ERM Toolbox – Why Do I Need Risk Appetite and Tolerance Statements?

- Ed McCaulley

- In Control

- minute(s)Risk Appetite and Tolerance Statements: Identifying the Risk You’re Prepared to Accept Have you ever been skydiving? I have not. To quote Clint Eastwood, “Jumping out of a perfectly good airplane is not a natural act.” Yet the US Parachute Association reported that in 2021, around 39,412 of its members made 3.57 million jumps. Do you have an adjustable-rate (ARM) or fixed-rate mortgage? When I was younger and poorer, I considered an ARM before choosing a fixed rate. Back then, ARMs were trendy. They became less popular in the low-interest rate environment of our recent past. Perhaps they’ll gain popularity once again. Do you drive faster than the speed limit? As a young man, I was clocked at 65 mph in a 35-mph zone. My defense? I was driving a straight-away on a clear, country road. The officer didn’t buy it, and I ended up spending two hours in remedial driving school for “aggressive drivers.” Why all the questions? To make a point. Both the ways in which each of us measures risk and the amount of risk we’re willing to assume can vary widely. We are individual and unique humans, with awareness and risk tolerance built into our DNA. Brain chemicals like dopamine impact our perception of risk—as do age, gender, race, stress, upbringing, etc. RISK APPETITE & TOLERANCE FOR ORGANIZATIONS In 1987, Nick Leeson, a currency trader with Barings Bank, made failed bets on Nikkei futures totaling approximately $1.3 billion. His bets exceeded the total value of his employer’s capital and reserves. As a result, the 233-year-old bank was forced into bankruptcy. One audacious individual brought down a sophisticated and mature organization that most certainly did not share his appetite for risk. To align risk, it’s important to develop risk appetite and risk tolerance statements—written documentation of the risks an organization is and is not willing to accept. Risk appetite statements serve as guidelines for developing strategic plans, operational processes, and business continuity plans. An excellent example is TD Bank’s statement, which reads as follows: TD takes risks required to build its business, but only if those risks: Fit its business strategy, and can be understood and managed. Do not expose the enterprise to any significant single-loss events. Do not risk harming the TD brand. Here’s another example from the Office of the Comptroller of the Currency (OCC): The OCC has no appetite for unauthorized access to systems and confidential data, and will maintain strong controls to mitigate external threats against its technology infrastructure. The OCC has a low appetite for losing continuity of business operations stemming from unreliable telecommunications or system availability. Business resiliency planning and execution must be aligned with strategic objectives. The OCC has a moderate appetite for innovative technology solutions to meet user demands in a rapidly changing environment. The agency will exercise appropriate governance and discipline when considering and adopting new technology. Risk tolerance statements further refine and “operationalize” broader appetite statements to provide specific context. They serve as tangible risk limits, setting clear boundaries within which a business must operate. Risk tolerance statements must be measurable, realistic, and capable of being monitored. For example: At all times, the [organization] will maintain a rating of [xx] from [rating agency] Annual employee turnover will not exceed [xx%] Operational losses will not exceed [xx%] of [transaction type] Minimum investment grade of no less than “A” for investment securities For many risks, there is a range of acceptable levels. Let’s take information security risk as an example. We want to avoid this risk, right? What is the easiest way to do so? Disconnect all your computers from the internet. But taking this extraordinary step has consequences—no (external) email, no cloud computing, and no working from home. In other words, requiring zero risk can hamper or even prevent us from accomplishing our objectives. Recognizing the benefits of being interconnected, most organizations have chosen to accept some level of information security risk. Some level of risk is fine, but too much risk is not. Over time, navigation of these risks starts to resemble a road, with edge lines and guard rails; the acceptable place to drive is in the middle. WHAT DO I DO WITH RISK APPETITE AND RISK TOLERANCE STATEMENTS? Use them. Ensure that individuals who make decisions affecting the organization’s risk profile understand these statements. Decision makers should consider how their choices affect an organization’s risk level—specifically, whether their decisions leave the organization within its established risk appetite and tolerance parameters or push the organization outside those limits. Report on them. Senior executives and risk committees should require regular updates on their organization’s status related to risk appetite and risk tolerance statements. Discussions might include: Is the organization within its risk tolerance for 15 of its 16 metrics? If so, what does the organization feel about the final metric? If the organization is uncomfortable accepting this level of risk, then the metric effectively identifies an area that needs attention. Risks in this area need to be reduced. In contrast, if the organization does not feel that current risks are unacceptable, then risk metrics might need adjustment. This is common. Initial risk metrics are like a new pair of shoes; you need to experience them for a while to see if they pinch. Don’t let them get stale. The last thing you want to do is create these statements, then put them on the shelf to forget. Just as organizations change over time, so does risk appetite. Periodically revisit your organization’s risk appetite and risk tolerance statements to determine whether they are still appropriate and relevant or need to be adjusted. Also consider whether the statements are understood by everyone or require additional context. We recommend conducting this evaluation while developing a strategic plan. After all, where we want our organization to go and where we don’t want it to go are interrelated considerations. CONCLUSION Risk appetite and risk tolerance statements provide important guidance to employees about which risks are acceptable and which are not. They help align individual employee tolerances to organization-wide tolerances, for more consistent risk response across the board. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Risk appetite and tolerance statements help align individual and organizational tolerance for consistent risk response.

READ MORE

Why focusing on simple can lead to catastrophe

- Jamie Black

- Best Practices

- minute(s)For finance and budget professionals, optimizing how we complete our work can save time, mitigate the risk of error and make processes easier to delegate & manage. When improving a process requires new software tools, we recognize a common bias towards "simple" tools. It often begins with our client making a comment like: My existing solution is highly manual, time intensive, and has a high risk of error but it is easy/simple/straightforward. This new solution will likely save time and reduce the risk of error, but it seems too complicated. Initially, this may seem like a wise approach and an easy assessment. However, addressing it fully requires foundational concepts to be thoroughly flushed out. For example, what precisely do you mean when you say simple, easy, and complicated? An illustrative example Let's imagine we want to mount a new 60" TV on the living room wall. Let's also assume that we are not home renovation or carpentry experts. We arrange the supplied equipment from the mounting kit we bought on the table and review the instructions. Scenario 1: We have a very limited toolbox to use in the task. We have a hammer, some screwdrivers, and a tape measure. Scenario 2: We decide to invest in more tools. We get a laser level, a stud finder, cordless drill, drill & screwdriver bits, and screw anchors, as well as the hammer, screwdrivers, and tape measure we already had. Scenario 1 seems simpler. There are only three tools, and you already own them. They are basic tools you often use for minor tasks around the house so no learning is necessary. Scenario 2 is more complicated. It requires you to have: the additional tools, charged batteries for the laser level and drill (if not charged, we need to wait for them to charge), some understanding of home construction: Inside the walls are studs that are typically spaced every 16" and that, if you screw into them, they support mounting much heavier objects. If you do not mount it into a stud, you will also need to know that you need to use screw anchors, but even then, it may not hold the TV. Also, inside the walls are electrical wires and pipes that you must avoid. knowledge of how to use the laser level, stud finder and screw anchors. A more careful review reveals that you need to understand home construction in both scenarios. But if all you have is the simple tool kit, you might (unless you supplemented these tools with an expert's knowledge and experience) overlook the required home construction knowledge. In other words, the simple scenario is simplistic and omits some crucial considerations that may lead to long-term rework. In the mounting TV scenario, rework means: buying a new TV when the mount rips out of the wall and crashes to the floor, repairing drywall and repainting, repairing the floor where the falling TV damaged it. If you don't have time to do it right, when will you have the time to do it over? John Wooden Thus Scenario 2, while more complex and more expensive (in tools and time to learn them), dramatically increases the probability of properly meeting the goal both in the short and long term. In other words, these additional tools allows the non-expert home renovator to achieve results that a master might be able to achieve with the limited tools of Scenario 1. Clients often question the value of the greater expense of Scenario 2. Depending on the precise tools we are considering, once the investment in tools and the knowledge to use them has been made, you will likely use them on other projects (hanging pictures, mirrors etc.). Scenario 1 means these other projects are at equal risk of disaster as when we hung the TV. Our recommended approach: Considering the above, having this simple vs. complex conversation with clients, we suggest and assist with the following steps: Determine the necessary tools and knowledge to properly solve a particular problem. Assess current tools & knowledge to determine the investment necessary to achieve a solution you will be happy with both today and in the future. Consider the preferences & aptitude of the team that will complete the project. Some folks like learning new tools and see it as an opportunity to continue developing their skills. Others see "being forced" to learn new tools and approaches as an absolute negative. Evaluate the Return on Investment of various options, with specific consideration to long term re-use of the tools and knowledge in other areas. We also explicitly highlight the often-hidden future cost of the simplistic versus the upfront cost of the sophisticated. Ensure expectations are accurate about the path they choose. Some closing thoughts: We recommend avoiding unnecessary complexity. For example, in our scenario above, consulting an engineer, electrician & plumber, or welding a metal rack that bolts to the floor and ceiling would increase the cost for minimal benefit. The art is in differentiating between necessary and unnecessary. Simple is a magic term for sales & marketing departments. It is often used to accelerate and increase sales. If you were selling TV mounts, you might be tempted to minimize the "tools required" section of your manual so you do not scare away some potential customers. After all, when that TV falls on the customer's floor, you are not doing the repairs. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

When does focusing on simple software solutions result in catastrophe? When simple becomes the objective. Instead, finance and budget professionals should focus on what they want to achieve while avoiding unnecessary complexity. Learn how to evaluate what is and is not necessary for real success.

READ MORE

Marion County Clerk

- Rachel Raymond

- Success Stories

- minute(s)Marion County prepares three publish-ready budget books in just eight hours Project: Budget Book Automation Organization: Marion County Clerk Solutions: Caseware Working Papers + custom scripting Budget Book: 2022-23 Adopted Line-Item Budget 2022/23 - 2026/27 Adopted CIP Success Story: Marion County With a team of five people and a billion-dollar budget, Marion County has always relied on technology to do more with less and do it quickly. Having worked first with GovMax, then with Tyler Munis for budget creation, the group decided that Munis’ budget-book automation capabilities were insufficient. To extend its capabilities such that its output would meet the needs of the county commissioner would require $150,000 worth of customization. Unprepared to pay the initial and any ongoing costs for subsequent updates and changes, the team started looking for alternatives. The whole package The team was introduced to Caseware and F.H. Black & Company Incorporated (FHB). Out of the box, the Caseware solution had much of what the county was looking for. And they soon learned that the public sector experts at FHB would fill in the gaps, making it the perfect solution for their organization. We interviewed Audrey Fowler, budget director at Marion County, to learn more about the project. Why not just use spreadsheets? Every day, we speak with finance and budget departments that still prepare their financial reports using some combination of spreadsheets, word processors, and publishing tools. Having made it our mission to replace these disjointed programs with purpose-built, database-driven solutions, we are always curious as to why organizations choose spreadsheets. So, when we asked Audrey why she chose not to use spreadsheets, we found that she was a kindred spirit, and her fear was real. It's a fear that our team of principal consultants knows all too well and has experienced firsthand during their time in public sector finance and budget departments: the fear that one or more of the thousands of points of entry is incorrect—that errors have propagated throughout the reports and that they’ve missed them. ”I would never dream of publishing a book from an Excel file, not at 700 pages.” Audrey Fowler, budget director at Marion County Clerk Automation by necessity In public sector finance and budget departments, obtaining buy-in, allocating budget, and setting aside time for an IT project is always challenging. And even when all of these things are in place, IT projects often fail, resulting in wasted time and money. More importantly, project failures drain enthusiasm for change. With the difficulty and risk involved, it's no wonder many organizations are hesitant to take on the challenge, despite the rewards of a successful project. When we asked Audrey about the county's decision-making process, it was immediately apparent that the budget team was very motivated and that this project was a means to an end. "I don’t have 40 hours to spend in a week on putting the book together... I have to spend the money on the automation, the technology to get things done. Otherwise, I can’t get my job done." Getting exactly what you want Audrey was no stranger to IT projects. She had versed herself in available and suitable solutions and knew what she wanted. She also knew that, to meet her needs precisely and guarantee optimal execution, she needed an implementation specialist. Audrey wanted a two-step process for preparing a visually appealing and accurate book: 1. Import data. 2. Click three buttons to generate the books. Using the FHB method, complemented by custom scripting, Marion County got exactly what it wanted and needed. "The implementation was fantastic, very responsive... I was a little skeptical at first, but [FHB] made a believer out of me, and it worked!” What does preparing your budget books look like today? "All three books are fully scripted... It's an eight-hour workday, start to finish." For more on this project, read the full story. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Some guidance and custom scripting is all it took to enable the dedicated team at Marion County Clerk to prepare 3 Budget Books of more than 1,000 pages in only 8 hours, start to finish.

READ MORE

Key considerations when employing Balance Sheet Account ...

- Ed McCaulley

- In Control

- minute(s)Given the nature of the public sector industry, with its vast constituent base, any process and control failures can become highly visible, highly contentious, and highly damaging to an organization’s reputation. Yet, with budget constraints and the hiring challenges from the “Great Resignation”, how are we to keep our organizations’ safe and out from under this magnifying glass? The challenges are significant and demand rational approaches as well as application of one of the oldest — yet most effective — accounting control processes: balance sheet account reconciliations. Reconciliations have long been an important control for ensuring the accuracy of financial statements. Validating balances in general ledger accounts through the reconciliation process provides management with assurances that controls are in place and are working effectively. Performing accurate and timely reconciliations receives considerable attention under various government regulations focused upon public sector reporting. For example, in the United States, the Office of Management and Budget’s (OMB) Circular No. A-123 (A-123), the Federal Managers’ Financial Integrity Act (FMFIA), and the Government Accountability Office’s (GAO) Standards for Internal Control in the Federal Government (known as the “Green Book”) have been at the center of Federal requirements to improve accountability in Federal programs and operations. Within the Green Book, “reconciliations” are specifically called out both as “transaction control activities” and “ongoing monitoring”. Yet even without the regulatory emphasis, it is because of their summary and comprehensive nature that reconciliations often become key, rather than secondary, controls. As accountants and auditors, we should understand best practices related to account reconciliations and have a clear plan for reviewing reconciliations. RECONCILIATION TYPES There are various types of reconciliation, and each has nuances that will indicate the nature, timing, and extent of audit tests. Some of the more common types include: Basic account reconciliations. Often far from basic or simple, these account reconciliations may be reconciled to an accounts receivable aging schedule, fixed asset ledger report, or an accounts payable report. There should be account reconciliations for all asset, liability, and equity accounts. Bank account reconciliations. This type of reconciliation is between a bank statement and a general ledger account. Zero balance accounts (ZBAs) add a twist to the generic bank account reconciliation, because the bank account is swept or funded daily, leaving the end-of-day balance at zero. Suspense account reconciliations. Suspense accounts are used as a “holding” account until the appropriate disposition or classification of the transaction can be made (e.g., a lockbox used for all deposits). Once the cash deposit is recorded on the organization’s books, the organization will then determine why it was received and book the corresponding entry to clear suspense (e.g., to post it against a notes receivable or to book revenue). Thus, testing procedures should be added or modified to address the specific nature or characteristics of the account being reconciled. BENEFITS There are many benefits that come from performing high-quality account reconciliations, but here are the key benefits: Identify necessary adjusting entries before financial or other regulatory reports are issued, thus reducing restatement risk Identify operational issues earlier, when the problem is smaller, resolution is more manageable, and before the “fog of time” starts to obscure events Improved confidence in the financial statements from investors, managers, constituents, and external auditors Emphasizes to all employees the need for accuracy in transaction processing when the feedback is closer to the error BEST PRACTICES Both accountants and auditors should understand the best practices being utilized around account reconciliations. The following are practical ideas for improving the effectiveness of an organization’s account reconciliation efforts: Formalize a policy for reconciling and reviewing all balance sheet accounts. Complete a risk assessment of all balance sheet and off-balance sheet accounts and determine their risk level. Designate a regular cycle for the process (e.g., monthly reconciliations for high- and medium-based risks and quarterly for low-based risks). Complete account reconciliations by a specific calendar day of the subsequent month. Use a standard format for preparing reconciliations across the organization, and ensure each reconciliation contains standard information. Assign different individuals to both preparer and reviewer roles for each reconciliation to be performed. Confirm that the preparer and the reviewer possess the adequate skill sets to perform their functions, understand the nature of the account being reconciled, and understand the documentation and analysis required to support and substantiate the account balance. Consider automating the reconciliation process. There are various tools available to help with reconciliations. For example, many tools will automatically match up transactions from the G/L to the bank records, which frees reconcilers to focus on the more value-added task of researching unmatched records. Other tools help track the status of all reconciliations. Consider use of continuous monitoring tools and testing to immediately alert staff to potential issues (e.g., search for duplicate payments based upon payee, amount, and payment date) when they can take preventative action, instead of waiting to detect the issue when the reconciliation is performed. There are no guarantees but employing these practices can help reduce the risks… of fraud, financial loss, or misstatements, while identifying operational issues early before they become too large. INTERNAL AUDIT’S ROLE Internal audit should be responsible for independently assessing compliance with stated procedures. When performing audits of reconciliations, it is essential that auditors consider various attributes. Including the following testing procedures can help auditors perform a complete and adequate review. Does the “balance per the general ledger” on the reconciliation agree to the amount reported on the general ledger? One common problem is not reconciling to the full general ledger balance (e.g., to a subaccount, to only the cash or accrual or tax subledgers, or to only a subsidiary account). Does the “balance per bank” or “balance per system” agree with the bank or system report? A recurring issue is reconciling the general ledger activity to the general ledger balance rather than to an outside, confirming source. Reconciling one general ledger source to another, such as a trial balance to an online balance report, will accomplish nothing — unless the intent is to test the general ledger system’s reports. Are there any unreconciled differences? Unreconciled or unknown differences should set off alarm bells. These differences mean the reconciliation work has not successfully identified all reconciling items. This typically indicates that the individual preparing the reconciliation does not have the appropriate skills, did not devote the time necessary to complete the reconciliation, or simply does not have access to all the appropriate data required. Be careful about de minimis limits that some groups have established. The theory behind a de minimis limit is that the difference is too small to warrant the time and effort to track down the difference and that it is more efficient to simply write off the unreconciled amount. However, the use of de minimis limits have dropped out of favor because the unreconciled balance may be hiding more than one error if the transaction amounts offset each other. In other words, a $10 unreconciled balance might be two or more transactions… a million-dollar credit, largely offset by a $999,990 debit. Are reconciling items being cleared timely? Unless the reconciling items identified are purely timing issues, they should result in some action (e.g., a journal entry or an entry to correct a subledger). These actions should clear the item before the next reconciliation is performed. If they are not cleared, it is an indication that the work is not being performed. As many organizations are operating with lean accounting departments, completing account reconciliations both correctly and timely can be a difficult task. However, staff shortages do not justify rolling reconciling items forward from period to period. Although this approach is quicker and may seem to be an acceptable solution to the overworked individual performing the reconciliation, it is often the cause of a restatement. Was the reconciliation signed by the preparer and reviewer, and are the preparer and reviewer different individuals? Having both roles is important for three reasons. First of all, it introduces a measure of segregation of duties, especially useful in smaller organizations where everyone wears multiple (and sometimes incompatible) hats. Secondly, the reviewer may offer a broader understanding of the transactions flowing through the account. Finally, the reviewer also should help ensure that reconciliations are being performed with consistent diligence between accounts. Was the reconciliation completed on time? Reconciliations should be completed before the data or report for the next reconciliation becomes available. Thus, a bank account reconciliation would be considered late if it was not completed before the next month’s bank statement was received. Has the organization established a monitoring control over reconciliations? Reconciliations are such an important control that many organizations have implemented an organization-wide policy or centralized monitoring to ensure their timely completion. All balance sheet accounts should be reconciled. SUMMARY Performing appropriate and timely reconciliations is a critical control function that should be in place in all organizations. Although account reconciliations may seem mundane and repetitive, a strong account reconciliation process is an important component of a solid system of internal controls. Implementing account reconciliation best practices — such as accountability, risk-based prioritization, and reconciliation automation — provides management with insight into the substance of transactions and account balance content. A robust reconciliation process can identify necessary adjusting entries before financial or other regulatory reports are issued, while also reducing restatement risk, improving investor confidence, and eliminating write-offs. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Accurate and timely reconciliations are a critical control function that should be in place in all organizations. Understand best practices related to account reconciliations and develop a clear plan for reviewing reconciliations.

READ MORE

Deschutes County

- Rachel Raymond

- Success Stories

- minute(s)Deschutes County Made Massive Efficiency Gains in Minimal Time with Only Moderate Guidance Project: Budget Automation Organization: Deschutes County Population: 204,801 (2021) Solutions: Workiva Wdesk & Wdata Budget Book: 2022 Adopted Budget Book Success Story: Deschutes County With a single automation project, the Deschutes County, Oregon finance and budget department team reduced its budget book preparation time by 60-65% in year one and anticipate greater efficiency gains in the coming years. Like many public sector organizations, the county's finance department was plagued by inefficient business processes and inadequate tools, tempering their ability to commit sufficient time to higher-value tasks like long-term forecasting. The Search Deschutes County enlisted the help of the experts at F.H. Black & Company Incorporated. Working together, they reviewed the county's existing processes, identified areas for improvement, generated a list of requirements, and assessed the qualifying solutions. "We looked at quite a few solutions, probably 8 or 9 different platforms over 6 to 7 months... FHB answered all our questions and steered us in the right direction." Daniel Emerson, Budget Manager at Deschutes County The Right Solution - Workiva After carefully assessing their requirements and stringently reviewing industry-leading solutions for the best fit, the county opted for Workiva. A combination of Wdesk and Wdata gave the county a robust cloud-based automation solution that enabled the seamless collaboration of all contributors to the book. The intuitive and familiar interface of Wdesk enables the team to instantly generate automated reports and create custom data sets and calculations in seconds. "We absolutely love Workiva! Right now, there’s an over 50% probability that at some point in the next year, we will reach out and talk about an ACFR implementation. We'll recommend F.H. Black for that as well.” FHB's Guided-Self Implementation Having selected Workiva as their reporting automation solution, it was time for the county to implement, configure, and optimize the solution for their environment. Workiva's seemingly limitless potential and plethora of features meant that if the county wanted to optimally implement the solution to maximize automation and collaboration, they would benefit from expert help. The question was, how much help? As no two organizations, finance departments, or implementations are the same, FHB offers its clients many options. Implementations are scoped, packaged, and priced based on the client's requirements, budget, and availability to contribute to the project. The county was offered a sliding scale of services. On one side, you have a delegated implementation. This option would see the county delegate the implementation to the CPAs at FHB. They would have to provide a little information, but almost all of the work would be completed by the team at FHB. This is the most expensive option; it requires very little input from the county and is fast. On the other side of the scale, there is the guided-self implementation. This is the least expensive option and designates most of the work to the team at the county. FHB provides initial infrastructure setup, training, guidance, and any additional custom development work requested. Confident in their ability and availability to self-implement the solution with guidance from FHB, the county opted for a guided-self implementation. Besides the cost, this option has the added benefit of including the county's team in just about every step of the implementation process, resulting in the team having familiarity and knowledge of the solution that they otherwise would not. The county also knew that they could always approach FHB for additional services if they ran into a problem. “I think that this project, by the end of July, will have already paid for itself”. Next year and beyond No matter how you measure it, the county's budget automation project was a huge success. As a result, the county can declare in no uncertain terms that it has massively improved the efficiency, reliability, repeatability, and accuracy of its budget preparation process, with far-reaching implications for the budget team, the department, the organization, and the community. For more on this project, read the full story. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Deschutes County reduced its budget book preparation time by 60-65% in year one and anticipate greater efficiency gains in the coming years. Learn how they made massive efficiency gains with only moderate guidance.

READ MORE

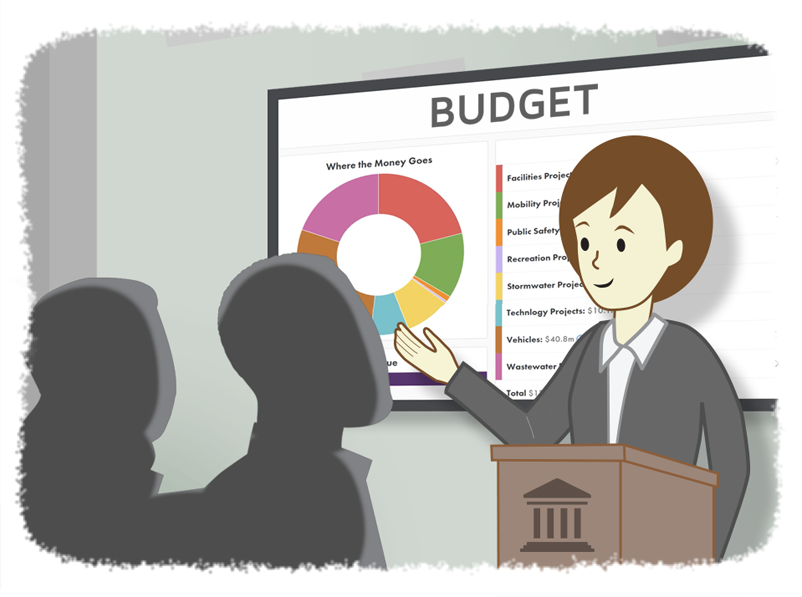

Strategies for getting Council to understand and support your budget

- Joy Richardson

- Budget Book

- minute(s)It's budget time, and you're ready! Painstaking detail and effort have gone into making sure that all 300+ pages of the budget book have been checked and rechecked. While this may feel like a job well done, the hard part (communicating) is just beginning. The reality is that a budget without context is just as ineffective as a map without a legend. The presentation of the budget's information is your chance to help Council, the Board, or any other stakeholders map out where your organization is today and its future direction (remember the map)! With lots of information to share in a limited time, effective communication is essential. Therefore, when developing your strategy, you should consider the objectives of: Informing, and Engaging. Informing is the starting point for communication and is based on the following: Information flow is in one direction Reading a budget book is an example of the one-way flow of information. The reader receives the information. However, without any accompanying conversation, they do not have the opportunity to ask questions or give feedback. Further, just providing the information is not enough. Communicating with the goal to enable understanding helps Council focus on and interpret the data so that the intended messages are received. Simple strategies for improving comprehension include using: Progressive disclosure to keep things focused Progressive disclosure keeps information at the summary level until the reader asks for or needs more detail. Providing too much information at once is overwhelming, causing that glazed-over-eyes phenomenon we have all seen! Learning efficiency benefits greatly from the use of progressive disclosure. Information presented to a person who is not interested or ready to process it is effectively noise. Information that is gradually or progressively disclosed to a learner as they need or request it is better processed and perceived as more relevant. Universal Principles of Design, Lidwell, Holden, Butler Using a drill-down approach provides additional information as necessary when the readers are ready to make sense of it. Style for understanding When it comes to style, remember that beauty is in the eye of the beholder. Thus, the focus should not be on what looks pretty but on understandability. To convey the message, consideration should be given to using the right combination of text, tables, and graphs. Find more information on this topic in our 3 questions to answer before report design blog. Engaging provides Council with the opportunity to receive information as well as respond with questions. The benefits of this multi-directional approach become apparent as heads begin nodding with understanding instead of the usual nodding off. While the Council presentation and budget deliberations themselves are forms of engagement, tools such as real time-modeling can make things even more dynamic. If a picture is worth a thousand words, a simulation is worth at least a million. Simulations can help demonstrate individual budget components, their relationship with other areas, and the impacts of making changes that are often hard to articulate. Specifically, a simulation can: Demonstrate the inherent trade-offs that come with competing resources and desires Highlight the differences between discretionary and non-discretionary items and how they impact the budget Show both the short- and long-term impacts of budgetary changes Shifting your Role: It is no secret that finance and budget departments' resources are limited, and much of those resources are already allocated to just preparing the budget. This begs the question of how to implement these strategies? If you are familiar with our work, you may have already guessed the answer: Best Practices paired with the appropriate Technologies. There are various software solutions that can free up staff resources by: Soliciting community engagement and integrating it into the budget Automating the preparation of the budget publication Assisting with a real-time, interactive presentation Budget simulators are one such tool you can consider. Read more on their utilization for engaging stakeholders. Using technology to reduce the more manual and mechanical processes, you can shift staff resources to focus on better communication and engagement. This allows finance departments to add value as not just number crunchers but as trusted advisors. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Go beyond just submitting and presenting your budget book to Council. Use these strategies for stakeholder buy-in and informed feedback.

READ MORE

Chicago Public Schools

- Rachel Raymond

- Success Stories

- minute(s)Chicago Public Schools saved hundreds of hours and tens of thousands of dollars in ACFR preparation costs The Challenge Project: ACFR Automation Organization: Chicago Public Schools Population: 636 Schools with 340,658 Students Solutions: Workiva Wdesk & Wdata ACFR: 2021 Annual Comprehensive Financial Report Success Story: Chicago Public Schools The dedicated team at Chicago Public Schools (CPS) was fighting a losing battle. A combined one thousand hours of overtime was not enough to prevent missed deadlines, extension requests, and reporting errors. The problem was clear; manually generating the Annual Comprehensive Financial Report (ACFR) with generic tools was extremely inefficient. "We could not provide the report on time. We tried, and we couldn’t turn it around quick enough to meet our board meeting timeline." Manual Overload Using Word and Excel to prepare the ACFR's contents and then compiling it into a PDF meant that nearly every word, number, graph, and chart in the organization's 214-page report had to be manually keyed in. In addition, any time a modification was made, it was down to the finance team to ensure that all associated information was updated in all applicable locations. Not only was this process time-consuming, it left lots of room for errors to creep into the report. Formatting to exhaustion Formatting the ACFR is not something often thought about outside the finance department, but those who generate it know it's a monumental task of great importance. A poorly formatted report is challenging to follow, invokes doubt, invites misinterpretation, and often results in poor planning/decision making. For finance departments with inadequate tools, formatting represents a relative black hole of lost time. Typically, financial reports are not simply formatted once. Every seemingly insignificant change results in another round of review, spacing, page number changes, table-of-content updates, chart and graph modifications—the list goes on and on. "We had a hard time dealing with formatting issues for our report. It took soo long! That's time I should have spent on other areas, but instead, we have to figure out how to correct formatting issues in the PDF...If we wanted to have a 3rd party compile the report, it cost more than $30,000." One review, two review, three review, more. The highly manual nature of the organization's ACFR preparation meant that the report had to be constantly reviewed and validated. Updating a balance or text didn't just mean modifying a cell in most cases; it could mean updating several cells, charts, graphs, and the MD&A to assure that all the data was correct and flowed the way it should. Then, they'd check over the formatting again—how the change affected margins, page numbers, images, etc. The worst part? The lingering doubt that accompanied the process: What if I missed something? Staff shortages "A main problem right now for the whole country, not only for school districts or state and local government, is a shortage of staff. It’s harder to maintain staff, and one of my solutions is to use a lot of automation. That way, we can reduce a lot of unnecessary work, and we don’t have to rely on so many staff." The Solution After reviewing several competitive solutions, including Gravity, CaseWare, and OneStream, as well as some offerings from smaller companies, CPS opted for Workiva's Wdesk and Wdata platforms. Wdesk serves as the organization's report writer, while Wdata is the database on the back end, driving automation. When asked what tilted the scales in Workiva's favor, Dongmei advised: "While some of the other solutions could accommodate our requirements for automating content and linkages, Workiva can also provide a very nice presentation, which is critical for us." The benefits didn't stop there. Dongmei continued to discuss the advantages of automation, fiscal and time savings, and improved collaboration with the auditor. Automation "I just need to set up one master worksheet and all the information flows to all the different worksheets; it’s done, it’s like a miracle happened. We saved so much time and headaches." "We don’t see a lot of errors now. Before, we would have errors because of technical issues. If we change something in one place, it's not automatically reflected in other areas; those types of errors happened all the time. This year because we are using this wonderful automation tool, we didn’t have this problem at all. It was a high-quality report. We were so happy about it." Fiscal and Time Savings "This software really saved us a lot of cost on the reporting piece, $30,000 at least... for a lot of other solutions, any time we need to change anything, we need to contact the vendor for support, and it becomes very costly." "We saved at least 500 hours; that’s minimum...I remember in 2020, I needed to work on the report to meet the timeline for the board meeting. I worked 30 hours straight to get the report done." The Audit "Communicating with the auditor was very easy. We could send them a single package with all of the supporting documentation. We didn’t need to send Excel documents back and forth...the auditor was really happy with the solution as well." The Implementation It's not the first time that Chicago Public Schools has attempted to implement a solution to automate its ACFR. An attempt was made in 2015, but the project never really got off the ground. The team at CPS credits the consultants and best practices of F.H. Black & Company Incorporated for the success of the implementation. "I have been involved with this kind of software implementation system upgrade for many, many years...when I started to go through the procurement process, I could never imagine it would have gone so smoothly, with this level of success." In conversation, Dongmei's auditor discussed another client who works with Workiva but had self-implemented. While Workiva was working for them, they were still working out the kinks and did not implement as many efficiencies as Chicago Public Schools had with FHB. "I feel like I am the lucky one. Thanks to F.H. Black, we did not have any issues, we met all our deadlines, and we are really confident in our solution. F.H. Black has the best consultants I have seen in my whole career. Not only are they IT experts, but they know the accounting side...I am a CPA and also a Certified Public Financial Officer, but I think our [FHB] consultant is a level above me." The Result "This project was really successful, but it's way bigger than that. If we failed, if we couldn't meet our deadline, or there were issues, or the auditor complained, I don't know how I could convince senior management to make other improvements that our team, that the whole organization needs. This project proved that we could successfully implement technology, and it's just the beginning. Now we have the confidence to work with F.H. Black to improve the whole finance department." For more on this project, read the full story. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Chicago Public Schools saved hundreds of hours and tens of thousands of dollars in their Annual Comprehensive Financial Report preparation costs. We interviewed them to learn more.

READ MORE

What a difference a year made for the City of Fort Wayne

- Rachel Raymond

- Success Stories

- minute(s)The City of Fort Wayne cut budget book prep time by 75%. That's 300 hours! Project: Budget Book Automation Project Scope: Automate balances and narrative GFOA Budget Book Award compliance Replicate appearance of existing book Organization: City of Fort Wayne, IN Population: 265,752 (2019) Solutions: Workiva Wdesk & Wdata Budget Book: Operating Budget Book Success Story: City of Fort Wayne The Challenge When we first met the finance team at the City of Fort Wayne, they were using multiple disjointed systems to prepare their budget book. The budget department would bring balances from Excel into Munis, their ERP system. Any required changes would be manually keyed in there. The team would then run "really clunky" Crystal Reports and open them in Excel. Next, they pivoted the data by inputting appropriate parameters by fund and department. If a department like "police" had sub-departments (police admin, radio shop, records, etc.) any changes to a sub-department would require running a report at the sub-department level before running a department-level report. They then needed to review the reports for accuracy before going back to Excel for any updates. "Every time we made one little number change, it caused at least another 30-45 minutes worth of work." Kathleen Smith, Finance Manager at the City of Fort Wayne The Solution Having had great success with the reporting automation solution used to prepare the city's ACFR, the team opted for more of the same: Workiva's Wdata and Wdesk, customized and implemented with F.H. Black & Company Incorporated. What does the process look like now? Data is pulled from the City's ERP system and imported into Workiva. The budget book is then automatically populated with balances. All participants have the ability to access the system and provide their contributions. Any required changes are updated in a single location in Workiva; the book and all other applicable materials are automatically updated. Reports that would have taken hours to prepare now take moments, and data can be pivoted in an instant. "I just can't say enough about how much efficiency and accuracy improved." The Implementation After carefully considering the implementation service levels offered, the city contracted FHB to automate the budget book on a "guided-self" basis, with onboarding support. This meant keeping costs low, as Kathleen and her team would do the majority of the work under the guidance of FHB's experts, once they had completed the initial setup and customization. FHB assigned a team to work on the city's project and the work began. As with all FHB-led implementations, the initial kick-off meeting defined scope, assigned tasks/deadlines, and trained the city's team on using their project management tool. Next, FHB implemented a pre-built data model designed for public sector organizations, and built a connection from the city's ERP system. FHB recreated the prior year budget book template in Workiva, then set up basic sections and ten pages of linking to train the city's team. Next, we assisted the city with the tasks assigned to their team, including loading, tagging, and grouping imported data by object and function; building and linking schedules, notes, and statements; then reconciling, reviewing, and testing. "We had the budget book done probably a week earlier than we normally do, and that was while learning and implementing a whole new system." The Result The city achieved a 75% time savings while improving its budget book preparation process. Kathleen and her team now have robust, documented, and repeatable processes, making onboarding new team members a breeze. Having automated the ACFR and the expenditure budgets, the city is planning another project to automate the revenue side. "I was here a lot of evenings making sure everything looked right and tied together correctly. We didn't have that this year, I didn't find myself working any evenings or weekends." For more on this project, read the full story. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The city of Fort Wayne reduced their budget book preparation time by 300 hours, that's 75%! This is how they did it.

READ MORE

Frederick County, MD Unifies and Automates the Budget Book

- Rachel Raymond

- Success Stories

- minute(s)Frederick County Unifies Budget Book Pieces Under Comprehensive Solution Project: Budget Book Automation Organization: Frederick County, MD Population: 271,717 (2020 Census) Total Budgeted Revenues: $905 million Solution: Questica Budget Book powered by CaseWare Budget Book: Adopted Operating & Capital Budgets Success Story: Frederick County The Challenge Frederick County's, Budget Department faced a challenge common to Public Sector organizations when preparing its Budget Book. They spent countless hours gathering and reconciling various pieces across multiple applications. There were pieces in Questica Budget, Excel, and Word, and they presented it in Adobe. To ensure confidence in the data, every change or update would require time-consuming review. "Budget Book pieces were coming from every direction, that's what we had to solve" Tanya Kauffman, Budget Analyst III at Frederick County Government The Solution The County's solution was to replace Microsoft and Adobe with Caseware and integrate it with Questica Budget. Caseware hosts the Budget Book template and pulls balances and narratives directly from Questica. Any changes applied to the budget are made in Questica and flow straight through to all applicable locations in the book, facilitating greater confidence in the data and reducing the requirement for constant review and reconciliation. In addition, Caseware's document-management functionality allowed contributions from all parties to be stored and managed in a single location. The Project F.H. Black & Company Inc. assisted the team at Frederick County to implement the solution with the FHB method. Discovery - What are the County's wants and needs? Scope - Defining project parameters Planning - Working backward from the project goal to define a timeline and assign tasks Configuration - Configure the selected solution to meet the County's needs Training - Provide training to the County's budget team in the use of their new tools Management - Weekly meetings and communication to ensure the project stays on track Completion - Mutual agreement that the scope of the project has been fulfilled Ongoing Support - FHB continues to support and work with the County to improve and refine their processes The Result The County has unified its piecemeal budget book under a single comprehensive solution, resulting in increased confidence in the data and an estimated 25% reduction in the time it takes to complete budget book preparation. We asked Tanya if she has anything to add about the project. Here's what she had to say... For more on this project, read the full story. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

Frederick County unifies and automates the budget book with a comprehensive solution for outstanding results.

READ MORE

City of Garland Modernizes its Budget Processes

- Rachel Raymond

- Success Stories

- minute(s)The Forward-Thinking City of Garland Overcomes 3 Budget Challenges With 1 Project Project: Budget & Budget Book Preparation Organization: City of Garland, Texas Population: 239,928 (2019 Census) Annual Budget: $1.1 billion (Operating + CIP) Solution: Caseware & Questica Budget Book: Annual Operating Budget CIP: Capital Improvement Program Success Story: City of Garland The Challenge The city of Garland's Budget Department faced a trio of challenges that shared the same root cause: antiquated software solutions, and the business processes required to make them work. The city relied on legacy budget software to prepare the budget and a combination of Word, Excel, and Adobe to prepare the Capital & Operating Budget Books. The processes were slow, disjointed, and error-prone. The Solution After extensive research, the city's Budget Director, Allyson Bell Steadman decided on Questica Budget to prepare the budget, CaseWare to prepare the budget book, and F.H. Black & Company Inc. to integrate the two and ensure the budget book solution was optimally implemented to maximize their benefits and guarantee project success. The Project The implementation process was managed and guided by consultants from FHB. It started with a planning meeting, introduction to FHB's online project management tool, allocation of deliverables, and scheduling of software training. Once trained in the use of their new tools, the FHB team built the Capital Improvement Program budget book template based on the City's specifications. Once complete, a similar process was carried out for the Operating Budget Book. The Result By the end of the sixteen week implementation, the City was able to produce and publish both the proposed and adopted 2020-21 CIP & Operating Budget Books. The City now has a robust, documented, repeatable, and largely automated process for preparing their budget book. "The Budget & Research Department is in a much better position to produce and distribute budget documents. Our most recent success was having our 2021 Adopted CIP document finalized for publication on the City’s website and distribution to City Council two weeks after adoption". For more on this project, read the full success story here. © 2025 FH Black Inc. All rights reserved. Content may not be reproduced, excerpted, distributed, or transmitted without prior written consent.

The City of Garland modernizes its Budget, Capital Improvement Program, and Annual Operating Budget Book preparation processes with a single project.

READ MORE