strongly influences their resistance, by transforming their attitudes. In other words, change is more successful when employees are prepared for it, not surprised by it. DID YOU KNOW? The Society for Human Resource Management (SHRM) has identified six states of change readiness: indifference, rejection, doubt, neutrality, experimentation, and commitment. Change in the Public Sector Is Especially Difficult Government entities are typically slower to accept and adopt changes—like the introduction of new technology or business processes—than organizations in the private sector. Reasons include: Less funding Higher public scrutiny Lack of internal informational technology (IT) staff or capacity Siloed duties and departments Complicated contract processes For some public sector organizations, slow adoption of technology and process change has led to more expensive and burdensome service provision. When they embrace change, they: Help eliminate time-consuming, frustrating, and “glitchy” processes Can focus on the actual work of providing services Make their staff more accessible to the public Get help more efficiently to those who need it The benefits of change in the public sector are clear. The challenge is that government employees may be among the least comfortable or familiar with change. Consequently, greater change management support is likely necessary in those settings. To Be Successful, You Must Manage Change The Importance of Leadership Both a systematic approach (strategy) and effective leadership are critical to the success of any organizational change endeavor. A change management strategy provides leaders with steps to successfully guide an organization through change, while limiting disruption and unexpected consequences. The goal may be to change a process or approach, but the key to success is the ability to effectively lead people through the change. Keep It Human The fundamental common denominator among successful change initiatives is people. To effectively implement change, leaders must take its impact on people into account. The following steps can help garner stakeholder trust and promote acceptance (and even appreciation) of a proposed change: Clarify the desired end result in advance. Highlight pain points and the need for change. Make the change as specific as possible. Be transparent about its benefits and challenges. Listen to and address employees’ reactions. Establish their commitment to the initiative. Remember the study that found monkeys adapted to change more readily than humans? Turns out, when the benefits of using a new approach were made clear, “humans were more likely to get on board.” Why It Matters The importance and impact of effective change management cannot be overstated. Financial, cultural, institutional, and other factors make organizational change in the public sector particularly challenging. The right approach is vital to the success of any change initiative. Securing employee buy-in not only makes change easier, it establishes a relationship of trust, reducing resistance overall and minimizing the need to campaign for future reengagement and support. With the right combination of communication, preparation, planning, and support, a well-managed change can dramatically elevate both the quality of employees’ day-to-day experience and the focus of their work. Let Us Help Decades in the business of change have informed FHB’s successful approach to streamlining and automating even the most deeply ingrained and archaic business processes in the public sector. Schedule a meeting with us today to explore how we can help manage your organization’s need for change. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Learn about organizational change, why it's particularly hard in the public sector, why it's important to manage it, and how to do so effectively.

READ MORE

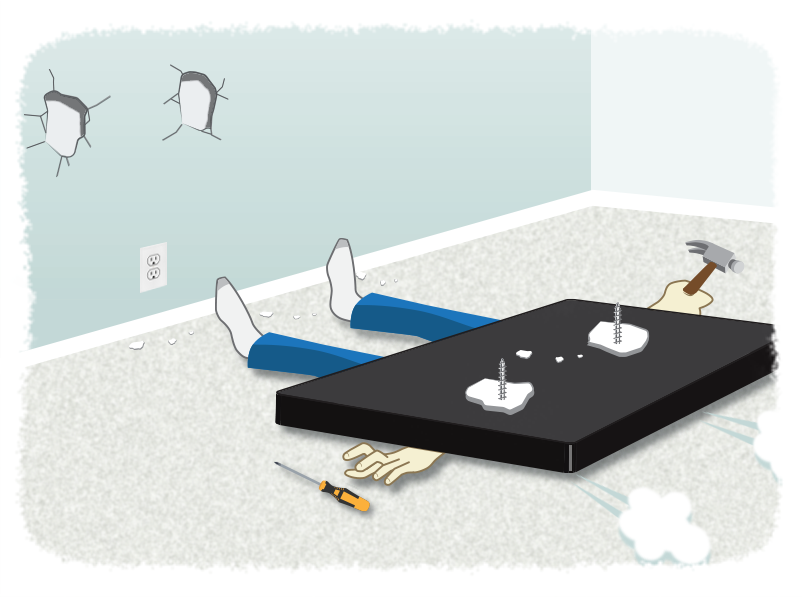

Why focusing on simple can lead to catastrophe

- Jamie Black

- Best Practices

- minute(s)For finance and budget professionals, optimizing how we complete our work can save time, mitigate the risk of error and make processes easier to delegate & manage. When improving a process requires new software tools, we recognize a common bias towards "simple" tools. It often begins with our client making a comment like: My existing solution is highly manual, time intensive, and has a high risk of error but it is easy/simple/straightforward. This new solution will likely save time and reduce the risk of error, but it seems too complicated. Initially, this may seem like a wise approach and an easy assessment. However, addressing it fully requires foundational concepts to be thoroughly flushed out. For example, what precisely do you mean when you say simple, easy, and complicated? An illustrative example Let's imagine we want to mount a new 60" TV on the living room wall. Let's also assume that we are not home renovation or carpentry experts. We arrange the supplied equipment from the mounting kit we bought on the table and review the instructions. Scenario 1: We have a very limited toolbox to use in the task. We have a hammer, some screwdrivers, and a tape measure. Scenario 2: We decide to invest in more tools. We get a laser level, a stud finder, cordless drill, drill & screwdriver bits, and screw anchors, as well as the hammer, screwdrivers, and tape measure we already had. Scenario 1 seems simpler. There are only three tools, and you already own them. They are basic tools you often use for minor tasks around the house so no learning is necessary. Scenario 2 is more complicated. It requires you to have: the additional tools, charged batteries for the laser level and drill (if not charged, we need to wait for them to charge), some understanding of home construction: Inside the walls are studs that are typically spaced every 16" and that, if you screw into them, they support mounting much heavier objects. If you do not mount it into a stud, you will also need to know that you need to use screw anchors, but even then, it may not hold the TV. Also, inside the walls are electrical wires and pipes that you must avoid. knowledge of how to use the laser level, stud finder and screw anchors. A more careful review reveals that you need to understand home construction in both scenarios. But if all you have is the simple tool kit, you might (unless you supplemented these tools with an expert's knowledge and experience) overlook the required home construction knowledge. In other words, the simple scenario is simplistic and omits some crucial considerations that may lead to long-term rework. In the mounting TV scenario, rework means: buying a new TV when the mount rips out of the wall and crashes to the floor, repairing drywall and repainting, repairing the floor where the falling TV damaged it. If you don't have time to do it right, when will you have the time to do it over? John Wooden Thus Scenario 2, while more complex and more expensive (in tools and time to learn them), dramatically increases the probability of properly meeting the goal both in the short and long term. In other words, these additional tools allows the non-expert home renovator to achieve results that a master might be able to achieve with the limited tools of Scenario 1. Clients often question the value of the greater expense of Scenario 2. Depending on the precise tools we are considering, once the investment in tools and the knowledge to use them has been made, you will likely use them on other projects (hanging pictures, mirrors etc.). Scenario 1 means these other projects are at equal risk of disaster as when we hung the TV. Our recommended approach: Considering the above, having this simple vs. complex conversation with clients, we suggest and assist with the following steps: Determine the necessary tools and knowledge to properly solve a particular problem. Assess current tools & knowledge to determine the investment necessary to achieve a solution you will be happy with both today and in the future. Consider the preferences & aptitude of the team that will complete the project. Some folks like learning new tools and see it as an opportunity to continue developing their skills. Others see "being forced" to learn new tools and approaches as an absolute negative. Evaluate the Return on Investment of various options, with specific consideration to long term re-use of the tools and knowledge in other areas. We also explicitly highlight the often-hidden future cost of the simplistic versus the upfront cost of the sophisticated. Ensure expectations are accurate about the path they choose. Some closing thoughts: We recommend avoiding unnecessary complexity. For example, in our scenario above, consulting an engineer, electrician & plumber, or welding a metal rack that bolts to the floor and ceiling would increase the cost for minimal benefit. The art is in differentiating between necessary and unnecessary. Simple is a magic term for sales & marketing departments. It is often used to accelerate and increase sales. If you were selling TV mounts, you might be tempted to minimize the "tools required" section of your manual so you do not scare away some potential customers. After all, when that TV falls on the customer's floor, you are not doing the repairs. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

When does focusing on simple software solutions result in catastrophe? When simple becomes the objective. Instead, finance and budget professionals should focus on what they want to achieve while avoiding unnecessary complexity. Learn how to evaluate what is and is not necessary for real success.

READ MORE

City of Greensboro Budget Book Automation Project

- Jamie Black

- Success Stories

- minute(s)With a population of nearly 300,000 and growing, the City of Greensboro is the third-most populous in North Carolina. The City's 2020-21 adopted budget of $602 million spans 169 pages and was awarded the GFOA Distinguished Budget Presentation Award. Long-time Questica Budget users, the City is extremely happy with their processes for preparing the budget. The Budget Book however was another story. Like many finance departments, the City used Microsoft Excel, Word, and Publisher to prepare the book. The process was time-consuming, repetitive, resource-heavy, and disjointed; it was time to make a change. The team at Greensboro had heard about F.H. Black & Company Incorporated at a Questica conference and reached out for help to improve their budget book. Once the project was complete, we gave the City a little time to bask in their achievement before interviewing them about their journey. Here are the highlights of that interview with the City's Budget Database Specialist, Leah Price. The Old Way "We used a combination of Microsoft Excel, Word, and Publisher, and it was very time consuming for all staff members. The Budget Analysts had to manually enter all of their departments’ numbers line by line twice: once for the Manager Recommended version and again for the Final Adopted version. The Budget Database Specialist also had to make sure all of the formatting was correct in Publisher, and finally work with our internal print shop to make sure every page had the perfect amount of space between the text and the hole punches. When we heard there was a software that we could use to import the numbers from Questica directly into the budget document, we jumped on it." The Project "We sent our FHB consultants a copy of our former budget document and a copy of our budget data from Questica. The consultants built a template for us that was similar to the old format, and then worked closely with our staff to make sure that the budget data was going to the right places in the document. We have over 25 operating funds and many tricky aspects to our budget rules overall, so assigning the budget numbers and FTEs where they needed to go was the biggest struggle. However, it all came together in the end." The Benefits "The process is more streamlined and controlled. It probably saves the analysts a couple of weeks’ worth of time because they no longer have to do any manual data entry." "The budget analysts are an important resource to our departments, and their new found availability during the budget development process allows them to help out more with current year concerns." The Relationship "Our (FHB) consultants have always helped us meet our deadlines and make sure to work us into their schedule if we have last minute issues." "I have mainly worked with Joy, and I am so grateful to her for all of her help and expertise! I really appreciated that she wanted to make sure that I was learning how to do (almost) everything we needed her help with. It was my first year being responsible for the budget book and I had very little knowledge of CaseWare. I truly could not have done it without her." Considering a reporting automation project? Schedule a meeting with one of our experts to explore your options. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Greensboro implemented an automated budget book solution that pulled data directly from their Questica Budget software resulting in a better book in less time.

READ MORE

Engaging residents to address the impact of COVID-19 on the Budget

- Jamie Black

- Budget Book

- minute(s)Public sector organizations across North America are facing considerable budget pressures as a result of the COVID-19 pandemic. This may necessitate slashing funding to programs and/or increasing tax rates. That is likely to be very unpopular with your stakeholders (council, board, and/or residents). Working through these options will require careful planning, making trade-offs, and effectively communicating new realities to stakeholders to get their buy-in and earn/maintain their trust. If you've read our Style & Substance blog articles before or attended our webinar series on best practices for communicating financial information, you know we have strong opinions on effective communication. In a time of massive budget challenges, your team's ability to communicate your message clearly and effectively is more important than ever. Over and above what we have laid out in our articles and presentations, what can your finance or budget department do to help stakeholders understand the complex issues you are facing? Too Much or Too Little Detail Stakeholder engagement is nothing new. Publication of large budget documents, public meetings to discuss these documents, focus groups, and advisory committees have been utilized for decades to engage with residents to educate them and receive their feedback. These approaches are often challenged by the complexity of the topic and the time investment required to execute them. Who wants to read even a 200+ page budget book? If they do read it, the result may not be what you expect: An implication for government transparency is that transparency initiatives that expect citizens to make sense of technical and abstract information, especially in large amounts, (such as the many line items and millions of dollars described in a typical public budget) probably face a much greater hurdle to increasing trust than their well-meaning originators thought. In fact, at worst, too much information could actually decrease trust. Transparency: A Means to Improving Citizen Trust in Government - Government Finance Officers Association As an alternative, local governments can utilize surveys or online budget tools to broaden the public meeting's reach. A classic example of this approach is the "digital budget book." These tend to be more approachable and, therefore, attractive to a typical stakeholder. This comes at the cost of the depth of detail and nuance necessary to truly educate the audience about the organization's constraints. Further, the act of merely putting a budget book online does not tackle the underlying barrier presented by large volumes of complex technical information noted by the GFOA. What you need then is: the ability to reach as many stakeholders as possible, in a way that encourages their participation, focuses on educating them on the context, constraints, and challenges we face and solicits their feedback. Engage Stakeholders with Budget Simulations This is where simulations come in. As technology has evolved, simulations have proven themselves to be the best of both worlds: broad reach and accessibility to maximize participation combined with the right amount of detail and nuance. Participants are invited to investigate the budget initially at a highly summarized level. This has the advantage of minimizing initial complexity and enabling understanding of the budget's overall state (e.g., surplus, deficit). They can drill down into more and more detail to understand the composition of the budget. Finally and most importantly, stakeholders are asked to increase or decrease budgeted amounts by department, service area, or program based on their own priorities and preferences. You can present them with a series of options to choose between that will impact the budget. Participants attempt to craft the budget they would like to see but will regularly bump into problems. Want to triple the budget on policing? Sure! But that puts us into a major deficit. How will you fund this increase? Participants can add comments explaining their rationale. All this data is collected for the hosting finance/budget department to analyze and leverage in refining the budget. Not having learned it is not as good as having learned it; having learned it is not as good as having seen it carried out; having seen it is not as good as understanding it; understanding it is not as good as doing it. ..He who carries it out, knows it thoroughly. The Works of Hsüntze Bringing your stakeholders into the budget process with simulations will allow them to understand the challenges you are facing and provide the feedback necessary to ensure you are optimally meeting their expectations. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

COVID-19 has hit some public sector budgets hard! See why some organizations are choosing to educate and engage residents with budget simulations for stakeholder buy-in.

READ MORE

Career Opportunity: Principal Consultant

- Jamie Black

- Job Opening

- minute(s)We need another world-class professional to join our team We are looking for a motivated, creative, highly technically-skilled individual with excellent time-management skills capable of working in a principal consultant role with minimal supervision who is excited about a challenge and wants to work remotely. About Us: For over 25 years, our firm has implemented, integrated, and optimized industry-leading tools and best practices to improve our clients' finance function. Our mission is to enable finance to do more with less, do it better than it was done before, and do it faster. Our clients are governments, universities, corporations, and public practice accounting firms across Canada and the United States. About You: Do you: Thrive on challenges? Dislike "the same-old-same-old"? Like to work outside your comfort zone, doing interesting and difficult things? Often find yourself saying, "There has to be a better way of doing this"? Need to be continuously learning and evolving? Achieve great satisfaction in helping others and providing creative solutions to challenging problems? Want to be led, not micro-managed? Value flexibility? Flexibility to live anywhere in the world and the freedom to relocate whenever it suits you? Loath commuting and being stuck in traffic, wasting your time? If you answered yes to all the above, you are a great fit for our firm's culture and should read on. Still here? Now, how about your technical attributes? You possess: A CPA designation, 3 to 5 years of experience working in public sector or corporate finance, A proven ability to learn and master technology, A minimum of 3 years of work experience with one or more of the following: CaseWare Working Papers, Financials & Connector Workiva Wdesk & Wdata IGM Gravity Project management experience, The capacity to solve complex challenges, within a defined framework and timeline, Outstanding verbal, written and presentation skills. You are a regular, clear, concise and professional communicator, The ability to effectively use the entire MS Office Suite including Outlook, Excel, Word & PowerPoint, A knack for building solid relationships; people want to work with you, Impeccable attention to detail and high standards for quality and creativity, Solid time management skills, we don’t believe in micro-managing our people, Sensitivity to confidential matters. The perfect candidate will also possess: Significant experience with one or more of the following: CaseWare Idea, Blackline's Continuous Accounting platform, Balancing Act budget simulations platform, Questica Budget, Accreditation as a Project Management Professional (PMP) Experience programming Job Duties: As a principal consultant, you will work on a team to improve our client's finance and budget office business processes. Specifically, you will be responsible for: Implementation and support respecting industry-leading tools from CaseWare, Workiva, IGM, Blackline & BalancingAct. Development and delivery of standard and customized training Diverse, ongoing consulting services Benefits: Competitive salary Work remotely - from home or with a laptop & WiFi from wherever you can take a VOIP call! Comprehensive benefits package including medical, dental and vision care coverage Fitness and professional development reimbursement © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

To meet increased demand, we are adding another principal consultant to our team to help deliver massive improvements to finance & budget departments.

READ MORE

City of Iqaluit keeps calm and carries on

- Jamie Black

- Success Stories

- minute(s)The City of Iqaluit is the capital of the Canadian Territory of Nunavut and is an ecological wonderland. Famed for an abundance of natural landscapes and wildlife, it attracts visitors from around the globe. The Challenge Located on beautiful Baffin Island in the Canadian Arctic with a population of just 7,740 (2016 census), the City's finance department has experienced some difficulty attracting qualified staff due to a remote location, housing shortage, high cost of living, and limited infrastructure to facilitate travel. When the City required urgent Payroll support, CAO Amy Elgersma was certain that employing an experienced, qualified Payroll Administrator could not happen before the next payroll run. Elgersma needed a quick, temporary solution so the organization's 150 employees would continue to be paid on time. With time of the essence, the City turned to F.H. Black & Company Incorporated to fill the gap until a suitable replacement could be on-boarded. She knew of FHB from a presentation they provided at a recent conference, and the work they had done with the Government of Nunavut previously. The Response After a few brief conversations, FHB assigned several members of their team to support the City: Michael Switzer, CPA, CA, was formerly the Town of Collingwood’s Deputy Treasurer with responsibilities including preparation of both the year-end financial statements and the annual Town budget as well as managing the town's receivables, payables, and payroll. Joy Richardson, CPA, was formerly the Chief Financial Officer of Thomasville, Georgia where her primary responsibilities included managing both the budget and year-end financial reporting processes as well as overseeing receivables, payables, payroll and all the other day to day activities of the finance department. Tina Steliga rounded out the team. Utilizing 16 years of experience managing the receivables, payables, and payroll processes for numerous clients of all sizes. Michael, Joy & Tina's decades of experience working in government finance made them an ideal addition to immediately and completely meet the City's needs. Within a week of the request, consultants Michael & Joy were onsite working with the team to transfer responsibilities and document processes. They were followed shortly thereafter by Tina, who assisted in administering payroll onsite before commencing remote support. FHB’s response time was exceptional. Their CPA's had the knowledge, skills, and experience needed to learn, document, and process the payroll system efficiently. They also had excellent interpersonal skills and were able to understand processes quickly. Once FHB was on board and started working with us, we were confident that payroll would be completed by the deadline. Disaster Averted The first step in the project was developing complete process documentation. Extensive interviews with City staff allowed FHB to build extremely detailed process documentation. The decision was made to put the documentation into a project management software to allow for the ongoing assignment of tasks and monitoring of the process by both FHB management and the City. This ensured FHB would not miss any steps and resulted in the proper execution of payroll each and every time. As the City's search for a Payroll Administrator was underway, FHB continued to process the payroll remotely. From mid-October to the end of February. We were able to arrange to have the payroll done via distance, this saved us time and money. The entire process was documented using a project management software tool. Ultimately the City successfully recruited a Payroll Administrator to take on the role. FHB transitioned to provide assistance getting the new Payroll Administrator up to speed and support them through the first few payroll runs. I would absolutely recommend FHB to other finance departments. They were able to process payroll with very little notice and continued via distance. They had a strong knowledge of the payroll and finance systems and could adapt to our processes easily © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Iqaluit required urgent support to keep its payroll on track. They turned to FHB's team of experienced CPAs for assistance.

READ MORE

Postponed effective dates of certain GASB Pronouncements

- Jamie Black

- What's New

- minute(s)The Governmental Accounting Standards Board (GASB) is taking steps to reduce the stress on government finance departments imposed by the COVID-19 pandemic. On April 15th, the Organization proposed to postpone the effective dates of some Pronouncements by one year. The Exposure Draft has a comment deadline of April 30th and is slated for a final statement of issuance on May 8th. The proposal will affect the following Pronouncements: Statement No. 83, Certain Asset Retirement Obligations Statement No. 84, Fiduciary Activities Statement No. 87, Leases Statement No. 88, Certain Disclosures Related to Debt, including Direct Borrowings and Direct Placements Statement No. 89, Accounting for Interest Cost Incurred before the End of a Construction Period Statement No. 90, Majority Equity Interests Statement No. 91, Conduit Debt Obligations Statement No. 92, Omnibus 2020, paragraphs 6–10 and 12 Statement No. 93, Replacement of Interbank Offered Rates, paragraphs 13 and 14 Implementation Guide No. 2017-3, Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions (and Certain Issues Related to OPEB Plan Reporting), Questions 4.85, 4.103, 4.108, 4.109, 4.225, 4.239, 4.244, 4.245, 4.484, 4.491, and 5.1–5.4 Implementation Guide No. 2018-1, Implementation Guidance Update—2018 Implementation Guide No. 2019-1, Implementation Guidance Update—2019 Implementation Guide No. 2019-2, Fiduciary Activities Implementation Guide No. 2019-3, Leases. GASB has also posted several resources for Stakeholders to a dedicated GASB Response to COVID-19 web page, including a GASB Emergency Toolbox. Subscribe to our blog for the latest developments impacting government finance departments. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Some good news! The Government Accounting Standards Board (GASB) is working to relieve some of the additional workload imposed by the COVID-19 pandemic.

READ MORE

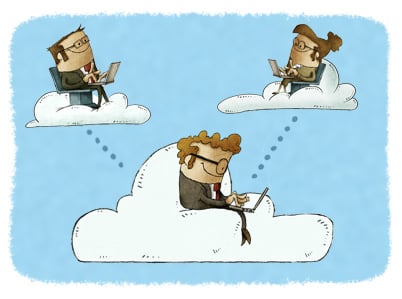

The remote finance team - why, how and how better

- Jamie Black

- Tech for Execs

- minute(s)Over the past decade, remote work has emerged as an increasingly attractive option for employers and employees. With the COVID-19 pandemic, remote work has become an immediate, unplanned necessity that finance departments the world over are scrambling to enable. This sudden, forced change does beg some questions: Why did it take this crisis to get finance to adopt remote work? How can finance utilize tools and techniques already at the organization's disposal to enable working remotely? How can finance bolster remote work environments and use this as an opportunity to make their business processes more efficient, effective, and reliable? In this blog series, we'll explore these questions in depth. We start with understanding the barriers to remote work as addressing them head-on will be essential if we are to make the most of our remote work environments in the weeks and months ahead. Public sector finance, in particular, has been slow to provide staff with remote work options. Sure they can take their laptop home occasionally, but they are not encouraging working outside of the office. This reluctance is despite organizations often having access to advanced applications that facilitate remote work. So why the hesitation? 1) Workload First and foremost, I suspect that the initial reaction to any discussion of setting up finance to take advantage of remote work is, "We have too much to do right now to even think about a luxury like remote work." When you are dashing day in and out to get ready for the audit, get the budget approved, and 900 other things in between, it can seem like an easy decision to defer. The current crisis has forced remote enablement to the top of the priority list. To a large degree, this barrier has been toppled out of pure necessity. 2) The Bias of Senior Management Often the heads of finance are the most experienced team members, with decades of experience. In short, these highly qualified, skilled, and experienced individuals often predate the remote work movement. For much of their career, the technological advancements required to facilitate efficient remote work were not available. If these senior managers were early adopters, experimenting with remote work environments before the technology was truly ready, they would have been left skeptical. Finally, those with decades of success in traditional office environments may not have seen a need for change, 'if it's not broken, why fix it?'. Once again, current events have interceded to illustrate the need clearly . 3) Paper Dependence Many organizations drive all their business processes via paper. Every form must be physically signed, routed, approved, and then filed. Processing payroll involves physical time cards, reconciling bank accounts, and physical statements. So paper-dependent are these environments that remote work does not seem like an option. Paper dependence is still a significant hurdle to effective and efficient remote work and one that needs to be tackled head-on. If there is a ray of light to the scramble into remote work, it is that we anticipate it will provide an opportunity (if you elect to seize it) to improve business processes to the ultimate and considerable long-term benefit of the organization. We will provide suggestions for this in our subsequent articles. 4) Security Working remotely definitely adds additional security concerns that have to be addressed. The workstations/laptops that are fully managed and locked down at the office are now connected to users’ home networks that are insecure and have not seen any security best practices applied. This naturally makes IT very nervous. For those organizations that rarely if ever work remotely, chances are that no VPN has been configured thereby further complicating remote work. All these issues are real, however they are not insurmountable hurdles. Assuming your organization’s IT department is currently following security best practices, working remotely can be done securely if a couple of additional measures are taken. If you are uncertain about your readiness for remote work, here is a list of 10 items (plus one bonus!) to begin your conversations with IT: Ensure a secure VPN is configured both on the network edge as well as remote user’s laptops, and that they are trained on how to use it. We wrote an article for finance officers who need to learn more about the basics of VPNs. Ensure strong passwords are used, and ensure passwords are set to never expire. We wrote an article for finance officers who need to learn more about the basics of passwords too! Make sure RDP (Remote Desktop Protocol) is not passed through on the edge network – either use VPN or make use of remote desktop gateway. Ensure all computers are set to automatically download and install software patches daily. Perform full disk encryption on all computers (using BitLocker). Enable the built-in Windows Firewall on all computers (or deploy the IT recommended firewall) and ensure proper rules are configured. Make sure only office traffic flows through the VPN and all other traffic flows through the end user’s network (split DNS configuration on the VPN). We discuss this in some depth in the article for finance officers who need to learn more about the basics of VPNs. Ensure all work sites accessed by users are using HTTPS. Enable anti virus on all computers and make sure they are set to auto-update. Ensure VPN connections only have access to subnets required for the user to perform their functions. Make sure important documents are either stored on the office network, or on a cloud storage provided by the organization as computers are certainly not being backed-up when remote. 5) Productivity Concerns If your organization does not support remote work typically, a significant concern may be, "How do I know if my team is working?" In recent weeks we have even seen articles of managers deploying spyware to monitor staff while they work remotely. In our nearly decade of working in a 100% remote work environment, this has never been a problem. Our experience is the opposite, and the major benefits easily justify the investment. The flexibility for our team to work remotely means that we're never late and have increased capacity to work through minor illness or meet constrained deadlines. We will continue to share best practices on how to proactively encourage good habits and monitor productivity as we progress in our subsequent articles. What's Next? Having explored the common barriers to remote work in public sector finance, our next article will discuss the second question, how to utilize tools you have today to enable remote work. We'll examine the tools already available to many public sector finance departments and analyze how they can be used to implement a secure and functional remote work environment. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The first article in a series on remote work, this blog explores the reasons why public sector finance has not adopted remote work historically.

READ MORE

![[Workiva + Adra]: An Integration Powered by FHB](https://blog.fhblackinc.com/hubfs/Blog%20Images/Workiva_Adra/workiva_adra_featured.png)